In 1972, Robert Kiyosaki bought his first gold coin for $50 while flying combat missions in Vietnam. Today, that same coin is worth $1,800. But here’s the question that changes everything about money: Did the coin get bigger, or did the dollar become worthless?

The author of Rich Dad Poor Dad just brought actual gold and silver on camera to reveal the biggest financial lie of the past 50 years—and why the money you’re desperately saving is destroying your wealth every single day.

If you’ve been taught to save money in a bank account, contribute to your 401(k), and invest for the long term in stocks and bonds, this article will challenge everything you think you know about building wealth.

Let’s start with the moment everything changed.

1971: The Year Your Money Became Fake

Robert Kiyosaki’s book “Fake” begins with him flying behind enemy lines in Vietnam in 1972 as a Marine pilot. But he wasn’t just fighting a war—he was searching for real money: gold.

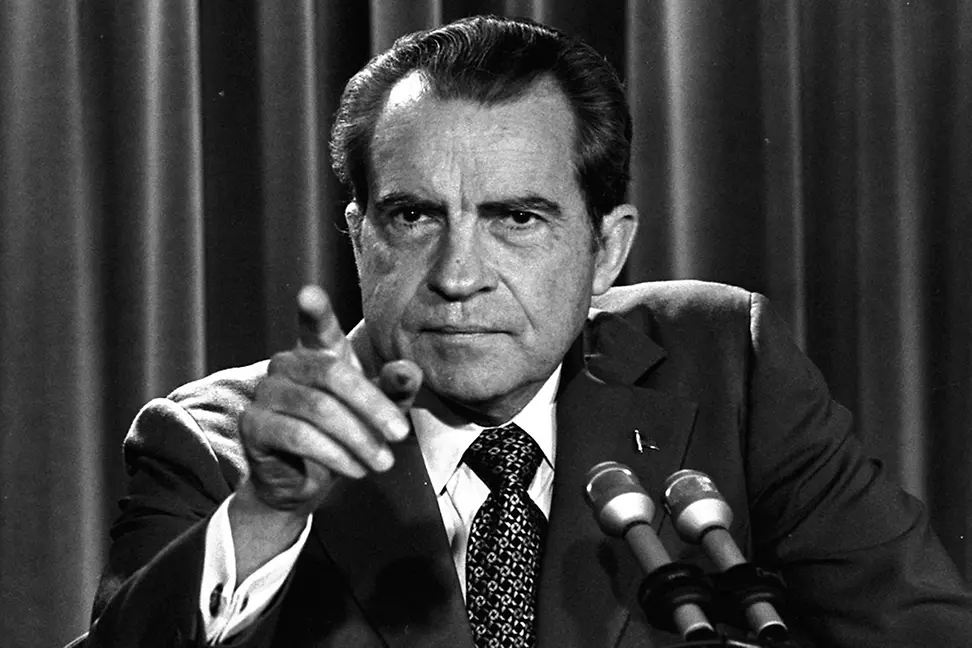

“In 1971, the US dollar became fake,” Kiyosaki explains. “This book starts with me flying behind enemy lines looking for gold because when Nixon took the dollar off the gold standard in ’71, he made it illegal for Americans to own gold.”

Wait—it was illegal to own gold?

Yes. From 1933 to 1974, American citizens were prohibited from owning gold. It was a criminal offense. The government confiscated gold and made it illegal for ordinary Americans to possess it.

Why? Because gold is real money. And governments can’t control real money the way they can control paper currency.

In 1971, President Richard Nixon completely severed the dollar’s connection to gold. Before that moment, dollars were backed by gold reserves. After that moment, dollars became what’s called “fiat currency”—money backed by nothing except government decree.

According to Kiyosaki, this was the moment your money became fake. And most people still don’t realize it happened.

“Most Americans don’t know what gold is because they’ve never seen it,” Kiyosaki says, holding up actual gold coins during the interview. “It was made illegal for Americans to own gold. Now everything is fake—fake money, fake teachers, fake assets.”

The Three Types Of Money (And Why You’re Saving The Wrong One)

Kiyosaki breaks down the monetary system into three categories that you need to understand:

1. God’s Money: Gold And Silver

“This is God’s money,” Kiyosaki explains, holding up gold and silver coins. “The reason I call it God’s money is you can’t fake it. It was here when the earth was created, and it’ll be here when we’re all dead and gone.”

Gold and silver are:

- Real, physical assets you can hold

- Cannot be created out of thin air

- Have been valuable for thousands of years

- Will maintain value for thousands more years

Most people have never actually seen or held real gold or silver. That’s why Kiyosaki brought physical coins to show during the interview—to demonstrate what real money actually looks like.

2. Government Money: Fiat Currency

This is the dollars, euros, pesos, yen, and every other paper currency printed by governments.

