Disclaimer: This article is for educational and informational purposes only and should not be construed as financial, investment, or professional advice.

The content is based on Warren Buffett and Charlie Munger’s responses at the 2008 Berkshire Hathaway Annual Meeting and Berkshire Hathaway’s 2008 Annual Report. All information is presented for educational purposes and not as recommendations to buy, sell, or hold any securities. Consult a qualified financial advisor before making investment decisions. Past performance does not guarantee future results. This post contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you.

Sources: 2008 Berkshire Hathaway Annual Meeting Q&A, Berkshire Hathaway 2008 Annual Letter to Shareholders

May 2008 — A young investor asked the Oracle of Omaha a simple question: “If you were 30 years old with your first million in the bank, how would you invest it?”

Warren Buffett’s answer shocked the room. No complex portfolio. No diversification across asset classes. No hedge funds or private equity.

His strategy? “I’d probably have it all in a very low-cost index fund.”

ALL of it. 100%. In one investment.

And then came the kicker: “Then I’d forget it and go back to work.”

This wasn’t some off-the-cuff remark. This was Buffett—during the 2008 financial crisis—telling America’s future millionaires exactly how to get rich. And almost nobody listened.

The Question That Changed Investment Advice Forever

The questioner set up specific conditions:

- 30 years old

- $1 million to invest

- 18 months expenses covered separately

- No dependents

- Not a full-time investor (you have a day job)

Buffett’s complete answer:

“I’d probably have it all in a very low-cost index fund. It’d probably be Vanguard, somebody I knew was reliable, somebody where the cost was low. Because you postulated that you’re not going to become a professional investor, I would recognize the fact that I’m an amateur investor.”

Then he added the crucial part:

“Unless bought during a strong bull market, which this hasn’t been, I would feel that was going to outperform bonds under current conditions over a long period of time and then I’d forget it and go back to work.”

Remember: This was May 2008. The S&P 500 would fall another 38% over the next 10 months. Financial institutions were collapsing. The world seemed to be ending.

And Buffett said: Put it all in stocks.

Charlie Munger’s Brutal Truth About “Professional” Investors

Charlie Munger didn’t sugarcoat why this simple strategy beats complexity:

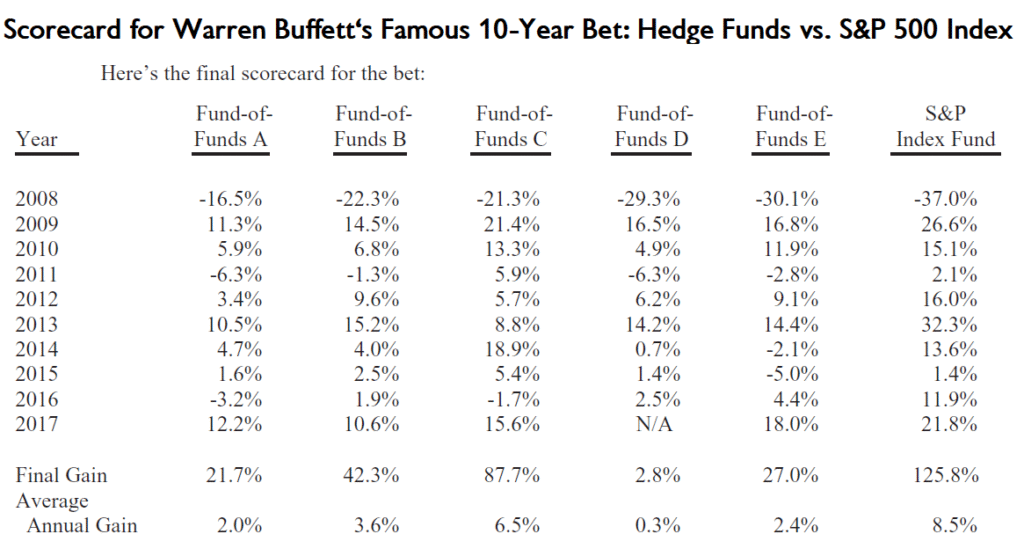

“It’s in the nature of things that you aren’t going to have a whole lot of screamingly successful professional investors. You’ve got a great horde of professionals taking crap’s profits out of the system. Most of them by pretending to be professional investors.”

Translation: The “professionals” are extracting fees, not delivering results.

Munger continued with devastating honesty:

“If you don’t have any rational prospects of being a very skilled professional investor, of course you should compromise on some simple thing like an index fund.”

