You’re watching your portfolio soar. Tech stocks are breaking records. AI companies are minting millionaires overnight.

Everything feels incredible… until it doesn’t.

Ray Dalio, the billionaire investor who predicted the 2008 financial crisis, just issued a stark warning that should make every investor pause: His proprietary “bubble indicator” is flashing red at levels not seen since 1999 and 1927—right before two of history’s most devastating market crashes.

In a revealing October 2025 interview with CNBC, Dalio didn’t sugarcoat his concerns. The hedge fund titan said he uses a personal “bubble indicator” that’s relatively high right now, comparing current market conditions to the infamous dot-com bubble and the Roaring Twenties boom that preceded the Great Depression.

If you have money in the stock market—especially in tech or AI stocks—you need to read every word of this guide. Because what happens next could either protect your wealth or destroy it.

What Is Ray Dalio’s Bubble Indicator? (And Why You Should Care)

Before we dive into the current warnings, you need to understand the genius behind Dalio’s system.

Ray Dalio isn’t just another talking head on financial television. As the founder of Bridgewater Associates—one of the world’s largest and most successful hedge funds—he’s spent over 50 years studying market cycles, economic patterns, and financial bubbles throughout history.

His secret weapon? A “bubble indicator” that systemized his understanding of unsustainably high prices into a quantitative measure.

The Six Questions That Predict Market Crashes

Dalio’s indicator is based on asking six key questions with reference to several different statistics:

- How high are prices relative to traditional measures? Are valuations stretched beyond historical norms using metrics like P/E ratios and price-to-sales?

- Are prices discounting future rapid appreciation? Are investors assuming explosive growth that may not materialize?

- How broadly positive is investor sentiment? When everyone is bullish, who’s left to buy?

- Are investments being financed by high leverage? Borrowed money amplifies both gains and devastating losses.

- Have buyers made extended forward purchases? Are people stockpiling assets to speculate on future price increases?

- How many new buyers have entered the market? A rush of new entrants, especially smaller players attracted by fast-rising prices, is often telling.

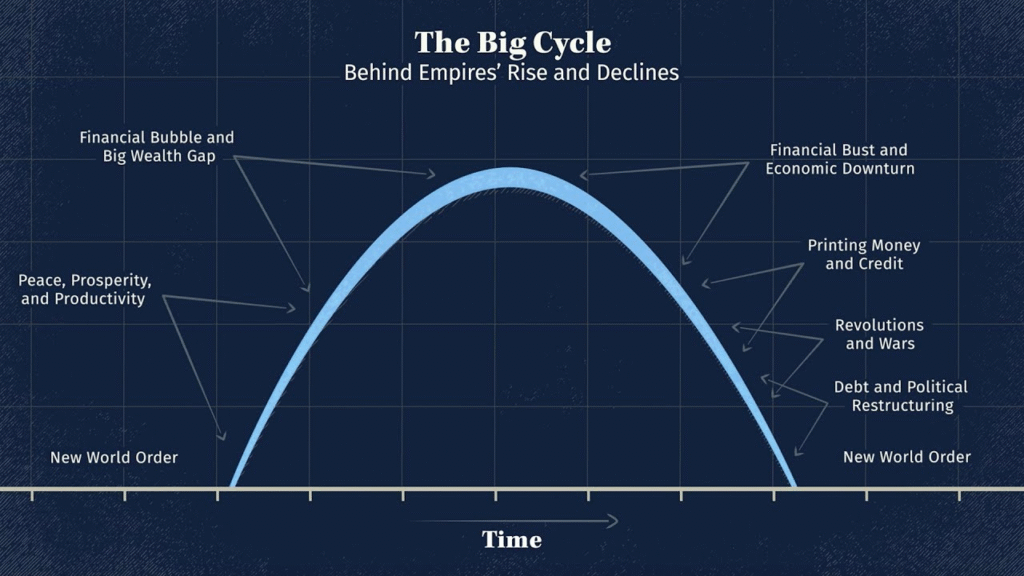

Caption: Ray Dalio’s Big Cycle Behind Empires’ Rise and Decline model

The aggregate bubble gauge is around the 77th percentile today for the US stock market overall. In the bubble of 2000 and the bubble of 1929 this aggregate gauge had a 100th percentile read.

Translation: We’re not at peak bubble territory yet—but we’re dangerously close.

The Two-Part Economy: Why This Bubble Is Different (And More Dangerous)

He said there’s a “two-part economy,” with the easing of interest rates because of weakening in some places while a bubble develops elsewhere.