“Government money is fiat currency—the dollar, the yen, the peso, the euro, the yuan,” Kiyosaki lists. “It’s fake. And everybody’s working hard for it. It’s like eating fake food or drinking fake water. That’s why people are getting sick financially—because they’re working for fake money.”

Fiat currency is:

- Backed by nothing tangible

- Can be printed in unlimited quantities

- Loses value over time through inflation

- Controlled entirely by central banks

3. Fake Assets: Paper Investments

This includes stocks, bonds, mutual funds, ETFs, and even some real estate investment trusts (REITs).

Kiyosaki doesn’t touch these because “it smells as bad as the guys printing the money.”

Why does he call them fake? Because:

- You don’t physically own or control them

- They’re paper representations of ownership

- They can be manipulated by central banks and governments

- Their value depends on the system remaining stable

Here’s the brutal reality: You’ve been taught your entire life to work for #2 (government money) and save in #3 (fake assets) while the wealthy accumulate #1 (real money).

The $50 Gold Coin That Became $1,800: What Really Happened?

In 1972, while stationed in Vietnam, Kiyosaki bought his first gold coin—a South African Krugerrand—for $50 in Hong Kong.

“Today that same coin is worth about $1,800,” Kiyosaki reveals.

But here’s the question that reframes everything: Did the Krugerrand get bigger? Or did the dollar get worthless?

The coin is exactly the same physical object. One ounce of gold. The same weight. The same size. Nothing about the coin changed.

What changed was the purchasing power of the dollar. The dollar became worth less and less over 50 years while the gold maintained its real value.

“And they tell you to save money at the bank,” Kiyosaki says with disbelief.

The Silver Story Is Even More Dramatic

Kiyosaki holds up a silver coin. “In 1972, this was a dollar forty. Today it’s sixteen dollars.”

That’s more than a 10x increase. But more importantly, Kiyosaki explains his philosophy about counting wealth:

“I don’t count the price. I count the number of ounces. All I care about is how many ounces I have. That’s why I’m a rich man.”

He doesn’t care if silver is $16 or $20 or $50. He only cares about accumulating ounces. Why? Because “they can take everything away from me, but gold and silver will be here a thousand years from now, ten thousand years from now, a hundred thousand years from now. It’ll still be here.”

Meanwhile, those dollars you’re saving? They’re losing purchasing power every single day.

Why Silver Might Be The Biggest Opportunity Of Your Lifetime

While Kiyosaki owns both gold and silver, he’s particularly bullish on silver for younger investors. Here’s why:

Silver Is Historically Cheap Right Now

According to the data Kiyosaki presents, silver is trading approximately 70% below its historical average relative to other assets.

Meanwhile:

- The stock market is at an all-time high

- Real estate is at an all-time high

- Education costs are at an all-time high

- Medical costs are at an all-time high

“Would you want to invest in the stock market now when it’s at an all-time high?” Kiyosaki asks. “No. But silver at fifteen dollars? Little silver is a joke compared to where it used to be as high as fifty dollars.”

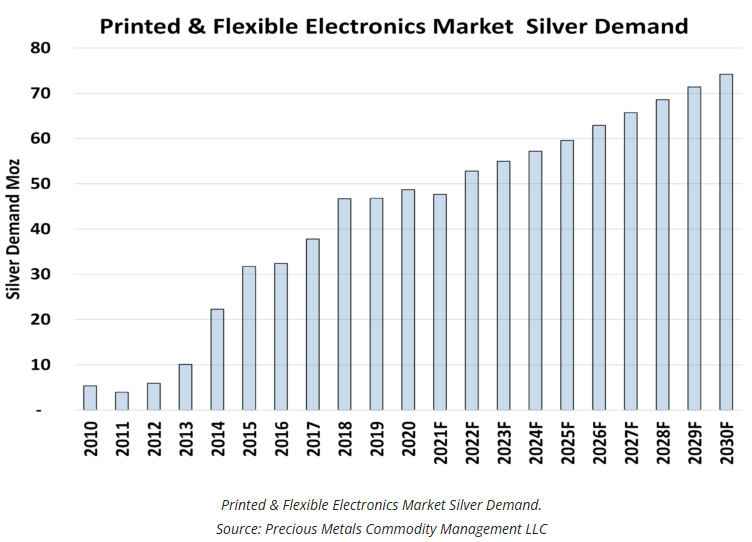

The Supply-Demand Crisis In Silver

Here’s where it gets really interesting. Kiyosaki presents several critical facts about silver supply and demand:

Demand Is Increasing:

- Silver fabrication demand in China is at record highs

- Industrial demand continues to grow

- Green energy revolution requires massive amounts of silver

- Solar panels need silver

- Electric vehicles need silver

- Electronics need silver

Supply Is Decreasing:

- Global government silver inventories are declining

- Almost half of all silver mined ends up in landfills

- Silver is an industrial metal that gets consumed and disappears

- Unlike gold (which is saved), silver is used up in manufacturing

“Silver is an industrial metal,” Kiyosaki explains. “It’s used in industry. It gets burned up. It keeps disappearing. Gold is saved.”

