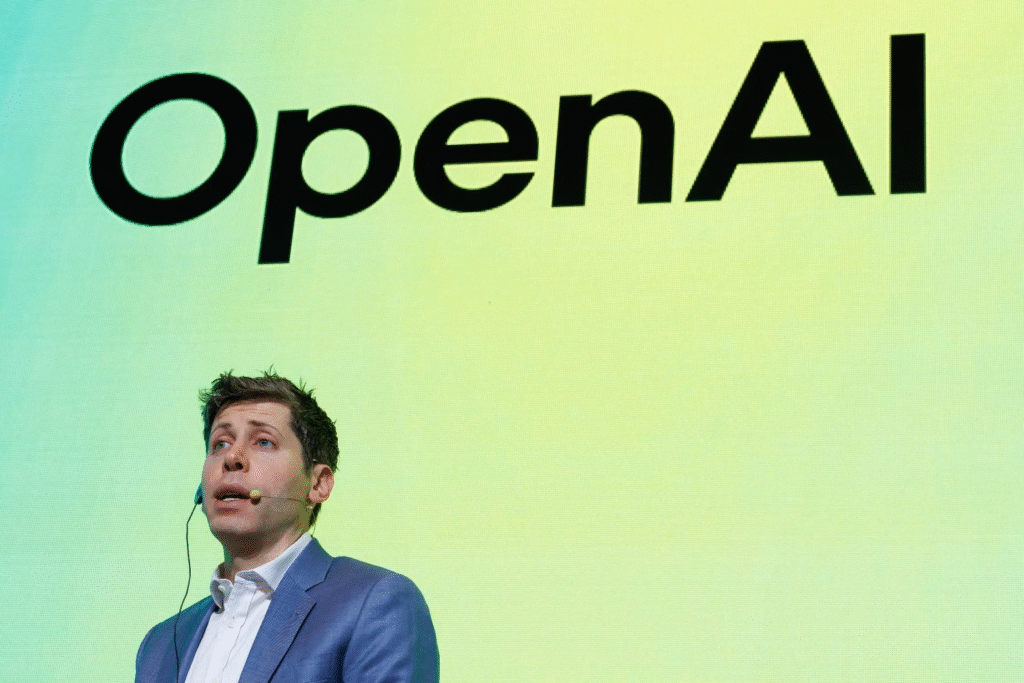

In a significant shift in the artificial intelligence landscape, OpenAI CEO Sam Altman has issued an internal “code red” directive, instructing teams to prioritize improvements to ChatGPT as Google’s Gemini AI model gains substantial market traction.

According to reporting from The Wall Street Journal and The Information, the memo represents OpenAI’s response to Google’s Gemini 3 release in November 2025, which has demonstrated strong performance in industry benchmarks and attracted notable user growth.

OpenAI Declares “Code Red” as Google Gemini Threatens ChatGPT’s Market Position

In a significant shift in the artificial intelligence landscape, OpenAI CEO Sam Altman has issued an internal “code red” directive, instructing teams to prioritize improvements to ChatGPT as Google’s Gemini AI model gains substantial market traction.

According to reporting from The Wall Street Journal and The Information, the memo represents OpenAI’s response to Google’s Gemini 3 release in November 2025, which has demonstrated strong performance in industry benchmarks and attracted notable user growth.

Understanding the “Code Red” Directive

The internal memo, reported by The Wall Street Journal, directs OpenAI employees to focus company resources on enhancing ChatGPT’s quality and user experience. According to the reporting, this includes improvements to personalization, speed, reliability, and the chatbot’s ability to answer a broader range of questions.

As part of this strategic shift, OpenAI has reportedly delayed several initiatives including advertising integration, AI shopping agents, and healthcare applications. The company is redirecting these resources toward core ChatGPT improvements.

Technology journalist Jacob Ward, speaking on CNBC, provided context for the situation: “Code Red sounds like some sort of national emergency. It is not. It is a business emergency for this company.”