The Fee Trap

Then Buffett explained why you’ll never hear this advice from a financial advisor:

“You will not get that advice from anybody because nobody gets paid to give you that advice. You will have all kinds of people telling you how much better they can do for you than that and how if you just give them a wrap fee or give them commissions or whatever it may be that they will do better. But they won’t do better.“

Munger added the statistical reality:

“On average, if a thousand other people like you do the same thing, that group of a thousand will do worse if they listen to the people that make pitches at them.”

The Three-Step Strategy (It’s Simpler Than You Think)

Step 1: Accept You’re Not a Professional

Buffett: “I would recognize the fact that I’m an amateur investor.”

This isn’t defeatist—it’s strategic clarity. Most people lose money trying to beat the market. Professionals with Bloomberg terminals, research teams, and decades of experience can’t beat it consistently.

Why would you?

Step 2: Put It ALL in a Low-Cost Index Fund

Buffett specifically recommended:

- Vanguard (by name)

- “Very low-cost” (he repeated this twice)

- Reliable company

What he means: Vanguard S&P 500 Index Fund or Vanguard Total Stock Market Index Fund.

Expense ratios: 0.03-0.04% (that’s $300-$400 annually on $1 million).

Compare that to actively managed funds charging 1%+ ($10,000+ annually on $1 million).

Over 30 years, that fee difference costs you $4+ million.

Step 3: Forget It and Go Back to Work

This is the step everyone ignores—and why most people underperform.

Buffett: “Then I’d forget it and go back to work.”

What “forget it” means:

- ✅ Don’t check it daily

- ✅ Don’t panic during crashes

- ✅ Don’t try to time the market

- ✅ Don’t chase hot stocks

- ✅ Don’t let CNBC scare you into selling

What “go back to work” means:

- ✅ Your career is your biggest asset at 30

- ✅ Focus on increasing your income

- ✅ Invest more as you earn more

- ✅ Let compound interest work uninterrupted

The 2008 Context: Why This Advice Was Radical

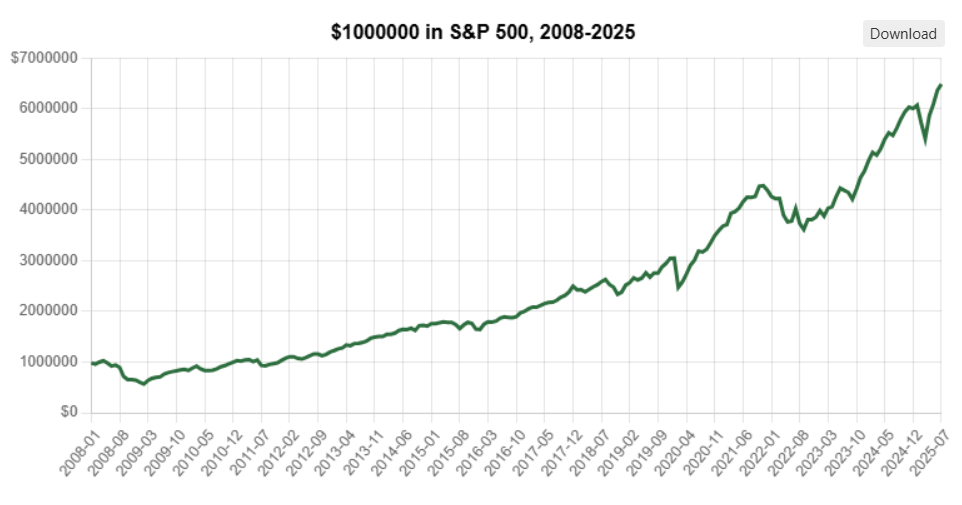

Buffett gave this advice in May 2008—arguably the worst time imaginable.

What Happened Next:

By March 2009:

- S&P 500 fell another 38%

- Major banks collapsed

- Unemployment soared

- People were terrified

From March 2009 to today (2025):

- S&P 500 has returned approximately 500%+ including dividends

- That $1 million would be worth $6+ million

But here’s the thing: Buffett wasn’t timing the market. He was buying time IN the market.

What Buffett Was Actually Doing in 2008

While telling others to buy index funds, what was Buffett himself doing?

From his 2008 annual letter:

“The investment world has gone from underpricing risk to overpricing it. This change has not been minor; the pendulum has covered an extraordinary arc.”