Think about that for a moment: Demand is rising. Supply is falling. The metal is being consumed and thrown away. And the price is at historic lows.

The Green Energy Connection

“Now everyone wants to go green,” Kiyosaki notes. “California now requires solar panels. All that requires silver.”

As the world transitions to renewable energy:

- Solar panel production increases

- Each panel requires silver

- Electric vehicle production increases

- Each EV requires significantly more silver than gas vehicles

- Electronics continue proliferating

- Each device needs silver

The consumption of silver is accelerating while inventories decline.

Kiyosaki’s Bold Prediction: $15 To $100 In Ten Years

“I predict—and my predictions are often wrong—that if you buy silver today at fifteen dollars, in ten years it’ll be about a hundred dollars because they keep burning it up, keep demanding it,” Kiyosaki states.

That would represent a 6-7x return over a decade.

But he clarifies: “This is not an investment. Would you rather save the dollar which is going down or save silver which is going up? Can you afford fifteen dollars?”

His point is that for the price of a meal or a few drinks, anyone can start accumulating real money instead of saving fake money.

“I know most Millennials say ‘yeah but you have money.’ I didn’t have any money either, but it was just a discipline. Can you afford twenty dollars today? Everybody in the world can, but they don’t have the discipline.”

The Criminal Operation Called The Federal Reserve

Kiyosaki doesn’t hold back on his view of central banks:

“The purpose of the central bank, the Fed—they’re a criminal operation as far as I’m concerned. The purpose of central banks like the Fed is to protect the banks, not you.”

How The Fed Keeps You Poor

According to Kiyosaki’s analysis:

The Fed prints unlimited money, which:

- Inflates asset prices (stocks, real estate)

- Devalues your savings

- Creates bubbles that eventually pop

- Benefits those who own assets

- Hurts those who save cash

“The Fed kept printing money, just kept blowing this bubble,” Kiyosaki explains, pointing to charts showing the stock market and real estate at all-time highs.

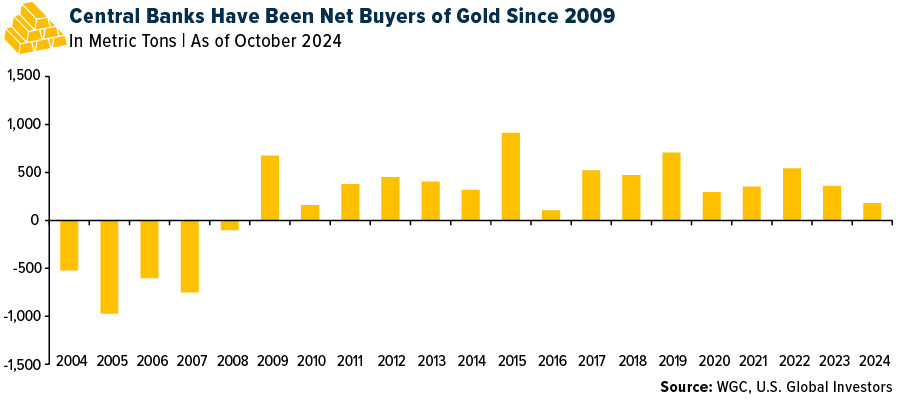

What Central Banks Do Privately

Here’s the kicker: While telling citizens to save dollars and invest in stocks and bonds, what are central banks themselves doing?

“China’s buying gold. Russia’s buying gold. Turkey’s buying gold. Everybody’s buying gold now. The central banks are buying gold.”

They know what’s coming. They’re protecting themselves with real money while encouraging you to hold fake money.

“They don’t tell you that,” Kiyosaki adds.

Why “Diversification” Is A Scam (According To Rich Dad)

When Kiyosaki was about 25 years old, he met his first financial planner.

“They told me ‘diversify.’ I said ‘you’re nuts.'”

What does diversification mean according to most financial planners?

“You buy a little of all this crap—stocks, bonds, mutual funds, ETFs, even fake real estate through REITs. It’s all paper.”

Kiyosaki’s view: “I’m not saying don’t touch it. I’m saying be aware of what’s real and what’s fake.”

His approach was the opposite of diversification in the traditional sense:

He focused exclusively on real assets:

- Real estate that produces cash flow

- Gold and silver

- Business ownership

- Oil and gas

“In 1972, when I was about 25 years old, I bought my first gold coin for $50. Today it’s worth about $1,800. I never saved dollars. What I started to do then as I got older, I just saved gold.”

The Discipline That Built Wealth

“Rather than saving dollars which was going down in value, I just saved gold and silver. It just became a habit. Sometimes it was hard because I didn’t have any money, but I started the discipline of buying a little bit at a time.”

“Today we’re multi-multi-multi-millionaires in gold and silver, and everybody will tell you ‘well that’s stupid because they’re in the stock market.'”