Historical Context: A Reversal of Fortune

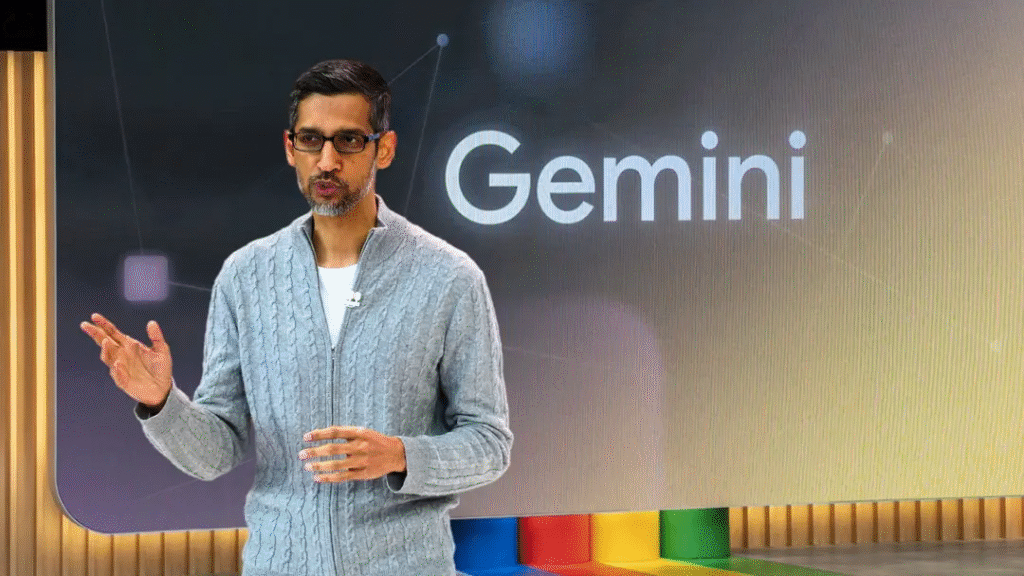

The current situation carries historical irony. In late 2022, when OpenAI launched ChatGPT, Google CEO Sundar Pichai reportedly issued his own “code red” warning about the potential threat to Google Search. Now, approximately three years later, the competitive positions have reversed, with OpenAI responding to Google’s advances.

As noted by Fortune and Search Engine Journal, before ChatGPT’s public release, Google was widely considered the global leader in AI research. Google researchers authored the landmark paper “Attention Is All You Need,” which introduced the transformer architecture that underpins modern large language models, including ChatGPT itself.

Google Gemini 3’s Market Impact

Google released its updated Gemini 3 AI model on November 18, 2025. According to multiple reports, the release has significantly affected the competitive landscape.

User Growth and Market Reception

According to data reported by Fortune and The Information, Gemini’s monthly active users grew from approximately 450 million to 650 million between July and October 2025—representing a 44% increase over three months.

The model’s release attracted public endorsements from prominent technology executives. Salesforce CEO Marc Benioff wrote on X (formerly Twitter): “Holy s—t. I’ve used ChatGPT every day for 3 years. Just spent 2 hours on Gemini 3. I’m not going back. The leap is insane — reasoning, speed, images, video … everything is sharper and faster.”

Benchmark Performance

According to reporting from Tom’s Hardware and other technology news outlets, Google’s Gemini 3 has scored higher than ChatGPT on several widely cited industry benchmarks since its November launch. These benchmarks typically evaluate AI models on tasks including complex reasoning, mathematical problem-solving, and coding capabilities.

However, as Ward noted in his CNBC interview, “We don’t care about that. I mean, we don’t care about that. We care about does it write funny jokes? Does it make cool images? And does it save me time?” This observation highlights the distinction between technical benchmarks and practical user experience.

OpenAI’s Financial Structure and Commitments

The competitive pressure occurs against a backdrop of significant financial commitments by OpenAI.

Infrastructure Investment Scale

According to reporting from The Wall Street Journal and Fortune, OpenAI has committed approximately $1.4 trillion to AI infrastructure development over the next eight years. These commitments include multibillion-dollar deals with AI cloud providers CoreWeave and Oracle, as well as agreements with semiconductor manufacturers including Broadcom, Nvidia, and Advanced Micro Devices.

The Information reports that OpenAI projects revenue growth from $13 billion in 2025 to $200 billion by 2030. However, according to market analyst Michael O’Jones of Jones Training, speaking on Yahoo Finance, “The projections are that OpenAI can’t even turn a profit till probably 2030.”

Structural Differences with Google

Jacob Ward highlighted a fundamental difference between the two companies’ financial positions: “Google makes billions of dollars a year. OpenAI has yet to turn a profit.”

