Are we witnessing the end of the dollar’s undisputed reign? According to David McAlvany, CEO of McAlvany Financial Companies, we aren’t just looking at a simple market rally; we are living through a once-in-a-generation monetary regime change.

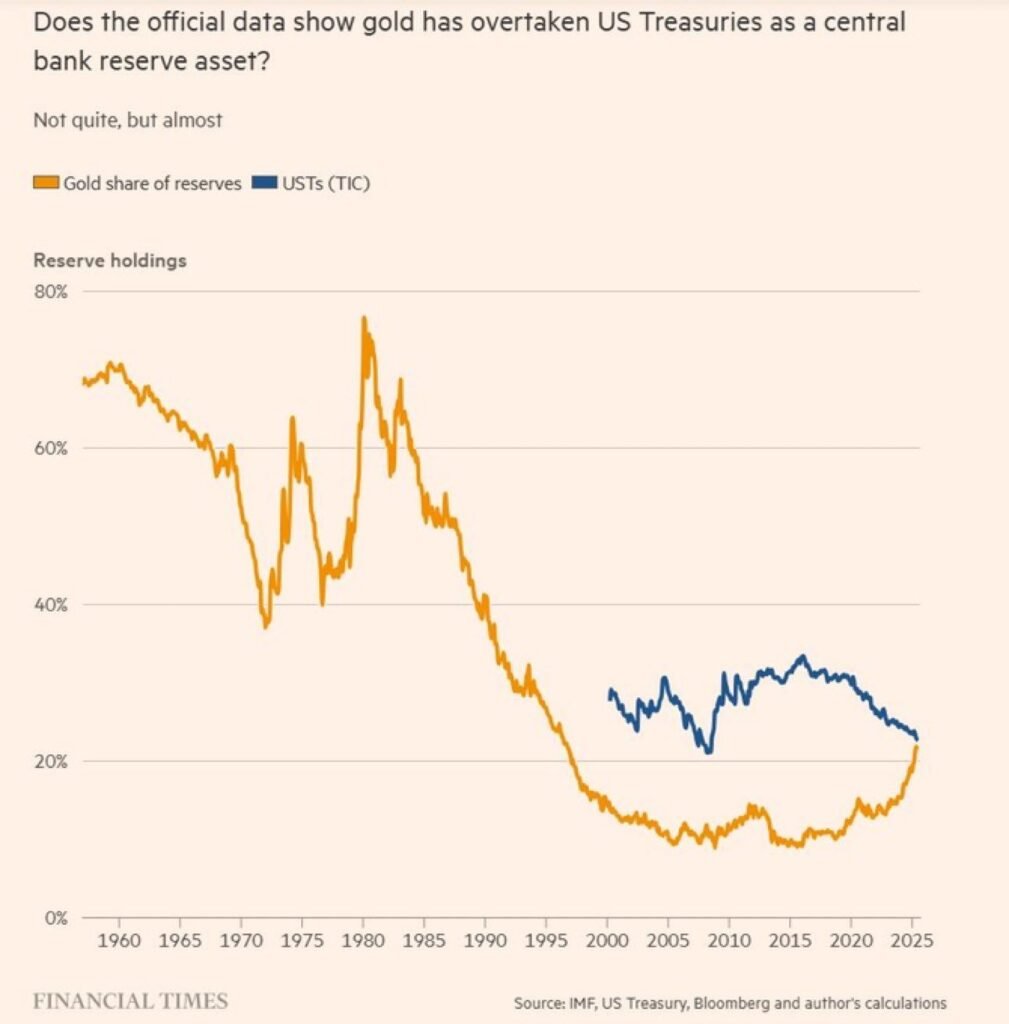

For decades, the US Dollar and Treasuries were the bedrock of global reserves. But the ground is shifting. Central banks are front-running a structural move toward hard assets, and if you are still waiting for a “sign” to diversify, you might already be behind the curve.

In this comprehensive guide, we’ll break down the urgent macro-trends discussed in McAlvany’s recent analysis, exploring why gold is hitting record highs, why silver is poised for a “generational repricing,” and why the copper supply gap is a mathematical impossibility that investors can exploit.

1. The Death of Dollar Dominance: A Structural Shift

For the first time in thirty years, the value and quantity of gold ounces held by central banks have surpassed US Treasuries in their reserve management programs. This isn’t just a headline; it’s a fundamental shift in how the world’s most powerful financial institutions view “safety.”

De-dollarization is No Longer a Theory

McAlvany notes that “de-dollarization” is a macro and structural issue that continues to play out. As the US administration puts pressure on institutions like the Federal Reserve, international disenchantment is growing. Investors are looking for alternatives to a system that feels increasingly weaponized or unstable.

Why Investors Haven’t Moved… Yet

Despite gold hitting record highs above $4,600, retail and institutional investors haven’t fully committed. Why?

- Civil Markets: Equity and bond markets have behaved “fairly civilly” to date.

- Tech Distraction: The allure of AI and Big Tech has kept capital locked in traditional growth themes.

- The “Safe Haven” Lag: Gold isn’t being utilized as a safe haven yet because the perceived need for one hasn’t hit a panic threshold.

“I think as we see a move from investors, you do have another leg higher… we are still early days in this bull market.” — David McAlvany

2. Silver’s Generational Repricing: The $200 Target

While gold captures the headlines, silver is setting up for a “very unique” price adjustment. McAlvany suggests that silver has the potential to outpace gold significantly due to a dual-threat of demand.

The 5-Year Supply Deficit

Silver has been running in a supply deficit for five consecutive years. When demand consistently outstrips supply in a commodity market, the eventual price correction isn’t incremental—it’s explosive.

The Industrial Catalyst: Solid State Batteries

One of silver’s greatest advantages over gold is its industrial utility. McAlvany highlights a massive upcoming catalyst: Samsung’s Solid State Batteries.

- The Requirement: These batteries, expected to be online within 12–18 months, require one kilo of silver per battery.

- The Impact: As these batteries replace old technology in EVs, the industrial demand will hit a supply chain that is already underwater.

Price Targets

McAlvany sees $50 an ounce as a psychological threshold that has held for 50 years. Once broken, he predicts:

- First Stop: $100

- 3-Year Horizon: $230 to $250 per ounce.

3. The Copper Crisis: The Math Doesn’t Add Up

The “electrification of everything” is a core pillar of modern political and environmental goals. However, there is a massive disconnect between political ambition and geological reality.

The 500% Production Gap

To meet global electrification and EV goals by 2030, mine production of copper would need to increase by five times (500%).

The Reality Check:

- Current producers can realistically increase production by only 5% to 15% in a best-case scenario.

- Mines have been underinvested in for decades.

- New mines take years, sometimes over a decade, to bring into full production.

As copper hits record highs, it isn’t just “data center buildout” driving the price—it’s a fundamental lack of capacity to meet forced political mandates.

4. How to Play the Metals Supercycle

For many investors, buying physical bars and coins is the first step. However, McAlvany and market analysts point toward “Silver Miners” as a way to gain leveraged exposure to these price moves.

The Mining Leverage (SIL ETF)

The Global X Silver Miners ETF (SIL) is a primary vehicle for this play. It includes heavy hitters like:

- Wheaton Precious Metals: A “streaming” company with an incredible business model that provides high margins without the direct operational risks of mining.

- Pan American Silver: A major producer that stands to benefit directly from a $150+ silver environment.

Why Silver Mining is Unique

Most silver is produced as a byproduct of mining other metals like copper or zinc. This means supply cannot be easily “throttled” up just because the price of silver rises. This inelastic supply makes primary silver producers (found in the SIL ETF) incredibly valuable during a bull run.

“If we assume $150, $200 silver prices, these companies are making an embarrassment of riches.” — David McAlvany

5. Conclusion: Are You Prepared for the Shift?

We are moving away from a world dominated by paper promises and back toward a world valued in hard commodities. The “Monetary Regime Change” McAlvany describes is a move toward tangible value—Gold for wealth preservation, Silver for industrial revolution, and Copper for the energy transition.

Authority Sources & References:

- Video Source: McAlvany: Once in a Generation Monetary Regime Change

- Featured Expert: David McAlvany, CEO of McAlvany Financial Companies.

- Referenced Data: Central Bank Reserve Management Programs (30-year trends), Samsung Solid State Battery Specifications.

- Recommended Reading: The Real Crash by Peter Schiff or The New Case for Gold by James Rickards (Available on Amazon).