His response? “The stock market’s gonna crash in a few years anyway.”

The key lesson: It’s not about having a lot of money to start. It’s about having the discipline to consistently convert fake money into real money, even in small amounts.

The Cashflow Quadrant: Why Your Brain Is In The Wrong Place

Kiyosaki introduces one of the most important concepts from his Rich Dad teachings: the Cashflow Quadrant.

The quadrant divides the working world into four categories:

E – Employee

- Work for money

- Trade time for paycheck

- Pay the highest taxes

- Trained to work in the income column

S – Self-Employed

- Still trading time for money

- Own your job

- Still pay high taxes

- Slightly better than E, but still working for money

B – Business Owner

- Systems work for you

- Don’t trade time for money

- Leverage other people’s time

- More tax advantages

I – Investor

- Money works for you

- Assets generate income

- Lowest tax rates

- Ultimate financial freedom

Here’s Kiyosaki’s critical insight: “The trouble with most Millennials is your brain is still in the E quadrant. I’m trying to put your brain in the I quadrant.”

Where Fake Teachers Keep You

“Fake teachers are always in the E quadrant—the income column, working for fake money. That’s why they’re fake teachers.”

Schools train people to:

- Get a job (E quadrant)

- Work for a paycheck (fake money)

- Save in a 401(k) (fake assets)

- Buy a house with a mortgage (they call it an asset, but it’s a liability)

“When I was your age, at 25, my brain went into the asset column. That’s the only place I think about today.”

The Asset Column Mindset

Kiyosaki explains the difference:

Income Column Thinking (E/S):

- How do I get a higher paying job?

- How do I cover my expenses?

- How do I pay my taxes?

- How do I afford a house/car?

Asset Column Thinking (B/I):

- What assets can I acquire?

- What produces cash flow?

- How many ounces do I own?

- How do I make money work for me?

“All I focus on is the asset column. I don’t care how much money I make. All I want are assets. That’s what makes me a rich man—my brain is not in the E quadrant where most teachers are, which is working for income.”

Why Your House Is NOT An Asset (And What Is)

This is one of Kiyosaki’s most controversial teachings, but he stands by it:

“Your house is not an asset.”

Why not? According to Rich Dad’s definition, an asset is something that puts money in your pocket. A liability is something that takes money out of your pocket.

Your primary residence:

- Takes money out through mortgage payments

- Takes money out through property taxes

- Takes money out through insurance

- Takes money out through maintenance

- Takes money out through utilities

“Fake teachers tell you your house is an asset, your car is an asset, your college education is an asset.”

But by the true definition of assets and liabilities, these are all liabilities until they produce income.

Compare that to Kiyosaki’s real estate:

- Rental properties that generate monthly cash flow

- Commercial properties with tenants

- Land that appreciates and can be developed

- Real assets that put money in his pocket

The difference isn’t just semantic—it’s the difference between building wealth and building debt.

The Financial Statement: Where Most People Get Trapped

Kiyosaki points to the financial statement from his Cashflow board game to illustrate where people go wrong:

Most people think like this:

- Get a high-paying job (income column)

- Pay expenses and taxes (first expense is always taxes)

- Buy liabilities they think are assets (house, car, education debt)

- Save what’s left in a bank account (fake money)

“Your brain is stuck in the liability column because fake teachers told you your house is an asset, your car is an asset, your college education is an asset.”

Wealthy people think like this:

- Acquire assets (things that produce income)

- Assets pay for expenses

- Assets pay for liabilities (if they have any)

- Reinvest surplus into more assets

“The moment you put your brain through the videos in the I quadrant and the asset quadrant, you start to see a different world.”

The Tax Trap

Here’s something most people don’t realize: “The higher the wage, the higher the expenses and the taxes.”

People in the E and S quadrants pay the highest tax rates. People in the B and I quadrants have access to numerous tax advantages.

“The reason you want to work for fake money is your first line of expense is called tax. That’s silly.”

Working for a paycheck means the government takes their cut first, before you see any money. Owning assets and businesses means you get to use tax laws designed to incentivize investment.

Socialism vs. Capitalism: The Political Dimension

Kiyosaki doesn’t shy away from the political implications of financial education:

“If I had a kid today, I’d take them out of school. I would homeschool my kid. I don’t want to put them in school because they’re learning to be socialists and communists. I want to teach my kid to be a capitalist.”

His framework:

- Capitalists operate in the B and I quadrants (business owners and investors)

- Socialists and communists operate in the E and S quadrants (employees and self-employed)

“That’s Bernie Sanders, AOC, Elizabeth Warren—they’re all in the E and S side.”

His point isn’t purely political—it’s about understanding that different economic philosophies lead to different financial outcomes:

- E/S thinking: Government should provide, redistribute wealth, tax the rich

- B/I thinking: Create wealth, build assets, understand tax laws, generate prosperity

“The videos I sent shifted you from the E side to the I side because it opens up things that were never taught in school—the corruption going on today, the devaluation of the dollar, what we should really be focusing on for our future.”