Google’s existing search and advertising businesses generate substantial revenue, which the company can allocate toward AI research and development. OpenAI, as a company focused on AI products that are not yet profitable, relies on investor funding for its operations and infrastructure development.

What OpenAI Is Changing

According to The Information’s reporting on Altman’s memo, several specific areas are receiving increased attention:

User Experience Priorities

ChatGPT head Nick Turley emphasized in a LinkedIn post that the goal is to make the chatbot “even more intuitive and personal.” The memo reportedly acknowledges that ChatGPT requires improvement in daily use scenarios.

Response to User Feedback

The Wall Street Journal reported that OpenAI received criticism from ChatGPT users following the release of its GPT-5 large language model in August 2025. Users described the new model as “too closed off and not compassionate enough.” In response, OpenAI reinstated its previous 4o model, which users found more approachable.

This feedback cycle illustrates the challenge of balancing technical advancement with user preference.

Delayed Initiatives

According to reporting, advertising integration—which OpenAI had been testing in beta versions of the ChatGPT app—is now on hold. AI agents designed for shopping and healthcare applications are also reportedly delayed as resources shift toward core ChatGPT improvements.

The Broader Competitive Landscape

While media attention focuses on the OpenAI-Google competition, multiple companies are developing competitive AI models.

Other Major Players

According to various technology news reports:

- Anthropic released Claude Opus 4.5 in late November 2025, which is gaining adoption among enterprise users

- Meta continues developing its open-source LLaMA models as an alternative to proprietary systems

- China’s DeepSeek represents emerging international competition in the AI space

Industry Impact and Dependencies

Yahoo Finance analysts discussed the broader implications for technology companies with significant exposure to OpenAI’s infrastructure plans:

Tom, a Yahoo Finance analyst, stated: “The Google Gemini AI model is a huge deal because it threatens to make OpenAI and ChatGPT substantially less relevant. And here’s why that matters for all of us. ChatGPT, OpenAI, has committed to spending over a trillion dollars in the coming years to fund data center buildout.”

The analysis noted that companies including Nvidia, AMD, Oracle, and CoreWeave have substantial business relationships dependent on OpenAI’s infrastructure expansion proceeding as planned.

Google’s Strategic Advantages

Industry analysts have identified several structural factors benefiting Google in the current competition.

Distribution and Integration

As noted in the Yahoo Finance analysis, Gemini is integrated into Google’s existing products including Search, Chrome browser, Android operating system, Gmail, and YouTube. This integration provides automatic access for billions of existing users.

One analyst explained: “Google was able to integrate Google Gemini into its Google search and it still has the best of both worlds because if you’re going to use Google search, you’re going to probably use it to look for a local handyman, right? And that still goes with their ad part of their business.”

Custom Hardware Development

According to reporting from Tom’s Hardware and Yahoo Finance, Google uses proprietary TPUs (Tensor Processing Units) for training AI models. These custom processors were developed specifically for AI workloads and reportedly offer cost advantages compared to purchasing commercial GPU chips.

Michael O’Jones noted on Yahoo Finance that Google “trained Gemini 3 on [TPUs] and that’s performed really well, and of course they’re a lot cheaper than Nvidia’s GPUs.”

OpenAI’s Response Strategy

According to reporting on Altman’s memo, OpenAI is implementing several measures in response to the competitive situation.

Upcoming Model Release

The Wall Street Journal reported that Altman referenced an upcoming reasoning model that “beats Google’s Gemini 3 in internal evaluations.” The memo indicated this model could be released as early as the following week.

However, the effectiveness of new model releases depends on user reception rather than internal assessments, as the GPT-5 feedback demonstrated.

Organizational Changes

According to The Information, Altman has encouraged temporary team transfers to support ChatGPT development and established daily calls for teams responsible for improvements. This level of executive involvement in operational details is unusual and indicates the priority being placed on ChatGPT enhancement.

Long-Term Strategy

Ward compared OpenAI’s current approach to Facebook’s early strategy: “You’ll remember like in the early days of Facebook, which nowadays makes all its money off advertising, Mark Zuckerberg was very reluctant to do advertising. He didn’t want to mess with the product. He wanted to make the product irresistible first before he began bothering people with advertising.”