He was buying aggressively:

- $14.5 billion in investments in Wrigley, Goldman Sachs, and General Electric

- Received “high current yields” plus “substantial equity participation as a bonus”

- Made deals “on terms that would be unavailable in normal markets”

His advice to himself in the letter:

“When investing, pessimism is your friend, euphoria the enemy.”

So why didn’t he tell the 30-year-old to make complex deals like he was making?

Because that 30-year-old:

- Doesn’t have Buffett’s expertise

- Doesn’t have access to those deals

- Doesn’t need to beat the market—just match it

The Stockbroker Warning Nobody Talks About

Then Buffett delivered this absolute gem:

“I would give you another word of warning. Do not judge stock brokers generally by the ones you meet at this meeting. We attract some of the most honorable intelligent stock brokers in the world. They are not representative of the class.“

The room erupted in laughter.

Translation: Most stockbrokers are salespeople, not fiduciaries. They’re incentivized to churn your account and sell products, not optimize your returns.

Why This Strategy Works (The Math)

Let’s run the actual numbers based on Buffett’s advice:

Scenario: 30-Year-Old Investing $1 Million in 2008

Index Fund Strategy (0.04% fee):

- Investment: $1,000,000

- Annual return: ~10% (historical S&P 500 average)

- Fee: 0.04%

- 30-year result: ~$17.4 million

Actively Managed Fund (1% fee):

- Investment: $1,000,000

- Annual return: ~10% gross (before fees)

- Fee: 1%

- 30-year result: ~$13.3 million

Difference: $4.1 million lost to fees

And remember Munger’s point: The average managed fund doesn’t even match the market’s 10% gross return. Most get 8-9% before fees, making the gap even worse.

[IMAGE PLACEHOLDER: Comparison showing wealth accumulation index vs. managed fund with widening gap]

The “But What About…” Objections

“But what about diversification?”

An S&P 500 index fund IS diversified. You own 500 of America’s largest companies across all sectors. A total market fund gives you even more—approximately 4,000 stocks.

“But what about bonds?”

Buffett addressed this. Given the questioner’s age (30) and time horizon (30-40 years), stocks will outperform bonds. His letter confirmed it:

“Clinging to cash equivalents or long-term government bonds at present yields is almost certainly a terrible policy if continued for long.”

“But what if the market crashes?”

Buffett’s answer: Keep holding. From his letter:

“This does not bother Charlie and me. Indeed, we enjoy such price declines if we have funds available to increase our positions.”

If you’re 30, market crashes are buying opportunities, not disasters.

“But what about international stocks?”

The questioner asked about a $1 million investment, not an entire portfolio. Buffett kept it simple: U.S. stock index fund. You can add international exposure, but don’t overthink it.

What Buffett’s 2008 Letter Reveals About His Philosophy

While writing to shareholders during the crisis, Buffett included wisdom that supports his index fund advice:

On Trying to Beat the Market:

“Approval is not the goal of investing. In fact, approval is often counter-productive because it sedates the brain and makes it less receptive to new facts. Beware the investment activity that produces applause; the great moves are usually greeted by yawns.“

Index investing gets yawns. Day trading and stock picking get applause. Guess which one makes money?

On Long-Term Thinking:

“In the 20th Century alone, we dealt with two great wars, a dozen or so panics and recessions, virulent inflation, and the Great Depression. America has had no shortage of challenges. Without fail, however, we’ve overcome them.“

This is why “forget it and go back to work” works. Short-term chaos doesn’t matter over 30-40 years.

On Simplicity:

“Price is what you pay; value is what you get.“

An index fund at 0.04% fees is incredible value. A managed fund at 1%+ fees rarely delivers equivalent value.

The 16-Year Test: Did This Strategy Work?

From May 2008 (when Buffett gave this advice) to 2025:

S&P 500 Performance:

- Total return: ~400%+ including dividends

- That $1 million would now be worth ~$6.5 million ($3.3 million adjusted by inflation)

- Annual compound return: ~11%

And remember—this includes:

- The 2008-2009 financial crisis

- 2011 debt ceiling crisis

- 2015-2016 market volatility

- 2020 COVID crash

- 2022 bear market

Through all of it, “forget it and go back to work” crushed active management.

📚 Master Buffett’s Investment Philosophy

Want to deeply understand why Buffett’s simple strategy beats complexity?