The Discipline Of Accumulating Ounces

Let’s return to Kiyosaki’s core strategy, because this is actionable for anyone at any income level:

“I don’t count the price. I count the number of ounces.”

What This Means In Practice

When silver is $15 per ounce:

- Don’t think “Is this expensive or cheap?”

- Think “How many ounces can I buy?”

When silver rises to $20 per ounce:

- Don’t think “I missed my chance”

- Think “How many ounces can I buy?”

When silver drops to $12 per ounce:

- Don’t think “Maybe I should wait”

- Think “How many ounces can I buy?”

The price in dollars is irrelevant because dollars are losing value. The only thing that matters is accumulating real money—ounces of gold and silver.

Starting With Just $15-20 Per Month

“Most Millennials say ‘I don’t have money.’ I didn’t have any money either, but it was just a discipline.”

Here’s the math:

- $20 per month = roughly 1 ounce of silver per month

- 12 months = 12 ounces per year

- 10 years = 120 ounces

If Kiyosaki’s prediction is correct and silver reaches $100 per ounce, those 120 ounces would be worth $12,000—from just $2,400 invested ($20/month × 12 months × 10 years).

But more importantly, you’d have 120 ounces of real money while everyone else has fake money losing value.

“Can you afford twenty dollars today? Everybody in the world can. But they don’t have the discipline.”

Why Gold And Silver Will Outlast Everything

Kiyosaki’s long-term perspective on precious metals is based on one undeniable fact:

“Gold and silver will be here a thousand years from now, ten thousand years from now, a hundred thousand years from now.”

What Can Disappear

Think about what’s happened in just the past century:

- Currencies have collapsed (Weimar Germany, Zimbabwe, Venezuela, Argentina)

- Stock markets have crashed (1929, 2000, 2008, 2020)

- Companies have gone bankrupt (Enron, Lehman Brothers, countless others)

- Real estate bubbles have popped (2008, Japan 1990s)

- Governments have fallen

- Banks have failed

What Has Never Disappeared

Gold and silver have been valuable for:

- 5,000+ years of recorded human history

- Every civilization across every continent

- Through wars, plagues, famines, and disasters

- Regardless of government or economic system

“They can take everything away from me. But gold and silver will still be here.”

This isn’t speculation. This is historical fact.

The Green Revolution Is The Silver Revolution

Here’s something most investors are missing:

The push for green energy is simultaneously a massive driver of silver demand.

Kiyosaki notes: “Now everyone wants to go green. When you go green, you go silver.”

Why Green Technology Requires Silver

Solar Panels:

- Every solar panel requires silver for conductivity

- No viable substitute exists at scale

- California now mandates solar panels on new homes

- Global solar installation growth is exponential

Electric Vehicles:

- EVs use significantly more silver than gas vehicles

- Battery technology requires silver

- Charging infrastructure requires silver

- Global EV adoption accelerating

5G and Electronics:

- Every smartphone contains silver

- 5G infrastructure uses silver

- Internet of Things devices need silver

- Electronics proliferation continues

“All that requires silver,” Kiyosaki emphasizes.

The Ironic Waste Problem

Here’s the tragic part: “Almost half of all silver mined is in landfills.”

Think about that. We’re mining a finite resource, using it in products, and then throwing it away. Unlike gold (which is recycled at high rates because it’s expensive), silver often isn’t worth recovering from old electronics.

So it ends up in dumps. Gone forever. Removed from the supply.

Meanwhile, demand keeps rising.

How To Actually Start Buying Gold And Silver

This isn’t financial advice—it’s educational information based on Kiyosaki’s approach. Here’s how to actually implement this strategy:

Step 1: Understand What You’re Buying

Physical silver:

- Silver coins (American Eagles, Canadian Maples, etc.)

- Silver rounds (generic bullion)

- Silver bars (1 oz, 10 oz, 100 oz, etc.)

Physical gold:

- Gold coins (American Eagles, Krugerrands, etc.)

- Gold bars (1 oz is most common for individuals)

What Kiyosaki DOESN’T buy:

- Silver ETFs

- Gold ETFs

- Mining stocks

- Certificates or paper claims

“I don’t touch that stuff because it smells as bad as the guys printing the fake money.”

His reasoning: If you don’t physically hold it, you don’t really own it.

Step 2: Find Reputable Dealers

Look for:

- Established precious metals dealers

- Transparent pricing close to spot price

- Buyback policies

- Secure shipping

- Good reputation and reviews

Many people buy from:

- Local coin shops

- Online dealers (APMEX, JM Bullion, SD Bullion, etc.)

- Direct from government mints

Step 3: Start Small And Build Consistently

You don’t need thousands of dollars to start.