Think about that for a moment. We have:

Part 1: A Weakening Economy

- Consumer spending slowing

- Manufacturing contracting

- Unemployment creeping higher

- Small businesses struggling

Part 2: A Raging Bubble

- AI stocks soaring to stratospheric valuations

- Tech companies valued at billions without profits

- Retail investors piling into “the next big thing”

- Concentration of gains in just a handful of mega-cap stocks

The Federal Reserve is stuck between a rock and a hard place. The easing of the rates is because most of the economy’s elements are weakening, but lower rates fuel the bubble even more.

Dalio’s chilling assessment: Monetary policy for both is not going to work because of that element of divergence.

Caption: Total Job Opening vs S&P 500

1999 vs. 2025: History Doesn’t Repeat, But It Rhymes

Dalio specifically mentioned comparing today’s conditions to “1998, 99… 1927, 28 and so on.”

Let’s unpack what happened in those periods—and why you should be aware of the similarities.

The 1999 Dot-Com Bubble: When “Profits Don’t Matter”

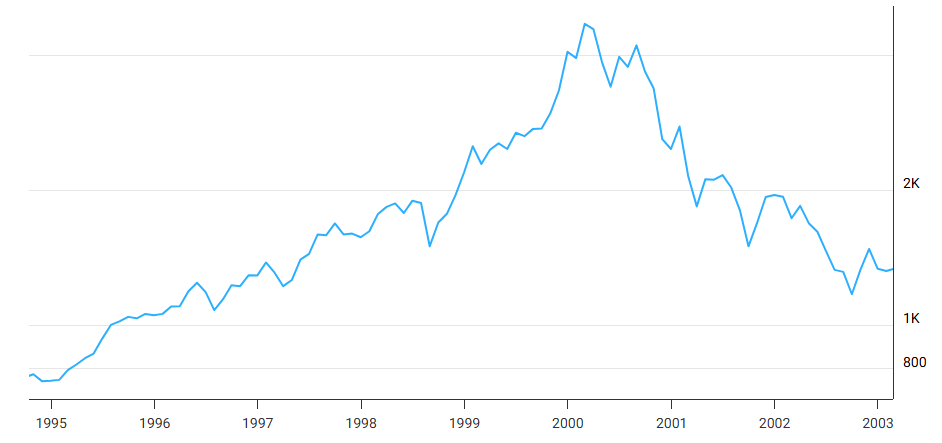

Between 1995 and 2000, the Nasdaq Composite stock market index rose 400%. It reached a price-earnings ratio of 200.

Sound familiar? Replace “dot-com” with “AI” and you’ve got today’s market.

The parallels are haunting:

Then: Companies with .com domains but no revenue went public

Now: AI startups valued at billions with no path to profitability

Then: In October 1999, the market cap of the 199 internet stocks tracked was a whopping $450 billion, but the total annual sales came to only about $21 billion, and their annual profits… collective losses totaled $6.2 billion

Now: Similar valuation-to-revenue mismatches in emerging tech

What Happened When the Music Stopped

The bubble burst, ushering in a two-year-long bear market that saw the Nasdaq index fall 76.81%. It took the Nasdaq 15 years to regain its value.

Let that sink in. Fifteen years to break even.

By April 2000, just one month after peaking, the Nasdaq had lost 34.2 percent of its value.

Fortunes evaporated overnight. Dreams died. Retirement accounts were decimated.

Caption: The dot-com bubble burst: a 76% collapse that took 15 years to recover from (NASDAQ)

The 1929 Crash: When America Lost Its Mind

The comparison to 1927-28 is even more ominous.

The Great Depression, which began with the crash of 1929, resulted in a 79% stock market loss—the worst drop of the past 150 years.

Think you’re diversified? In 1929, people thought railroad stocks, utility stocks, and manufacturing stocks provided diversification too.

The crash took more than four years to recover to pre-crash levels—and that’s before the second wave hit in 1937.

The AI Bubble: Concentration Like We’ve Never Seen Before

Now here’s where it gets personal for your portfolio.

The billionaire investor pointed out that outside of AI-linked names, the market as a whole has done “relatively poorly” and there’s a “concentrated environment.” He noted that 80% of gains are concentrated within Big Tech.

Translation: If you own index funds, your returns are being driven by just a handful of companies. When they fall, everything falls.

