Important Disclaimer: This article is for educational purposes only and is not financial advice. The author is not a licensed financial advisor. Always do your own research and consult qualified professionals before making investment decisions.

Affiliate Disclosure: This article contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you.

Warren Buffett’s First Stock: The $114.75 Investment That Changed Everything

Important Disclaimer: This article is for educational purposes only and is not financial advice. The author is not a licensed financial advisor. Always do your own research and consult qualified professionals before making investment decisions. This article contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you. Have a good reading.

March 11, 1942. While World War II raged across the globe, an 11-year-old boy in Omaha, Nebraska, walked into a bank and made a decision that would shape his entire life.

His name was Warren Buffett, and he was about to buy his first stock.

“I went all in, investing $114.75 I had begun accumulating at age six,” Buffett later wrote in his annual letter to shareholders. “What I bought was three shares of Cities Service preferred stock. I had become a capitalist, and it felt good.“

But what happened next taught him a lesson worth more than billions—a lesson about patience, timing, and the real secret to building wealth.

This is the story of Warren Buffett’s first stock, the costly mistake he made, and the three principles that turned a scared 11-year-old into one of the greatest investors in history.

The Boy Who Saved Every Penny

Before we get to the investment itself, you need to understand something about young Warren Buffett: he was obsessed with money.

Not spending it—accumulating it.

From age six, Buffett saved every penny he could find. He delivered newspapers. He collected golf balls at the local course and resold them. He bought six-packs of Coca-Cola for 25 cents and sold individual bottles for a nickel each, pocketing a 20% profit.

By age 11, he had saved $114.75—equivalent to about $2,100 in today’s dollars.

But money sitting idle wasn’t enough for young Warren. He spent his afternoons in the customers’ lounge of a regional stock brokerage near his father’s office, watching numbers change on the board, listening to traders talk, absorbing everything.

His father, Howard Buffett, was a stockbroker and U.S. Congressman who encouraged his son’s curiosity. At age 10, Warren’s father took him to visit the New York Stock Exchange. For most kids, it would be boring. For Warren, it was magic.

By early 1942, Warren had picked his target: Cities Service Preferred.

The Investment: Cities Service Preferred Stock

Image: Cities Service, 1940. Kenmore Square in Boston, Massachusetts

Cities Service Company was a natural gas and oil company founded in 1910. It operated service stations, explored for oil and natural gas, and handled refining and production across the Midwest.

The stock had been trading at $84 the previous year. By January 1942, it had fallen to $55. Now, on March 10, 1942, it was selling for around $40 per share.

Warren saw opportunity. The company was solid, the price had dropped, and he believed it was time to act.

On March 11, 1942, Warren enlisted his older sister Doris as a partner (she was 13). Together, they bought six shares total—three for Warren, three for Doris—at $38.25 per share.

Total investment: $114.75

Warren’s share: $57.38

Doris’s share: $57.37

As Buffett later joked, he “successfully top-ticked the market” because the stock closed that day at $37, down 3.3% from his purchase price.

“This was really kind of characteristic of my timing in stocks that was going to appear in future years,” he said with his trademark self-deprecating humor.

The Mistake That Cost $492

Almost immediately, Warren learned that the stock market doesn’t care about your feelings or your carefully saved money.

Cities Service Preferred plummeted.

By June 1942—just three months after purchase—the stock had crashed to $27 per share.

Warren had lost nearly 30% of his capital. But worse than the financial loss was the emotional torture.

Every single day on the way to school, his sister Doris “reminded” him that her stock was down. Every. Single. Day.

Alice Schroeder, in her biography The Snowball: Warren Buffett and the Business of Life, writes that this daily reminder was excruciating for the young investor who had convinced his sister to trust him with her savings.

Finally, after what felt like forever, the stock recovered. When it climbed back to $40 per share, Warren immediately sold.

They made a $5 profit total (about $2.50 each after splitting). Warren was relieved. The nightmare was over. His sister would stop reminding him.

Then came the gut punch.

Within weeks, Cities Service Preferred soared to $202 per share.

If Warren had held onto those six shares, they would have been worth $1,212 instead of the $120 he got by selling early.

He had missed out on $492 in profit (equivalent to over $9,000 today) because he sold too soon.

As Schroeder notes, Buffett would later call this “one of the most important episodes of his life” and a lesson he would “never, never, never forget.”

The Three Lessons That Built a $145 Billion Fortune

Years later, reflecting on this first investment, Warren Buffett distilled three critical lessons that shaped his entire investment philosophy:

Lesson #1: Don’t Fixate on Your Purchase Price

When the stock dropped to $27, all Warren could think about was getting back to his $38.25 purchase price. He was anchored to that number.