Kiyosaki’s approach:

- Start with what you can afford ($15-20 for silver)

- Make it a habit (monthly purchases)

- Don’t worry about timing the market

- Focus on accumulating ounces

- Be consistent for years

“Sometimes it was hard because I didn’t have any money, but I started the discipline.”

Step 4: Store It Securely

Options include:

- Home safe (for smaller amounts)

- Bank safety deposit box

- Private vault storage

- Allocated storage with dealers

Kiyosaki keeps his precious metals close: “This is the basis of my wealth.”

Step 5: Never Spend Your Core Holdings

“I never spend this stuff because that’s the basis of my wealth.”

Think of gold and silver as:

- Your savings account in real money

- Your financial insurance policy

- Your generational wealth

- Your protection against currency collapse

You’re not buying it to flip it for profit. You’re converting fake money into real money and holding it long-term.

The Comparison: Where Would You Rather Be?

Let’s do a thought experiment based on Kiyosaki’s actual experience:

Scenario A: The Traditional Saver (1972-2025)

Starting in 1972 with $50:

- Put $50 in a savings account

- Added $20/month consistently

- Earned average savings account interest (about 3% historically, much less recently)

- Total saved over 50+ years: roughly $12,000-15,000 in principal

Purchasing power today: Significantly less than when you started due to inflation.

Scenario B: The Gold Saver (Kiyosaki’s Approach)

Starting in 1972 with $50:

- Bought one Krugerrand for $50

- Added whatever possible in gold and silver over decades

- Didn’t care about daily price fluctuations

- Focused only on accumulating ounces

Value today: That first coin alone is worth $1,800. Every ounce accumulated over the decades has appreciated similarly.

Result: “Today we’re multi-multi-multi-millionaires in gold and silver.”

The Real Difference

It’s not that Kiyosaki started with more money. He explicitly states he didn’t.

The difference was:

- Understanding what money actually is (real vs. fake)

- Having the discipline to consistently buy real money

- Ignoring financial planners who pushed fake assets

- Thinking long-term (decades, not months or years)

- Never selling the core holdings

“Everybody will tell you ‘that’s stupid because they’re in the stock market.’ Well, the stock market’s gonna crash in a few years anyway, and this goes up and down too, but I don’t count the price. I count the number of ounces.”

What About The Stock Market And Real Estate?

Kiyosaki’s view on traditional investments is nuanced:

The Stock Market Problem

“Look at this chart—the Dow is at an all-time high. Why would you invest in the stock market now?”

His point isn’t that stocks are always bad. His point is timing and awareness:

- The Fed has blown a massive bubble by printing money

- Valuations are at extremes

- When bubbles pop, people lose fortunes

- Better opportunities exist when assets are cheap, not expensive

“The Fed kept printing money, just kept blowing this bubble.”

The Real Estate Timing

Same principle applies to housing:

“You guys always complain ‘oh I can’t afford a house.’ Well, wait till it crashes, then buy a house. In 2008, after it crashed, that’s when I bought real estate.”

He’s not against real estate—he owns significant real estate. But he bought when prices crashed, not when they’re at all-time highs.

“Housing—you can’t afford it now because you’re trying to buy at the top.”

The Strategy

When assets are expensive (now):

- Buy cheap assets (silver, gold)

- Build cash flow through business

- Prepare for the crash

- Don’t chase expensive assets

When assets are cheap (after crashes):

- Buy real estate at discount prices

- Buy stocks if you understand them

- Acquire businesses in distress

- Deploy cash you’ve been building

This is how wealth is built—buying low, not buying high.

The Education System Is Training You To Be Poor

One of Kiyosaki’s most controversial positions is his view on traditional education:

“If I had a kid today, I’d take them out of school. I would homeschool my kid.”

What Schools Teach

According to Kiyosaki:

- Work for money (E quadrant thinking)

- Save money (fake money that loses value)

- Invest long-term (in expensive markets at all-time highs)

- Your house is an asset (when it’s actually a liability)

- Diversify (into paper assets you don’t control)

- Get a good job (and pay the highest tax rates)

“Fake teachers teach us nothing about money. They tell you if you make mistakes you’re stupid. But if you don’t make mistakes, you don’t learn anything.”

What You Need To Learn

- How money actually works (real vs. fake)

- The difference between assets and liabilities

- How to acquire cash-flowing assets

- How taxes actually work (and how to legally reduce them)

- The Cashflow Quadrant (E-S-B-I)

- The history of money and central banks

“Those videos I sent you shifted you from the E side to the I side. They open up things that were never taught in school.”

The Political Agenda

Kiyosaki sees the education system as politically motivated:

“They’re learning to be socialists and communists. I want to teach my kid to be a capitalist.”

Whether you agree with his politics or not, his core point stands: Schools don’t teach financial intelligence. They teach you to be a good employee, not a wealthy investor.

The Fake Asset Trap: What To Avoid

Kiyosaki is explicit about what he considers fake assets:

Paper Gold And Silver (ETFs)

“I don’t touch them because they smell as bad as the guys printing the fake money.”