The Unicorn Valuation Problem

Dalio dropped a truth bomb about modern valuations that most investors don’t understand:

You start a unicorn. So what happens is maybe for example you raise $100 million but you value it at a billion. Now everybody says ‘I’m a billionaire and it’s worth a billion dollars’ but yet actually nobody ever paid a billion dollars for it.

This is phantom wealth—paper billions that evaporate the moment reality strikes.

Remember WeWork? Valued at $47 billion in 2019. Nearly bankrupt by 2021.

The GPU Depreciation Time Bomb

Dalio even warned about specific technical risks most investors ignore:

Things of course about AI which are interesting in terms of the length of time that GPUs last and data centers and what the new GPUs are going to be compared with the others and how quickly they’re worthless.

Companies are spending hundreds of billions on AI infrastructure that could become obsolete within months.

When Will the Bubble Burst? (The Most Important Question)

Here’s the part that will either save you or destroy you.

Bubbles don’t pop really until they are popped by tightness of monetary policy, Dalio explained.

And here’s the twist: “We’re going to be more likely to ease rates than to tighten rates”.

Why This Might Keep Inflating

The Federal Reserve is caught:

- Tighten too soon → Crash the economy AND the bubble

- Keep rates low → Fuel the bubble larger

- Try to thread the needle → Likely fail at both

Dalio said the outcome could be similar to what was seen in 1998 to 1999 or in 1927 and 1928.

This is both good news and terrifying news.

Good news: You might have more time to position yourself safely.

Terrifying news: When it finally pops, the damage will be even more catastrophic.

What Ray Dalio Sees That You Don’t: The Retail Investor Flood

This gauge has reached the 95th percentile recently, according to reports from early 2021 based on Bridgewater’s analysis, due to the flood of new retail investors into the most popular stocks.

If you started investing during the pandemic, this is directed at you.

History shows that when unsophisticated investors flood into the market at the peak, that’s the signal the top is near.

Why? Because experienced investors are the ones selling to you at inflated prices, taking their profits before the crash.

Signs You’re in Bubble Territory (Check Yourself)

Are you:

- ✓ Investing based on social media tips?

- ✓ Buying stocks you don’t understand because “they’re going up”?

- ✓ Using leverage or margin to increase exposure?

- ✓ Feeling FOMO (fear of missing out) when you see others’ gains?

- ✓ Dismissing valuation concerns because “this time is different”?

If you answered yes to even one… you’re the bubble.

The $1 Trillion Question: Which Stocks Are in Extreme Bubbles?

Dalio didn’t name names in the interview, but his research provides clues.

Some stocks are, by these measures, in extreme bubbles (particularly emerging technology companies), while some stocks are not in bubbles.

It is about 5% of the top 1,000 companies in the US, which is about half of what we saw at the peak of the tech bubble.

Translation: Around 50 major companies are in bubble territory right now.

How to Protect Yourself: The Ray Dalio Playbook

Dalio isn’t just warning about problems—his entire investment philosophy is built on surviving scenarios like this.

Here’s how to apply his principles to protect your wealth:

1. The All Weather Portfolio Approach

Dalio’s famous “All Weather Portfolio“ is designed to perform in any economic environment:

- 30% Stocks (diversified, not just tech)

- 40% Long-term bonds

- 15% Intermediate-term bonds

- 7.5% Gold

- 7.5% Commodities

This isn’t about maximum returns—it’s about survival.

2. Geographic Diversification

Dalio mentioned his views on China in the interview. Smart investors don’t bet everything on one country’s market.

Consider exposure to:

- Emerging markets

- European equities

- International bonds

- Global real estate

3. The Gold Hedge

Dalio is famously bullish on gold. Why?

Gold performs when:

- Central banks lose credibility

- Fiat currencies devalue

- Markets crash

- Inflation surges

It’s insurance, not an investment.

Want to learn more about portfolio construction? Check out Ray Dalio’s book Principles for Navigating Big Debt Crises (Amazon affiliate link) where he details exactly how to position for economic storms.

Caption: Essential reading for understanding Dalio’s investment philosophy

4. Cash Is NOT Trash Anymore

With interest rates higher, cash and short-term treasuries actually generate returns now.

Having 10-20% in cash gives you:

- Dry powder to buy the crash

- Peace of mind to sleep at night

- Flexibility to capitalize on opportunities

5. Stop Loss Discipline

Set automatic sell orders at -15% to -20% below current prices on your most speculative positions.

You’ll sleep better knowing you can’t lose everything.

The Stocks That Survive (And Thrive) After Crashes

Here’s some hope: Not every company dies in a crash.