According to Ward’s analysis, OpenAI appears to be prioritizing product excellence and user engagement before implementing significant monetization strategies.

Market and Investment Implications

The competitive developments have implications for publicly traded companies with AI exposure.

Market Movements

Michael O’Jones described recent market activity: “What we’ve seen in the markets as of late with rotation into Google and Broadcom as there’s been some profit taking in Nvidia and the likes of Oracle who’s partnered with OpenAI.”

He characterized the current environment as “almost a blood sport between the most largest, most capitalized organizations in the world, finally competing with one another.”

Risk Factors for Related Companies

Yahoo Finance analysts discussed potential vulnerabilities for companies with significant OpenAI partnerships:

Regarding AMD, which announced a major partnership with OpenAI: “If you’re an AMD shareholder, you got to be quaking in your boots” because the partnership’s value depends on OpenAI’s continued infrastructure expansion.

Oracle and CoreWeave, which have substantial cloud infrastructure agreements with OpenAI, face similar dependencies on OpenAI’s growth trajectory.

Market Concentration Concerns

O’Jones noted the broader pattern: “We’ve developed this pattern in the past 15 years or so where when a leader comes about in the technology space, it seems to be a winner-take-all proposition.”

However, he cautioned that “we’re pricing in in many cases forward earnings for the next several years based on forecast and projections” and that recent events “raise further doubts” about these projections.

Apple’s Position

While other technology giants compete directly in AI models, Apple has maintained a different approach.

Strategic Rationale

Ward explained Apple’s position: “With Apple, I mean, you really cannot as a hardware company—if you make a mistake and then ship everything with a mistake in it, that’s a real problem. In software, you can ship tons of a broken thing and fix it over time, no problem.”

He added: “Apple is in a very careful business as a handset maker, and I think that they probably just don’t want to mess with their brand reputation.”

Partnership Possibilities

Ward speculated on Apple’s future strategy: “If they partner up maybe with somebody like a Google to get this out there in the future, they’re going to be in a position to put it into all of our pockets instantaneously.”

The analysis suggests Apple may be waiting to evaluate which AI approaches prove most successful with users before committing to a specific strategy, allowing them to integrate proven technology into their ecosystem when the timing is optimal.

User Considerations

The competitive developments raise practical questions for individuals currently using AI assistants.

Current State of AI Models

Both ChatGPT and Google Gemini offer free tiers with basic functionality and paid subscriptions with advanced features. According to current reporting, ChatGPT maintains approximately 800 million weekly active users, while Gemini has reached 650 million monthly active users.

The models demonstrate different strengths based on various use cases. Users report that specific tasks may be better suited to one model or another, though these evaluations are subjective and task-dependent.

Platform Integration

Google Gemini’s integration into existing Google products means users already accessing Gmail, Google Docs, or Google Search have immediate access without creating separate accounts. ChatGPT operates as a standalone service requiring separate registration.

Evolution of the Technology

Given the rapid pace of development in AI models, the relative capabilities of different systems change frequently. As Ward noted, “ChatGPT clearly is still going to be able to” perform the core functions users care about, while both companies continue releasing updates and improvements.

Industry Outlook

Multiple analysts have offered perspectives on the future competitive landscape.

Market Share Projections

According to forecasts cited by Search Engine Journal, Gemini could reach nearly 53% US market share by 2029, suggesting a significant shift from ChatGPT’s current dominance.

Competition Benefits

Despite the competitive pressure on individual companies, multiple analysts noted that competition accelerates innovation. Each advance by one company prompts responses from competitors, potentially accelerating the pace of improvement in AI capabilities.

Uncertainty Factors

O’Jones cautioned that “the landscape shifted in the past couple of weeks” and that “everything has to be taken with a big grain of salt at this point in time because” the competitive situation remains fluid.

The ongoing development of new models, potential partnerships, and evolving user preferences all represent variables that could significantly affect future market positions.

Frequently Asked Questions

What does “code red” mean in this context?

According to The Wall Street Journal’s reporting, “code red” refers to an internal directive from Sam Altman instructing OpenAI teams to prioritize ChatGPT improvements above other projects. As Jacob Ward explained on CNBC, “It is a business emergency for this company” rather than a literal emergency.

How does Google Gemini 3 differ from ChatGPT?