Why?

- You don’t physically own the metal

- It’s a paper claim on gold/silver

- In a crisis, you can’t take delivery

- Counterparty risk exists

- It’s just another form of paper

Stocks, Bonds, Mutual Funds

“All paper. Fake financial planners tell you to invest for the long term when the market’s at an all-time high.”

His issues:

- You don’t control the companies

- Value depends on the system staying stable

- Markets are manipulated by Fed money printing

- Buying at all-time highs is insane

REITs (Real Estate Investment Trusts)

“Fake real estate. I don’t touch the stuff.”

Why?

- It’s paper representation of real estate

- You don’t own physical property

- No control over management

- Subject to stock market volatility

What He DOES Own

- Physical gold and silver (he can hold it)

- Cash-flowing real estate (he controls it)

- Businesses (he owns them)

- Oil and gas investments (real commodities)

The pattern: Real assets you can touch, control, or directly benefit from.

The Coming Crash: Why Timing Matters

Kiyosaki is clear about his predictions (though he admits predictions can be wrong):

“The stock market’s gonna crash in a few years anyway.”

Why He Believes This

- Fed money printing created artificial bubbles

- Stock market at all-time highs

- Real estate at all-time highs

- Bubbles always pop

- Historical patterns repeat

- 1929 crash

- 2000 dot-com crash

- 2008 financial crisis

- 2020 COVID crash (brief)

- Next crash coming

- When everything is expensive, something’s wrong

- Stocks: expensive

- Real estate: expensive

- Bonds: historically low yields

- Only cheap asset: silver

What To Do About It

Before the crash:

- Convert fake money to real money (gold/silver)

- Build cash reserves

- Don’t buy expensive assets

- Learn about investing in down markets

During the crash:

- Don’t panic

- Your gold and silver hold value

- Look for opportunities

After the crash:

- Buy real estate at discounts

- Buy stocks if appropriate

- Acquire distressed assets

- This is when fortunes are made

“In 2008, after it crashed, that’s when I bought real estate.”

The wealthy don’t make money during good times—they make money during crashes by being prepared and buying assets on sale.

Why Central Banks Are Quietly Buying Gold

Here’s something that should make you think:

“China’s buying gold. Russia’s buying gold. Turkey’s buying gold. The central banks are buying gold—they don’t tell you that.”

The Hypocrisy

Central banks tell citizens:

- Save dollars

- Invest in stocks and bonds

- Diversify into paper assets

- Gold is a “barbarous relic”

- Modern portfolio theory is best

Central banks actually do:

- Accumulate massive gold reserves

- Increase gold purchases during uncertainty

- Understand gold is real money

- Protect themselves with tangible assets

Recent Central Bank Gold Purchases

According to the World Gold Council data:

- China has been aggressively adding to reserves

- Russia bought heavily before sanctions

- Turkey dramatically increased holdings

- Poland and other countries diversifying into gold

- Central banks are net buyers, not sellers

Why would they do this if gold is worthless?

The answer is obvious: They know what’s coming. They’re protecting their nations’ wealth with real money while encouraging citizens to hold fake money.

“They know. You should too.”

The Affordability Argument: Anyone Can Start

One of the most powerful aspects of Kiyosaki’s message is accessibility:

“Can you afford fifteen dollars? I can afford it. That’s why I think it’s a perfect opportunity for Millennials who complain about living paycheck to paycheck. You set aside fifteen bucks.”

Breaking Down The Math

Monthly commitment: $20

- Skip two expensive coffees

- Cook one meal instead of ordering out

- Cut one streaming service

- Find $20 somewhere

What you get:

- 1+ ounce of silver per month

- 12+ ounces per year

- 120+ ounces in 10 years

If silver reaches $100 (Kiyosaki’s prediction):

- 120 ounces × $100 = $12,000

- From $2,400 invested

- 5x return

But that’s not even the point.

The point is you have 120 ounces of REAL money while everyone else has fake money that lost value.

The Discipline Factor

“I know most Millennials say ‘yeah but you have money.’ I didn’t have any money either. But it was just a discipline.”

This is crucial. Kiyosaki didn’t start rich. He started with discipline.

The discipline of:

- Converting fake money to real money consistently

- Not spending on worthless things

- Thinking long-term (decades, not days)

- Ignoring what everyone else is doing

- Trusting in real assets over time

“Everybody in the world can afford twenty dollars. But they don’t have the discipline.”

Physical Gold And Silver: What It Actually Looks Like

Kiyosaki brought actual precious metals to the interview specifically because “most people haven’t seen it or touched it.”

What He Showed

Silver:

- “This is silver. That’s what it looks like.”

- Physical coins and rounds

- “This here is real silver. Most people don’t know what it looks like.”

Gold:

- “This here is gold. This is God’s money. This is what it looks like.”