Companies that famously survived the dotcom crash were Amazon, eBay, and Priceline.

Amazon dropped 95% from peak to trough—but if you held on, you’d be extraordinarily wealthy today.

The survivors share common traits:

✓ Real revenue (not just “potential”)

✓ Path to profitability (not “someday maybe”)

✓ Strong balance sheets (minimal debt)

✓ Competitive moats (true advantages)

✓ Management execution (not just promises)

Building Your Survivor Portfolio

Focus on companies with:

1. Actual Free Cash Flow If they’re not generating cash, they’re not real businesses—they’re science experiments funded by speculation.

2. Low Price-to-Sales Ratios Looking at the Mag-7, we are reading Alphabet and Meta as somewhat cheap, and Tesla as somewhat expensive, according to Bridgewater’s analysis (Feb, 2024).

3. Dividend Payments Companies that pay dividends can’t fake cash flow—it’s proof of real profits.

4. Proven Business Models Boring businesses that generate consistent profits outlast exciting stories that burn cash.

🎥 Bridgewater founder Ray Dalio: Market is showing signs of a bubble – YouTube

What About Crypto? (The Bubble Within the Bubble)

Dalio didn’t explicitly mention cryptocurrency in this interview, but his framework applies devastatingly well.

Crypto markets show bubble characteristics:

- ✓ Prices disconnected from any traditional metric

- ✓ Massive retail investor participation

- ✓ Heavy leverage (100x on some exchanges)

- ✓ New entrants flooding in daily

- ✓ “This time is different” mentality

The cryptocurrency and Bitcoin boom has been compared to the dot com boom, where prices spiked in a steeper-than-average bull market, subsequently crashing after highly speculative investment craze.

If You’re in Crypto

Apply even stricter risk management:

- Never invest more than you can afford to lose completely

- Take profits systematically on the way up

- Diversify beyond just Bitcoin and Ethereum

- Understand you’re speculating, not investing

The Contrarian View: Why This Might NOT Be 1999 or 1929

Let’s play devil’s advocate, because balanced thinking saves portfolios.

Reasons for Optimism

1. Corporate Profitability Is Real Unlike 1999, today’s tech giants (Apple, Microsoft, Google, Amazon) generate massive actual profits.

2. Innovation Is Tangible AI isn’t vaporware—it’s already transforming industries. The dot-com era had speculative promise; this has demonstrable results.

3. Balance Sheets Are Stronger Equities may have rallied meaningfully, for the Mag-7

4. Monetary Policy Has Options Central banks learned from 2008 and have more sophisticated tools.

5. Global Diversification The 1929 crash was primarily US-focused. Today’s economy is global, providing more stability.

The Middle Path

“Whether or not it’s a bubble and when that bubble is going to burst, maybe we don’t know exactly,” Dalio said.

Even Dalio admits uncertainty. What he’s sure about: There’s a lot of risk.

Your Action Plan: What to Do Right Now

Stop reading. Start acting. Here’s your step-by-step protection plan:

Week 1: Assessment

- Calculate your tech/AI exposure percentage

- Identify your most speculative positions

- Review when you bought each position and why

- Check current valuations vs historical norms

- Determine your risk tolerance honestly

Week 2 and 3: Rebalancing & Protection

- Reduce positions above 10% of portfolio

- Trim anything up more than 100% in a year

- Increase cash position to 15-20%

- Add gold/commodities exposure (5-10%)

- Review bond allocation

- Set stop losses on speculative stocks

- Document your strategy in writing

Week 4: Education

- Read Ray Dalio’s principles

- Study historical bubbles and crashes

- Learn technical analysis for market timing

- Follow contrarian investors

- Join investment communities for diverse perspectives

The Resources You Need to Stay Ahead

Essential Reading

📚 Principles for Navigating Big Debt Crises by Ray Dalio

- Dalio’s comprehensive framework for understanding economic cycles

- Historical case studies of crashes

- Specific strategies for protection

📚 Irrational Exuberance by Robert Shiller

- Nobel Prize winner’s analysis of market bubbles

- Behavioral economics insights

- Valuation tools

📚 The Big Short by Michael Lewis

- Inside story of investors who predicted 2008

- How to spot systemic risks

- Contrarian thinking

Tools and Trackers

1. Bridgewater’s Public Research Visit bridgewater.com/research for Dalio’s updated market views

2. FRED Economic Data Track real-time economic indicators at fred.stlouisfed.org

3. Fear & Greed Index Monitor market sentiment at cnn.com/markets

4. Shiller CAPE Ratio Track long-term valuations at multpl.com/shiller-pe

The Uncomfortable Truth: Most People Will Lose Money

Yes, most people who invest aren’t prepared for big drops, and that’s often how the great opportunities arise.