The moment it hit $40—barely above his entry point—he sold to “break even” and end the emotional pain.

The lesson: The price you paid is irrelevant. What matters is the company’s intrinsic value and future potential.

The stock market doesn’t know or care what you paid for a stock. Your purchase price is just a number in your head. Making decisions based on that number instead of the company’s actual value is a recipe for mistakes.

As Buffett later wrote: “The market is a no-called-strike game. You don’t have to swing at everything. Wait for the right pitch.”

Lesson #2: Don’t Try to Time Short-Term Price Movements

Warren sold at $40 because he thought he was being smart—taking a small profit rather than risking another drop.

But he was trying to time short-term price movements, something even professionals struggle to do consistently.

The lesson: Stop trying to guess when to buy and when to sell based on price action.

If you’ve invested in a quality company at a fair price, short-term volatility doesn’t matter. In fact, it’s an opportunity to buy more, not sell.

Years later, Buffett would famously say: “The stock market is a device for transferring money from the impatient to the patient.”

Lesson #3: Consider Opportunity Cost of Selling Too Early

The $5 profit felt like success in the moment. But the $492 he left on the table by selling too early was the real education.

The lesson: Every decision to sell has an opportunity cost. When you sell a great company too early, you forfeit all future gains.

This lesson fundamentally changed how Buffett invests. Today, his favorite holding period is “forever.” He’s held Coca-Cola since 1988, American Express since the 1960s, and countless other positions for decades.

When asked about his favorite time to sell a great company, Buffett’s answer is simple: “Never.”

Book recommendation: The Snowball: Warren Buffett and the Business of Life by Alice Schroeder provides the most detailed account of this story and Buffett’s early years. It’s the definitive biography authorized by Buffett himself.

What Happened to Cities Service?

Cities Service continued operations for decades. The company eventually became Citgo Petroleum Corporation—yes, the gas station chain you see today.

In 1982, Occidental Petroleum acquired Citgo for $4 billion. The company that 11-year-old Warren bought shares in became a multi-billion dollar enterprise.

If Buffett had somehow held those original shares and they converted properly through all the corporate changes, a conservative estimate suggests his $114.75 investment could have been worth around $683,000 by 2014.

But that’s just speculation. What matters more is what Buffett did with the lesson.

What Would That $114.75 Be Worth Today?

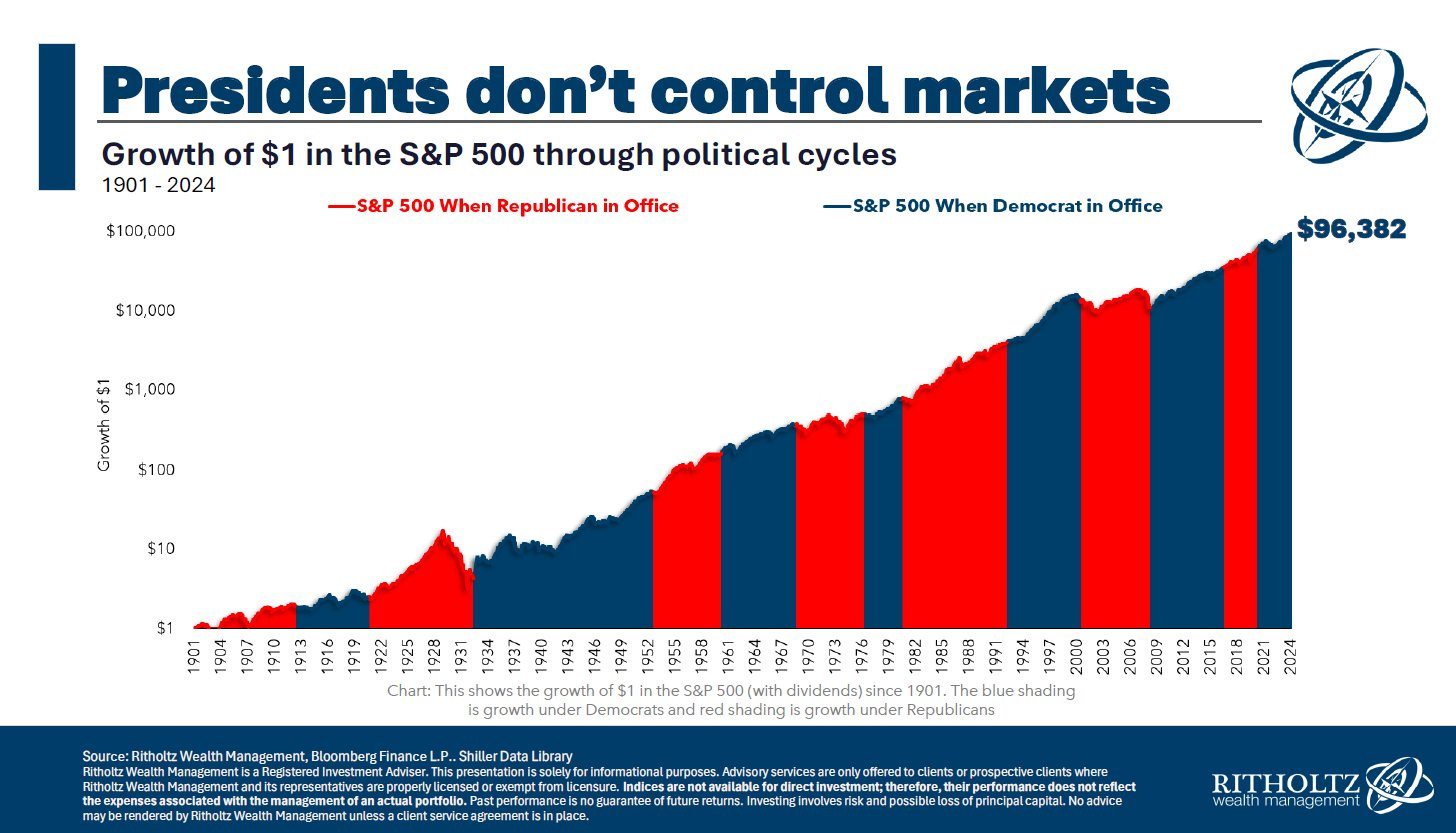

Image: $114.75 invested in the S&P 500, Jan 1942 – May 2024

In his 2018 letter to shareholders, Buffett did the math on what would have happened if instead of buying Cities Service, he’d invested that $114.75 in a hypothetical no-fee S&P 500 index fund with all dividends reinvested.

(Important note: The first index fund wasn’t available until 1975, so this is a thought experiment.)

The result?

That $114.75 would have been worth $606,811 by January 31, 2019.

That’s a gain of 5,288-to-1 over 77 years. More than half a million dollars from $114.75.

But here’s what’s even more remarkable: If a tax-free institution like a pension fund or college endowment had invested $1 million in 1942 the same way, it would have grown to $5.3 billion.

Buffett wrote: “The magical metal was no match for the American mettle” when comparing this to what would have happened if he’d bought gold instead (which would be worth only $4,200 today—less than 1% of the stock investment).

The Bigger Lesson: The American Tailwind

Image: Chart showing U.S. stock market growth from 1901 to present through multiple presidencies

Buffett didn’t share this calculation to brag about what could have been. He shared it to make a point about something bigger: the long-term power of the American economy.

In his shareholder letter, he wrote:

“Since 1942, we have had seven Republican presidents and seven Democrats. In the years they served, the country contended at various times with a long period of viral inflation, a 21% prime rate, several controversial and costly wars, the resignation of a president, a pervasive collapse in home values, a paralyzing financial panic and a host of other problems.

All engendered scary headlines; all are now history.“

The lesson? Don’t let headlines, politics, or short-term fear keep you out of the market. Over decades, quality investments compound.

As Buffett puts it: “It is beyond arrogance for American businesses or individuals to boast that they have ‘done it alone.’ The American tailwind is real.”

Book recommendation: The Intelligent Investor by Benjamin Graham changed Warren Buffett’s life when he read it at age 19. Graham became his mentor at Columbia Business School. This book teaches the value investing principles that Buffett built his fortune on.

From Stock Picker to Company Buyer: Buffett’s Evolution

The Cities Service lesson was just the beginning of Buffett’s education. But his philosophy evolved dramatically over the decades.

After reading Benjamin Graham’s The Intelligent Investor and studying under Graham at Columbia Business School, Buffett learned to buy stocks at extreme bargain prices based on financial ratios—what Graham called “cigar butt” investing (picking up discarded cigar butts with one puff left).

This worked well for years. But in the 1960s and 70s, Buffett’s business partner Charlie Munger challenged him to think differently.

Munger convinced Buffett that fundamentally excellent businesses were worth buying even at fair prices—not just at extreme bargains.

The turning point came in 1972 when Buffett and Munger bought See’s Candies for three times book value. To Graham disciples, this was heretically expensive.