- Physical gold coins

- Actual tangible wealth you can hold

The Green Box:

- Contains 500 tubes of silver

- “This is one tube, which is worth more—the gold? This is worth more than all that.”

- Visual demonstration of gold’s concentration of value

Why The Physical Demonstration Matters

Most people’s entire concept of wealth is abstract:

- Numbers on a bank statement

- Digits in a brokerage account

- Property deeds

- Stock certificates

But when you hold an ounce of gold in your hand, something shifts. It’s real. It’s tangible. It has weight and substance.

“The reason I brought this here is most people haven’t seen it. They don’t know what it looks like.”

This is intentional. When gold was illegal to own (1933-1974), multiple generations of Americans grew up never seeing real money. They only knew paper dollars.

By making precious metals unfamiliar, the government ensured people would trust fake money instead.

Argentina, Venezuela, Zimbabwe: The Currency Death Spiral

Kiyosaki uses international examples to prove his point about fake money:

“If you live in a country like Argentina, gold is more expensive because the spot price is relative to the currency of the country.”

What Happens When Currency Collapses

Argentina:

- Peso has collapsed multiple times

- Anyone who saved pesos lost everything

- Anyone who saved gold and silver survived

- “If they had saved this, they’d be okay today. But they saved pesos.”

Venezuela:

- Hyperinflation destroyed the bolivar

- Life savings became worthless

- People couldn’t buy food

- Gold holders could still eat

Zimbabwe:

- Currency became so worthless they issued trillion-dollar notes

- Savings accounts evaporated

- Only tangible assets retained value

“It Can’t Happen Here” Is Naive

Americans think “that could never happen in the United States.”

But remember:

- The dollar has lost 98% of its purchasing power since 1913

- It just happens slowly instead of quickly

- The outcome is the same—your savings become worthless

“The same as Mexico. Same as Peru. This is relative to government money.”

The spot price of gold in dollars, pesos, or bolivars doesn’t matter. What matters is: Gold is real. Currencies are not.

The Next Generation: Why This Matters For Millennials And Gen Z

Kiyosaki specifically addresses younger generations:

“This could be the biggest opportunity you’ll ever see.”

Why Young People Have An Advantage

Time horizon:

- Decades to accumulate ounces

- Compound discipline over time

- Start young, end wealthy

Lower initial capital needed:

- $15-20 per month is achievable

- Don’t need $10,000 to start

- Can’t afford a house anyway—buy silver instead

Comfort with challenging authority:

- Millennials and Gen Z question traditional systems

- More open to alternative assets

- See the corruption Kiyosaki describes

Digital native perspective:

- Understand that numbers on screens aren’t real

- Get that crypto and digital currency exist

- Easier to grasp that dollars are just data

What’s At Stake

If you follow traditional advice:

- Work for fake money

- Save fake money

- Invest in fake assets at all-time highs

- Retire with money that buys nothing

If you follow Kiyosaki’s approach:

- Work for assets

- Save real money (gold and silver)

- Invest when assets are cheap

- Retire with wealth that lasts generations

“Stop listening to fake teachers. Get your brain out of the E quadrant.”

Final Thoughts: The Choice Is Yours

Robert Kiyosaki has been teaching these principles for decades. He’s been proven right repeatedly:

- Predicted 2008 crash

- Has been accumulating gold/silver for 50+ years

- Built massive wealth following his own advice

- Watched fake money lose 98% of value

- Seen multiple currency collapses worldwide

His message is simple but radical:

Stop working for fake money. Stop saving fake money. Stop buying fake assets.

Start accumulating real money. Start thinking like an investor. Start building actual wealth.

The question isn’t whether he’s right. History has proven gold and silver maintain value across centuries. The Fed admits it prints money. Central banks are buying gold.

The question is: What will you do about it?

Will you:

- Keep saving dollars that lose value every day?

- Keep working for a paycheck in the E quadrant?

- Keep listening to fake teachers and fake financial planners?

- Keep buying expensive assets at all-time highs?

Or will you:

- Start converting fake money to real money?

- Shift your thinking from E to I quadrant?

- Build the discipline to buy $15-20 of silver per month?

- Position yourself for the coming market crash?

“Can you afford fifteen dollars? Everybody in the world can. But they don’t have the discipline.”

The information is here. The opportunity is available. The choice is yours.

Fifty years from now, what will you wish you had done today?

Continue Your Financial Education

Watch The Full Interview: Robert Kiyosaki: Fake Money Is Making You Poorer

Essential Reading:

- Rich Dad Poor Dad by Robert Kiyosaki: https://amzn.to/3LxHeAU

- Fake: Fake Money, Fake Teachers, Fake Assets by Robert Kiyosaki: https://amzn.to/3Nas6Kb

Learn By Doing:

- Cashflow Board Game: https://amzn.to/4jxHSuO

Follow For Daily Insights:

- Website: https://www.investingtimedaily.com/

- Instagram: https://www.instagram.com/investingtimedaily/