Disclaimer: By continuing to read, you acknowledge that you understand this is educational content and that you are responsible for your own investment decisions. Full disclaimer by the end of this article.

Sources: Meta Platforms Q3 2025 Earnings Call Transcript (October 29, 2025), Prof G Markets podcast (October 30, 2024), Wedbush Securities analysis

October 29, 2025 — Meta Platforms delivered blockbuster Q3 results that should have sent the stock soaring. Instead, shares plummeted more than 8% in after-hours trading, wiping out tens of billions in market value.

The culprit? Two words that terrified Wall Street: AI spending.

The Numbers: Record Revenue Meets Market Panic

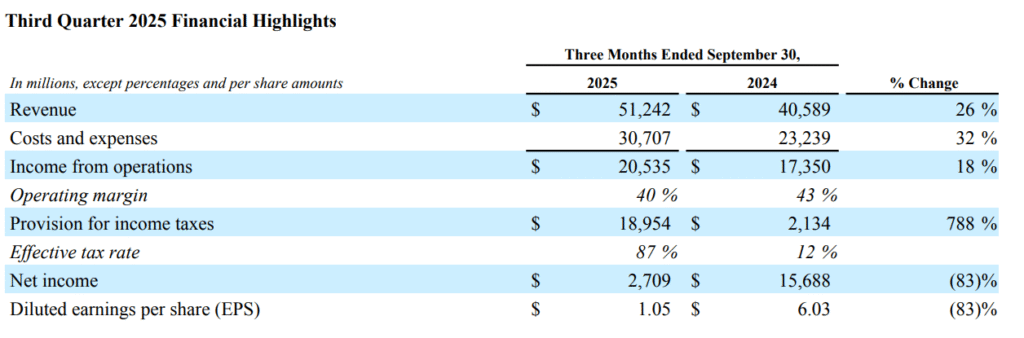

Meta reported Q3 revenue of $51.2 billion, up 26% year-over-year, with 3.5 billion people using at least one of its apps daily.

The highlights:

- $50.1 billion in ad revenue (+26%)

- 3 billion Instagram monthly users (milestone reached)

- 150 million Threads daily users

- 40% operating margin

- $20.5 billion operating income

So why did investors sell?

The Spending Bombshell That Spooked Wall Street

CFO Susan Li dropped guidance that made investors’ blood run cold:

“Our current expectation is that capex dollar growth will be notably larger in 2026 than 2025. We also anticipate total expenses will grow at a significantly faster percentage rate in 2026 than 2025.”

Translation: Meta is already spending $70-72 billion in capex for 2025. “Notably larger” in 2026 could mean $90-100+ billion annually.

And here’s the kicker: Expenses will grow faster than revenue in 2026, meaning profit margins will compress.

Scott Devitt from Wedbush Securities told Prof G Markets: “Meta will go through probably a 12-month period where income doesn’t grow as fast as revenue, and that’s going to be 2026.”

Enter: Meta Superintelligence Labs

The reason for the spending spree? CEO Mark Zuckerberg is betting the company on AI supremacy.

Zuckerberg announced: “I’m very focused on establishing Meta as the leading frontier AI lab — building personal superintelligence for everyone.”

He claims “we have already built the lab with the highest talent density in the industry.”

His three-scenario framework:

- Best case: Superintelligence arrives soon, Meta dominates the AI era

- Middle case: Extra compute accelerates Meta’s already-profitable core business

- Worst case: Meta pre-built infrastructure and grows into it over time

The Bet: Why Zuckerberg Thinks This Will Pay Off

Here’s the most surprising revelation from the earnings call:

Zuckerberg explained: “We keep on seeing this pattern where we build some amount of infrastructure to what we think is an aggressive assumption and then we keep on having more demand to be able to use more compute, especially in the core business in ways that we think would be quite profitable than we end up having compute for.”

In plain English: Meta keeps running out of computing power. Their $50 billion advertising business can profitably use far more AI infrastructure than they currently have.

AI Results Already Showing Up

Unlike vague AI promises, Meta is delivering measurable results today:

- $60 billion annual run-rate through “completely end-to-end AI-powered ad tools”

- 1 billion+ monthly users of Meta AI

- $50 billion annual run-rate for Reels alone

- 30% increase in video time spent on Instagram year-over-year

What’s Actually Working: AI Wins Today

Engagement Explosion

- Facebook time spent up 5% in Q3

- Threads time spent up 10%

- Instagram video time up 30%+ since last year

Advertising Performance

CFO Susan Li reported specific AI improvements: Lattice architecture rollout to app ads “drove a nearly 3% gain in conversions,” while a new runtime ranking model delivered “more than 2% lift in conversions on Instagram.”

New Products Gaining Traction

Vibes: Meta’s new AI content tool saw media generation “increase more than tenfold” since launching in September.

Business AI: “Millions of conversations between people and Business AIs” have occurred since July, with expansion to US markets underway.

AI Glasses: Meta’s Ray-Ban Display glasses “sold out in almost every store within 48 hours, with demo slots fully booked through the end of next month.”

The 2026 Roadmap: Where the Money Goes

Meta outlined specific AI improvements justifying the spending increase:

Technical Upgrades

Foundational ranking models that will “significantly scale up the amount of data and compute we use to train our recommendation models in 2026, yielding more relevant recommendations.”

LLM content understanding that will “enable our systems to more precisely label the keywords and topics within videos and posts.”

New Revenue Streams

Threads ads rolling out globally, WhatsApp Status ads completing rollout in 2026—both representing billions in potential new revenue.

The Bear Case: Why Investors Are Worried

Margin Compression Ahead

When expenses grow faster than revenue, profits suffer. For a company posting 40% operating margins, any compression is painful.

Regulatory Landmines

Susan Li warned: “In the EU, we continue to engage constructively with the European Commission on our Less Personalized Ads offering. However, we cannot rule out the Commission imposing further changes that could have a significant negative impact on our European revenue, as early as this quarter.”

Superintelligence Timeline Uncertainty

What if superintelligence takes 7-10 years instead of Zuckerberg’s optimistic 3-5 years? Meta will have front-loaded massive costs for capabilities they can’t fully monetize yet.

Fierce Competition

Google, Microsoft, Amazon, and well-funded startups are all racing toward similar AI goals. No guarantees Meta wins.

The Bull Case: Why This Could Be Brilliant

The Distribution Advantage

Zuckerberg: “Meta has the best track record of any company out there of taking a new product that people love and getting it to billions of people.”

3.5 billion daily users gives Meta instant distribution for any AI product they launch. Competitors can’t match that.

The Profitable Safety Net

Unlike startups betting everything on AI, Meta has:

- $20.5 billion quarterly operating income

- $10.6 billion quarterly free cash flow

- $44.4 billion cash on hand

They can afford to invest aggressively without risking the core business.

The Track Record

Meta successfully navigated:

- Mobile transition (when many doubted them)

- Video competition (Stories and Reels vs. Snapchat/TikTok)

- AI recommendations (industry-leading algorithms)

Why bet against that track record now?

What Should You Do?

If You’re Bearish:

Watch for further downside as the market digests 2026 margin compression. Regulatory risks could amplify selling pressure.

If You’re Bullish:

This selloff may be a buying opportunity if you believe in:

- Zuckerberg’s AI vision and track record

- Meta’s ability to monetize 3.5B users with new AI products

- The core business absorbing extra compute profitably

- Long-term (3-5 year) investment horizon

The Middle Path:

Hold current positions, wait for Q4 2025 and Q1 2026 results before adding. Watch whether:

- User engagement continues growing

- Ad performance metrics stay strong

- Meta AI adoption accelerates

- Regulatory actions materialize

- Spending stays within guidance

Key Metrics to Watch

Short-term (Q4 2025, Q1 2026):

- User engagement trends

- Ad conversion rates

- Meta AI user growth

- EU regulatory developments

- Expense trajectory vs. guidance

Medium-term (2026):

- Revenue growth sustainability

- New AI product launches

- Threads/WhatsApp monetization

- Business AI expansion

- Margin compression depth

Long-term (2027+):

- AI glasses mainstream adoption

- Superintelligence timeline

- New revenue streams beyond ads

- Competitive AI positioning

- ROI on $200B+ cumulative spending

The Bottom Line

Meta reported exceptional Q3 results and got punished because Wall Street hates uncertainty about future margins—even when the company is growing 26% at massive scale.

Zuckerberg’s bet is clear: “Rather than continuing to be constrained on CapEx… the right thing to do is to try to accelerate this to make sure that we have the compute that we need.”

The market’s question: Is this visionary leadership or reckless spending?

The answer: We won’t know for 18-24 months.

What we do know:

- Meta’s core business is crushing it

- AI investments are already delivering measurable returns

- Zuckerberg has a strong track record on platform shifts

- But margin compression and regulatory risks are real

For long-term investors, this selloff may be an opportunity. For short-term traders, volatility ahead is guaranteed.

📚 Essential Reading for Tech Investors

Want to understand Meta’s AI bet and make informed investment decisions?

For Understanding AI Infrastructure:

- Chip War: The Fight for the World’s Most Critical Technology by Chris Miller – Essential context on why Meta is spending $70B+ on computing infrastructure

For Investment Strategy:

- The Intelligent Investor by Benjamin Graham – Framework for evaluating whether this selloff is opportunity or trap

- One Up On Wall Street by Peter Lynch – Practical advice on investing in companies whose products you use daily

For Tech Industry Insight:

- The Four: The Hidden DNA of Amazon, Apple, Facebook, and Google by Scott Galloway – From the Prof G Markets host, explains how Meta actually makes money

For Critical Thinking:

- Thinking, Fast and Slow by Daniel Kahneman – Understand the cognitive biases affecting market reactions to Meta’s earnings

What’s Your Take?

Is Meta’s AI spending:

- ✅ Brilliant long-term strategy?

- ❌ Reckless over-investment?

Drop your thoughts in the comments below.

If you found this analysis valuable, share it with fellow investors trying to make sense of Meta’s AI gamble.

Subscribe for real-time analysis when major tech companies report earnings.

Disclaimer: The content presented here is based on publicly available information, including Meta Platforms’ official Q3 2025 Earnings Call Transcript (October 29, 2025) and analysis from the Prof G Markets podcast featuring Scott Devitt, Managing Director of Equity Research at Wedbush Securities. All analysis and opinions expressed are for educational purposes and should not be considered recommendations to buy, sell, or hold any securities.

Important considerations:

- Not Financial Advice: Nothing in this article constitutes personalized investment advice. Always consult with a qualified financial advisor before making investment decisions.

- Market Volatility: Stock prices are subject to significant volatility and can change rapidly based on market conditions.

- Past Performance: Historical performance and growth rates discussed do not guarantee future results.

- Source Attribution: Analysis is based on Meta’s official earnings call transcript and third-party analyst commentary. We cite our sources to maintain transparency and credibility.

- No Guarantees: All projections, forecasts, and forward-looking statements are speculative and subject to change.

- Do Your Own Research: This article presents one perspective on Meta’s earnings and strategy. Readers should conduct independent research and consider multiple viewpoints before making any financial decisions.

- Potential Conflicts: The author may or may not hold positions in securities mentioned. This article may contain affiliate links.