But See’s proved to be one of Berkshire Hathaway’s best investments ever, generating over $2 billion in profits from a $25 million purchase.

Buffett never looked back. He stopped “buying stocks” and started “buying companies.”

As he told Charlie Rose in a 2022 interview: “I knew more when I was 11 than I know now,” he joked, before adding: “I stopped buying stocks and started buying companies.”

Today, Buffett’s favorite holding period is 10-20 years minimum. And surprisingly, he hopes stocks he buys go down in the short term—so he can buy more.

Book recommendation: Poor Charlie’s Almanack by Charlie Munger explains the mental models and philosophy that transformed Buffett’s thinking from “cigar butt” investing to buying wonderful businesses.

How to Apply Buffett’s First Stock Lesson Today

So what does an 11-year-old’s mistake in 1942 mean for you in 2025?

Everything.

1. Start Now, Not Later

Buffett famously joked: “I bought my first stock at 11. I wasted my life until then.”

It’s funny, but the underlying truth is serious: time is your most valuable asset in investing.

You don’t need $10,000 to start. You don’t need to be an expert. You just need to begin.

Every year you wait is a year of compound interest you’ll never get back.

If you’re 25 and start investing $100/month with 7% returns, you’ll have $264,000 by age 65.

If you wait until 35 to start, you’ll only have $122,000—less than half.

The best time to start was yesterday. The second best time is today.

2. Think in Decades, Not Days

When the stock dropped to $27, Warren panicked because he was thinking in weeks and months.

Today, Buffett thinks in decades. He doesn’t care what the stock does next month or next year. He cares about where the company will be in 10-20 years.

This mindset shift is the difference between mediocre returns and life-changing wealth.

Practical application: When you buy an investment, ask yourself: “Would I be comfortable holding this if the market closed for 10 years?”

If the answer is no, don’t buy it.

3. Stop Checking Prices Constantly

Daily price checking creates emotional decisions. Warren sold at $40 to end the psychological pain of daily reminders from his sister.

Modern investors make this worse by checking portfolio apps 10 times per day.

Practical application:

- Set up automatic monthly investments

- Check your portfolio quarterly at most

- Focus on the business fundamentals, not the ticker

4. Buy Quality and Hold

Warren’s mistake wasn’t buying Cities Service—it was selling too soon.

The companies Buffett has held the longest have generated the most wealth: Coca-Cola (since 1988), American Express (1960s), GEICO (1976).

Practical application:

- For most people, low-cost index funds like VOO or VTI are the best “companies” to buy and hold forever

- If buying individual stocks, only buy companies you’d be happy to own for 10+ years

- Selling should be rare and only when fundamentals deteriorate, not because of price movements

5. Embrace Volatility as Opportunity

When Cities Service dropped to $27, it was actually the best time to buy more, not panic.

Buffett learned this lesson and built his fortune buying when others were fearful.

His famous quote: “Be fearful when others are greedy, and greedy when others are fearful.”

Practical application:

- Keep cash reserves to buy during market crashes

- When markets drop 20%+, increase your investment rate

- Don’t sell during drops—that locks in losses

Book recommendation: Common Stocks and Uncommon Profits by Philip Fisher teaches how to identify quality companies worth holding long-term, complementing Buffett’s philosophy perfectly.

The Real Wealth Multiplier: Time + Patience

Here’s what Warren Buffett’s first stock story really teaches us:

Wealth isn’t built by picking the perfect stock. It’s built by starting early and staying patient.

Buffett is worth $145+ billion today not because he bought Cities Service at age 11, but because he:

- Started investing as early as possible

- Learned from his mistakes instead of being destroyed by them

- Developed patience and long-term thinking

- Let compound interest work for decades

- Never stopped learning and adapting

The stock market is, as Buffett said, “a device for transferring money from the impatient to the patient.”

Your purchase price doesn’t matter as much as you think. Your ability to time the market perfectly doesn’t matter. What matters is:

- Starting now

- Investing consistently

- Thinking long-term

- Staying patient through volatility

- Learning from mistakes

What’s Stopping You?

If an 11-year-old boy in 1942—during World War II, with just $114.75 saved from delivering newspapers—could take that first step, what’s stopping you?

You have advantages Warren didn’t:

- Online brokers with $0 commissions

- Index funds that didn’t exist until 1975

- Fractional shares (you can invest $10 in Amazon)

- Roth IRAs that protect growth from taxes

- 80+ years of additional market history to learn from

The barriers to entry have never been lower. The educational resources have never been more accessible.

The only thing standing between you and your financial future is the decision to start.