The Winner’s Mindset

The investors who thrive through this will:

✓ Accept uncertainty instead of predicting certainty

✓ Position defensively while maintaining opportunity exposure

✓ Have liquidity when others are desperate

✓ Think in decades not quarters

✓ Learn continuously instead of assuming they know

Which investor will you be?

Ray Dalio’s Final Warning (The One That Should Keep You Up at Night)

“There’s a lot of risk. We certainly must say that whether or not it’s a bubble and when that bubble’s going to burst, maybe we don’t know exactly, but what we can say is there’s a lot of risk”.

Ray Dalio has $160 billion in assets under management. He employs hundreds of PhDs. He has access to data and analysis you’ll never see.

And even HE is warning about risk.

If the billionaire investor who predicted the 2008 crisis is nervous, shouldn’t you be?

The Choice Before You

You have three options:

Option 1: Ignore the Warning Keep doing what you’re doing. Hope it works out. Gamble your financial future on everything staying perfect.

Option 2: Panic and Sell Everything

Go to cash. Miss potential gains. Guarantee you’ll have FOMO while watching others profit.

Option 3: Position Strategically (The Smart Choice) Reduce risk systematically. Maintain opportunity exposure. Sleep well knowing you’re protected either way.

Most people choose Option 1 or 2. Wealthy people choose Option 3.

Conclusion: The Decision That Defines Your Financial Future

Ray Dalio’s bubble warning isn’t about being pessimistic—it’s about being prepared.

The market might go up another 50% before it crashes. Or it might crash tomorrow. Nobody knows.

What you CAN control:

- ✓ Your risk exposure

- ✓ Your diversification

- ✓ Your emergency fund

- ✓ Your education

- ✓ Your discipline

- ✓ Your emotional responses

Dalio’s bubble indicator is relatively high, comparing current conditions to periods that preceded catastrophic crashes.

The question isn’t whether to panic. The question is: What are you going to do about it?

Take Action Today

- Watch the full interview – Ray Dalio on CNBC

- Read the book – Principles for Navigating Big Debt Crises

- Assess your portfolio – Calculate your tech concentration

- Set your rules – Write down your exit strategy

- Execute your plan – Start rebalancing this week

The investors who thrive through the next crisis will be those who prepared during the calm before the storm.

Will that be you?

Frequently Asked Questions

Is Ray Dalio’s bubble indicator accurate?

Dalio’s indicator tracked bubble conditions at the 77th percentile for the overall market, compared to 100th percentile readings before the 1929 and 2000 crashes. While not perfect, his systematic approach has identified dangerous conditions before previous major crashes.

Should I sell all my stocks now?

No. Even Dalio maintains stock exposure. The goal is intelligent risk management, not abandoning markets entirely. Reduce concentration risk, increase cash, and add defensive positions.

When will the bubble burst?

Dalio said “bubbles don’t pop really until they are popped by tightness of monetary policy”. With rates likely to stay lower, the bubble could inflate further before an eventual pop.

What percentage should I have in cash?

Conservative investors: 20-30%. Moderate: 15-20%. Aggressive: 10-15%. More important than the exact percentage is having enough dry powder for opportunities.

Are index funds safe?

80% of gains are concentrated within Big Tech, meaning index funds have hidden concentration risk. Consider equal-weight indices or broader global diversification.

Is gold a good investment now?

Gold is insurance, not investment. Dalio recommends 5-10% as portfolio protection. It performs when traditional markets crash and currencies devalue.

What about real estate?

Real estate can provide inflation protection and diversification, but avoid overleveraging. Commercial real estate faces particular risks with changing work patterns.

Should I try to time the market?

No. Position defensively now, rebalance regularly, and have cash ready for opportunities. Nobody times perfectly, but preparation beats prediction.

DISCLAIMER: This article is for educational purposes only and does not constitute financial advice. Market predictions are inherently uncertain. Consult with qualified financial professionals before making investment decisions. Some links are affiliate links, meaning we may earn a commission at no cost to you.

Sources: CNBC, Bridgewater Associates, Historical Market Data

Share this article with investors who need this warning. The people you care about deserve to know the risks Ray Dalio sees.