Essential Buffett & Munger Reading:

The Essays of Warren Buffett: Lessons for Corporate America by Warren Buffett & Lawrence Cunningham

- Buffett’s actual letters organized by topic

- Learn directly from the master himself

- Includes the 2008 letter wisdom we referenced

Poor Charlie’s Almanack: The Essential Wit and Wisdom of Charles T. Munger

- Munger’s complete philosophy on investing

- Why simplicity beats complexity

- The “elementary, worldly wisdom” approach

The Intelligent Investor by Benjamin Graham

- Buffett: “By far the best book on investing ever written”

- Teaches the value investing principles behind the index fund advice

- Explains why Mr. Market’s mood swings don’t matter

For Understanding Index Funds:

The Little Book of Common Sense Investing by John C. Bogle

- Written by Vanguard’s founder (the company Buffett recommended)

- Mathematical proof why index funds beat active management

- Simple, clear, and convincing

A Random Walk Down Wall Street by Burton Malkiel

- Classic guide to why beating the market is nearly impossible

- Statistical evidence supporting Buffett’s advice

- Perfect for understanding efficient markets

For Long-Term Wealth Building:

The Psychology of Money by Morgan Housel

- Modern take on timeless investing wisdom

- Why behavior matters more than intelligence

- Explains why “forget it and go back to work” is so powerful

One Up On Wall Street by Peter Lynch

- For those who insist on stock picking (despite Buffett’s advice)

- If you must pick stocks, Lynch shows you how

- But he’d probably agree with Buffett for most people

The Bottom Line: Buffett’s Strategy in 2025

The same advice Buffett gave in 2008 works even better today:

What to Do:

- Open a Vanguard account (or equivalent low-cost provider like Fidelity or Schwab)

- Buy VTSAX or VOO (Total Market or S&P 500 index fund)

- Invest your money

- Set up automatic monthly investments with future income

- Forget about it

- Go back to work and focus on your career

What NOT to Do:

❌ Don’t hire a financial advisor charging 1% AUM fees

❌ Don’t buy actively managed mutual funds

❌ Don’t day trade

❌ Don’t try to time the market

❌ Don’t check your account daily

❌ Don’t panic sell during crashes

❌ Don’t chase crypto, meme stocks, or “hot tips”

Why It Still Works:

- Index fund fees are even lower now (some at 0.03%)

- More historical data proving active management fails

- Tax advantages of index funds (lower turnover)

- Simplicity reduces emotional mistakes

- Time remains the investor’s greatest ally

What Buffett Would Say About Today’s Market

Based on his 2008 wisdom, here’s what he’d likely tell that same 30-year-old today:

On market highs: “I would feel that was going to outperform bonds over a long period of time.” (It doesn’t matter if markets are high—over 30-40 years, stocks beat bonds)

On financial media: “Beware the investment activity that produces applause; the great moves are usually greeted by yawns.” (Ignore the noise about AI stocks, crypto, etc.)

On America’s future: “America’s best days lie ahead.” (From his 2008 letter—still true today)

On getting rich slowly: “You will get a very perfectly decent return over a 30 or 40 year period.” (Decent = becoming a multi-millionaire)

The Investment Nobody Wants (But Everyone Needs)

Here’s the uncomfortable truth: Buffett’s advice is boring.

It won’t make you feel smart at cocktail parties. You can’t brag about your “wins.” There’s no excitement, no adrenaline, no story to tell.

But remember Buffet’s question:

“Why should you expect more than that when you don’t bring anything to the party?”

You’re not Warren Buffett. You don’t have his expertise, his deal flow, or his decades of experience.

But you can have his results—by doing exactly what he told you to do:

- Low-cost index fund

- Forget it

- Go back to work

Your Move

If you’re 30 with a million dollars to invest:

Buffett told you exactly what to do 16 years ago. The advice hasn’t changed. The math hasn’t changed. Human nature hasn’t changed.

The only question is: Will you listen?

If you’re NOT 30 with a million dollars:

The same principles apply:

- 20 years old with $10,000? Same strategy

- 40 years old with $100,000? Same strategy

- 50 years old with $500,000? Maybe add some bonds, but mostly same strategy

The beauty of Buffett’s advice is that it scales and it adapts to almost any situation.

💬 Let’s Discuss

Would you actually follow Buffett’s advice?

Or would you try to beat the market anyway?

Drop your honest answer in the comments.

If this article changed how you think about investing, share it with someone who needs to hear Buffett’s wisdom.

Subscribe for more insights from the greatest investors in history.