Affiliate Disclosure: This article contains affiliate links. If you use them, InvestingTimeDaily may earn a commission.

Every major market crash — from 1929 to 2008 — begins with the same structural weaknesses.

They don’t explode all at once.

They build slowly.

Quietly.

Predictably.

And then suddenly… the market breaks.

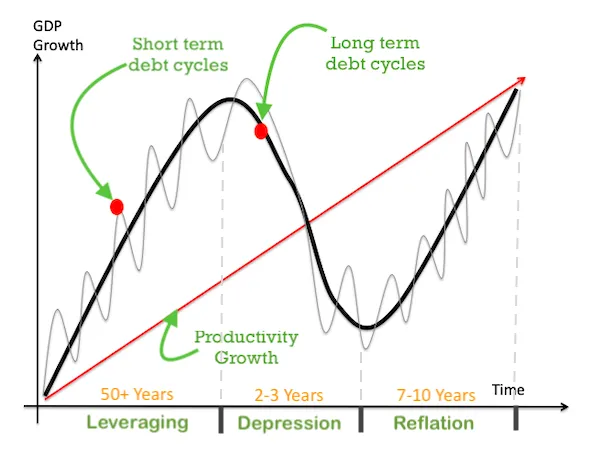

Using historical patterns and frameworks from experts like Ray Dalio and financial historians, here are the five market bombs that ignite nearly every major downturn.

1. The Debt Bomb

“All major crashes begin with too much debt.” — Ray Dalio

This is the biggest bomb of all.

Debt grows → asset prices rise → confidence surges → credit expands → leverage becomes excessive → then reality hits.

Signs of a debt bomb:

- rising consumer and corporate leverage

- government borrowing accelerating

- debt-to-income ratios stretched

- credit tightening from banks

This exact pattern preceded:

- 1929

- 2000

- 2008

- Japan’s 1989 crash

2. The Asset Bubble Bomb

Every bubble feels rational… until it isn’t.

Classic bubble psychology includes:

- “It will always go up.”

- “This time is different.”

- “Everyone is making money except me.”

History proves otherwise.

Bubbles in:

- housing (2008)

- tech stocks (2000)

- Japanese equities (1980s)

- U.S. equities (1920s)

…all ended violently once reality returned.

3. The Liquidity Bomb

When liquidity dries up, markets panic.

Liquidity bombs ignite when:

- few buyers remain

- margin calls accelerate

- banks limit lending

- credit spreads widen

Dalio calls this the “doom loop”:

falling prices → forced selling → even lower prices → more forced selling.

This is exactly what happened in 1929 and 2008.

4. The Geopolitical Bomb

War. Trade conflict. Political instability.

Geopolitical shocks don’t always cause crashes, but when combined with debt and bubbles, they can accelerate one.

Examples:

- World War I → 1920 crash

- Vietnam → 1970s stagflation

- U.S.–China tensions → modern volatility

Today’s geopolitical tensions echo earlier eras — but don’t guarantee the same outcome.

5. The Psychology Bomb

Markets are human-driven.

Fear and euphoria amplify everything:

- investors chase gains

- leverage builds

- narratives form

- panic triggers a stampede

Dalio’s lesson from studying hundreds of crashes:

“Human behavior is the most consistent force in markets.”

Emotion turns structural vulnerabilities into explosions.

Recommended Reading

If readers want to understand how debt, liquidity, psychology, and leverage create market bombs, this is the #1 resource:

👉 Principles for Navigating Big Debt Crises — Ray Dalio

https://amzn.to/4otV44T

For crisis reporting:

👉 Too Big To Fail — Andrew Ross Sorkin

https://amzn.to/48jVp5n

Conclusion

Market bombs don’t appear out of nowhere.

They build over months or years — in patterns that repeat over centuries.

By understanding these five forces:

- Debt

- Bubbles

- Liquidity

- Geopolitics

- Psychology

Investors can recognize stress signals long before the explosion.