Warren Buffett’s first investment taught him patience. What will your first investment teach you?

Start Your Journey: Practical First Steps

This week:

- Open a brokerage account (Fidelity, Vanguard, or Schwab)

- Set up a Roth IRA if you’re eligible

- Invest in a low-cost S&P 500 index fund (VOO, FXAIX, or SWPPX)

- Set up automatic monthly contributions

This month:

- Read The Intelligent Investor or The Snowball

- Calculate your target investment amount (10-15% of income)

- Build your 3-6 month emergency fund

- Commit to not checking prices daily

This year:

- Max out your Roth IRA ($7,000 limit in 2025)

- Track your progress quarterly, not daily

- Keep learning but don’t let analysis paralysis stop you from investing

- Remember: Time in the market beats timing the market

Final Thoughts: The Legacy of a $114.75 Mistake

Warren Buffett’s first stock investment lost him 30% in three months and caused him to sell too early, missing out on 400% gains.

Most people would call that a disaster. Buffett calls it “one of the most important episodes of his life.”

Why? Because the lesson was worth infinitely more than the $492 he left on the table.

That lesson—think long-term, be patient, don’t fixate on purchase price—became the foundation of a $145 billion fortune and made him one of the most successful investors in history.

Your first investment might go up. It might go down. You might sell too early or hold too long.

It doesn’t matter.

What matters is that you start, you learn, and you stay in the game long enough for compound interest to work its magic.

The best time to buy your first stock was when you were 11 years old.

The second best time is today.

Recommended Reading

Want to learn more about Warren Buffett’s investing philosophy and how to apply it? These books are essential:

- The Snowball: Warren Buffett and the Business of Life by Alice Schroeder – The definitive Buffett biography with the complete Cities Service story

- The Intelligent Investor by Benjamin Graham – The book that changed Buffett’s life and taught him value investing

- Poor Charlie’s Almanack by Charlie Munger – Mental models and philosophy from Buffett’s partner

- Common Stocks and Uncommon Profits by Philip Fisher – How to identify quality companies worth holding forever

- The Essays of Warren Buffett compiled by Lawrence Cunningham – Buffett’s wisdom from his shareholder letters

- Berkshire Hathaway Letters to Shareholders – Free on Berkshire’s website, the best investing education available

- The Warren Buffett Way by Robert Hagstrom – Practical application of Buffett’s investing strategies

Start with The Intelligent Investor—it’s the foundation everything else builds on.

Frequently Asked Questions

How much money did Warren Buffett make from his first stock? Buffett made a $5 profit total ($2.50 for himself, $2.50 for his sister) by selling at $40. If he’d held until the stock reached $202, he would have made $492 profit instead.

What was Warren Buffett’s first stock? Cities Service Preferred, purchased on March 11, 1942, at $38.25 per share. He bought three shares for himself and three for his sister Doris, totaling $114.75.

How old was Warren Buffett when he bought his first stock? 11 years old. He had been saving money since age 6 specifically to invest.

What happened to Cities Service stock? Cities Service later became Citgo Petroleum Corporation. The company was acquired by Occidental Petroleum in 1982 for $4 billion.

What lesson did Warren Buffett learn from his first investment? Three lessons: (1) Don’t fixate on your purchase price, (2) Don’t try to time short-term movements, and (3) Understand the opportunity cost of selling too early.

How much would Buffett’s $114.75 be worth today? If invested in an S&P 500 index fund with reinvested dividends, it would be worth over $600,000 as of 2019—a 5,288-to-1 return over 77 years.

Full Legal Disclaimer

Investment Risk Disclosure: All investments involve risk, including potential loss of principal. Past performance does not guarantee future results. Warren Buffett’s results are exceptional and not typical of investor outcomes.

Not Professional Advice: The author is not a licensed financial advisor. Content represents educational information based on publicly available sources. Nothing here should be considered personalized investment advice.

Do Your Own Research: Before making investment decisions, conduct your own research and consult qualified financial, legal, and tax professionals.

No Guarantees: There are no guarantees of income or profit. The investment returns mentioned are historical examples for illustration only. Individual results vary significantly.

Affiliate Disclosure: This article contains affiliate links to books. The author may receive commissions from purchases at no additional cost to you.

Your Responsibility: You are solely responsible for your investment decisions and outcomes. The author assumes no liability for losses or damages from using information in this article.

Updated: October 2025

Remember: “The best time to plant a tree was 20 years ago. The second best time is today.” The same is true for investing. Start now.

Pingback: Warren Buffett Portfolio Strategy: Why You Need 3 Stocks