Are you feeling the shift? If you look at the news today—surging inflation, geopolitical tensions, and shifting global alliances—it’s easy to feel like the world is becoming increasingly unpredictable. But what if I told you that what we are experiencing right now isn’t new? What if there was a repeatable “Big Cycle” that has governed the last 500 years of human history?

Ray Dalio, the legendary investor and founder of Bridgewater Associates, spent years researching the rise and fall of the 10 most powerful empires to find the answer. In his transformative work, “Principles for Dealing with the Changing World Order,” Dalio reveals that history moves in cycles, and by understanding these patterns, you can protect your wealth and navigate the future with clarity.

In this comprehensive guide, we will break down the mechanics of global power, why empires inevitably decline, and how you can prepare for the new world order.

The 250-Year Cycle: How Empires Rise and Fall

History is not just a sequence of random events; it is a series of overlapping cycles. Through his research, Ray Dalio identified that the most powerful empires typically follow a cycle that lasts approximately 250 years, with a 10-to-20-year transition period between them.

According to Dalio’s study of the Dutch, British, and US empires, these transitions are rarely peaceful. “Leading powers don’t decline without a fight,” Dalio notes. This is why we often see significant global conflict when a new power begins to challenge the incumbent.

The Eight Metrics of Power

To determine where an empire stands in its life cycle, Dalio uses eight specific metrics. By averaging these, we can see a country’s total power in real-time:

- Education: The foundation of all progress.

- Inventiveness & Technology: Turning knowledge into tools.

- Competitiveness: The ability to sell goods in global markets.

- Economic Output: Total GDP and productivity.

- Share of World Trade: How much of the world’s commerce flows through the nation.

- Military Strength: The ability to protect interests.

- Financial Center Power: Dominance in capital markets (e.g., Wall Street).

- Reserve Currency Strength: The ultimate prize of global dominance.

“Because these powers are measurable, we can see how strong each country is now, was in the past, and whether they’re rising or declining.” — Ray Dalio

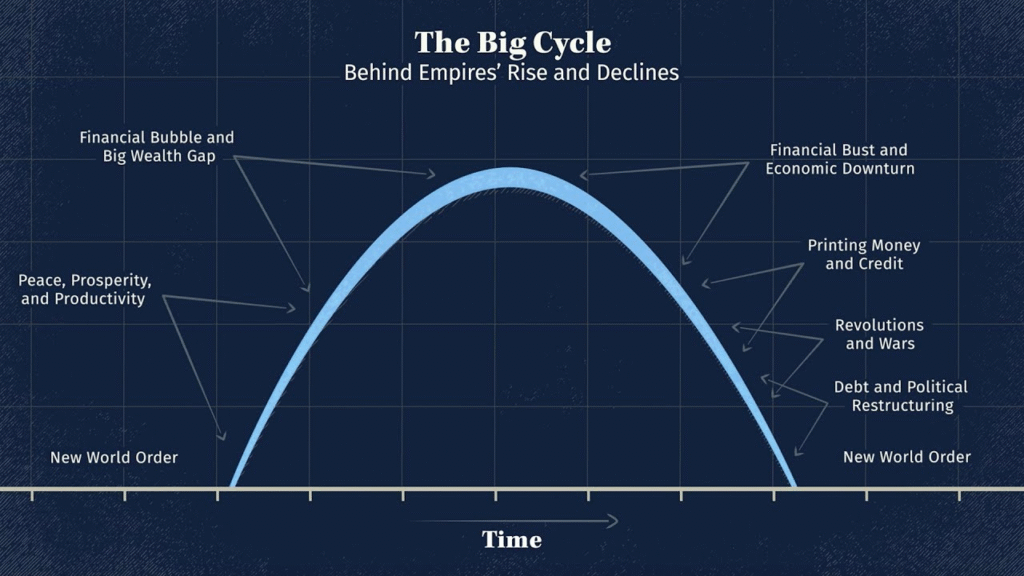

The Typical Sequence: From Peace to Bubble to Bust

Every great empire follows a specific “script.” If you want to know where the United States or China stands today, you have to look at the stages of the Big Cycle.

1. The New World Order and Prosperity

The cycle typically begins after a major conflict (often a war) that establishes a clear winner. Because no one wants to challenge the new dominant power, a period of peace and prosperity follows. During this stage, people work hard, innovate, and education levels rise.

2. The Debt Bubble and Reserve Currency Status

As the empire becomes the dominant force in trade, its currency becomes the world’s reserve currency. This is a “superpower” that allows the nation to borrow much more money than other countries. People begin to bet on prosperity continuing indefinitely, leading to massive borrowing and the formation of a financial bubble.

3. The Wealth Gap and Internal Conflict

Prosperity is rarely distributed equally. Over time, a massive wealth gap develops between the “rich haves” and the “poor have-nots.” This creates social tension and political polarization. If you feel like the world is more divided today than ever, you are witnessing this specific stage of the cycle.

4. The Printing of Money and Revolution

When the debt bubble eventually bursts, the government cannot pay its bills. To solve this, they do the only thing they can: they print money. This devalues the currency and increases inflation. The internal conflict between the rich and poor intensifies, often leading to a revolution or civil war to redistribute wealth.

The Rise of China and the Decline of the West

Ray Dalio’s research isn’t just about the past; it’s a warning about the present. By studying Chinese dynasties back to the year 600, Dalio highlights that China is currently in a rapid rise phase, while the United States is in an “early decline” phase of its cycle.

The United States currently struggles with high debt levels, significant internal political conflict, and a shrinking lead in technology and trade. Meanwhile, China has seen a massive surge in education, innovation, and military strength.

Why This Matters for Your Portfolio

When the leading power faces domestic breakdowns, external rivals see an opportunity. This is when external conflicts and wars typically occur. For investors, this means the “safe” assets of the last 40 years (like the US Dollar or Treasury bonds) may carry more risk than history suggests.

Conclusion: The Cycle Begins Again

The winners of the next conflict will get together to create a New World Order, and the cycle will begin again. While this may sound daunting, remember that these transitions have happened dozens of times throughout history. Those who are educated and prepared are the ones who survive and thrive.

As Ray Dalio teaches, “Success comes from knowing how to deal with what you don’t know.”

What do you think? Are we in the final stages of the US Dollar’s dominance? Let us know in the comments below!

Recommended Resources for Your Journey:

- Book: Principles for Dealing with the Changing World Order – The definitive guide to this topic.

- Book: Principles: Life and Work – How Ray Dalio built the world’s largest hedge fund.

- Website: Investing Time Daily

- Instagram: @InvestingTimeDaily