According to various technology publications, Gemini 3 has scored higher on several industry benchmarks testing reasoning, mathematics, and coding capabilities. Google’s model is also deeply integrated into Google’s ecosystem of products. However, user experience preferences vary based on individual needs and use cases.

Will ChatGPT continue to exist?

There is no indication that ChatGPT will discontinue. The company maintains approximately 800 million weekly active users according to reporting, has substantial investor backing, and is actively developing new models. The “code red” directive represents an effort to improve the product’s competitive position, not an acknowledgment of failure.

What happened with GPT-5?

According to The Wall Street Journal, OpenAI received user feedback that GPT-5, released in August 2025, was “too closed off and not compassionate enough.” The company responded by reinstating the previous 4o model, which users found more approachable. This demonstrates how user preference sometimes conflicts with technical advancement.

How much money has OpenAI committed to infrastructure?

According to reporting from The Wall Street Journal and Fortune, OpenAI has made approximately $1.4 trillion in infrastructure commitments over the next eight years, including agreements with cloud providers CoreWeave and Oracle, and chip manufacturers Nvidia, Broadcom, and AMD.

Why is Google able to compete effectively despite arriving later?

Industry analysts cite several factors: Google invented the transformer architecture underlying modern AI models, has substantial existing revenue from search and advertising to fund AI development, manufactures custom AI processors (TPUs), and can integrate AI into products used by billions of people. Additionally, Google has extensive AI research expertise accumulated over many years.

What does this mean for other AI companies?

According to Yahoo Finance analysis, companies with significant business relationships with OpenAI—including AMD, Oracle, CoreWeave, Nvidia, and Microsoft—have varying degrees of exposure to changes in OpenAI’s growth trajectory and infrastructure spending plans.

Are there other AI models besides ChatGPT and Gemini?

Yes. Anthropic’s Claude, Meta’s LLaMA, and China’s DeepSeek represent other significant AI models. The competitive landscape includes multiple companies developing AI capabilities, though current media attention focuses on the OpenAI-Google competition.

What is Apple doing in AI?

According to analysis from Jacob Ward on CNBC, Apple appears to be observing the competitive landscape rather than rushing to release its own AI model. Ward suggested Apple may be waiting to partner with or integrate whichever AI approach proves most successful with users, allowing them to enter the market with proven technology.

How quickly is this situation changing?

Very rapidly. Major AI model releases occur every few months, and competitive positions can shift quickly. As Michael O’Jones noted on Yahoo Finance, “The landscape shifted in the past couple of weeks,” referring to Gemini 3’s release and market reception.

Conclusion

The “code red” directive from Sam Altman represents a significant moment in the artificial intelligence industry’s evolution. What began with OpenAI’s ChatGPT disrupting the technology landscape in late 2022 has evolved into intense competition among the world’s most well-resourced technology companies.

According to current reporting and analyst commentary, several factors will likely influence the outcome: execution on product improvements, user reception of new models, financial sustainability of different business models, and the ability to convert technical capabilities into practical user value.

The competitive intensity benefits users through accelerated innovation and improvement cycles. However, the financial scale of the commitments involved—particularly OpenAI’s $1.4 trillion in infrastructure spending—and the uncertainty about which AI approaches will prove most valuable create significant questions about the industry’s near-term trajectory.

As Ward concluded in his CNBC analysis, for users “what they really want is personalization and emotional attachment. They want ChatGPT to be a thing that you just can’t help but use on a psychological and emotional level.”

Whether OpenAI, Google, or other competitors succeed in creating that compelling user experience will determine the ultimate outcomes of this competition.

Sources and Further Reading

This article synthesizes reporting and analysis from:

- The Wall Street Journal: Original reporting on Sam Altman’s “code red” memo

- The Information: Additional details on OpenAI’s strategic shifts

- CNBC Interview: Jacob Ward, technology journalist and author of “The Loop: How Technology Is Creating a World Without Choices and How to Fight Back”

- Yahoo Finance Analysis: Michael O’Jones, Chief Market Strategist at Jones Training

- Fortune: Coverage of competitive landscape and financial commitments

- Tom’s Hardware: Technical analysis of AI model capabilities

- Search Engine Journal: Market analysis and projections

- SFGATE: Additional reporting on competitive developments

For video analysis of these developments: