Affiliate Disclosure: This article contains affiliate links. If you use them, InvestingTimeDaily may earn a commission at no additional cost to you.

Is Another 1929 Possible? What Ray Dalio Actually Says About Market Crashes

When markets feel unstable, one question always resurfaces:

👉 Is another Great Depression possible?

Because Ray Dalio often compares today’s conditions to 1929, many assume he predicts another catastrophic crash.

But the truth is more nuanced — and more useful.

Dalio’s work (especially Principles for Navigating Big Debt Crises) focuses on patterns, not predictions.

He never forecasts dates. Instead, he explains why cycles repeat, what triggers crashes, and how history helps investors understand risk.

This article breaks down Dalio’s real view — without hype, without speculation.

Why Dalio Studies 1929 (But Doesn’t Predict a Repeat)

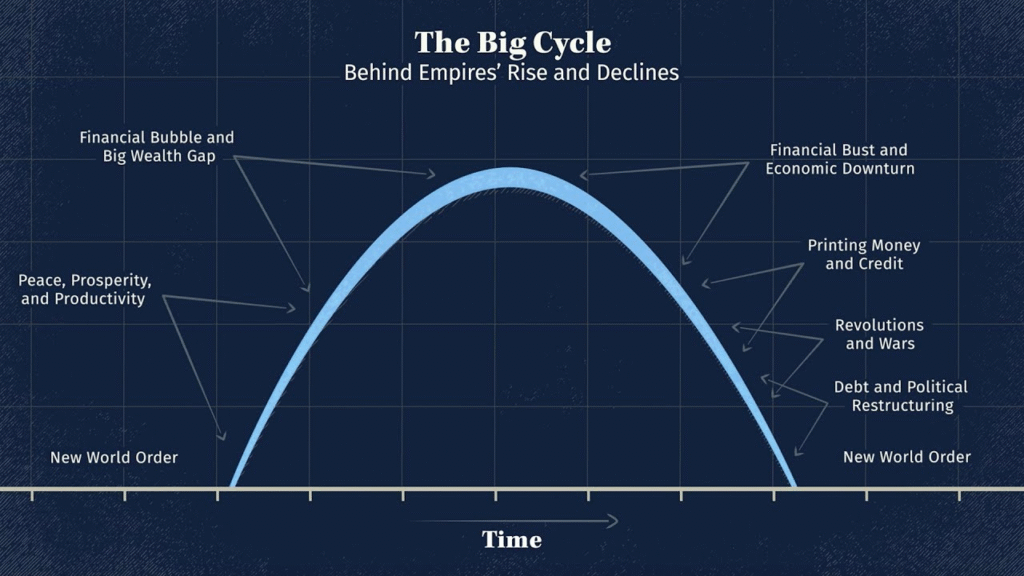

According to Dalio, markets move in long-term debt cycles lasting 50–100 years.

Crashes happen not because of “bad luck,” but because of predictable forces:

- excessive leverage

- easy credit

- inflated asset prices

- central bank limits

- rising inequality

- geopolitical tensions

These conditions did exist in the late 1920s.

They also existed in the 2000s.

And parts of them exist today.

But Dalio is clear:

“History doesn’t repeat perfectly, but it rhymes.”

He uses 1929 as a case study, not a prophecy.

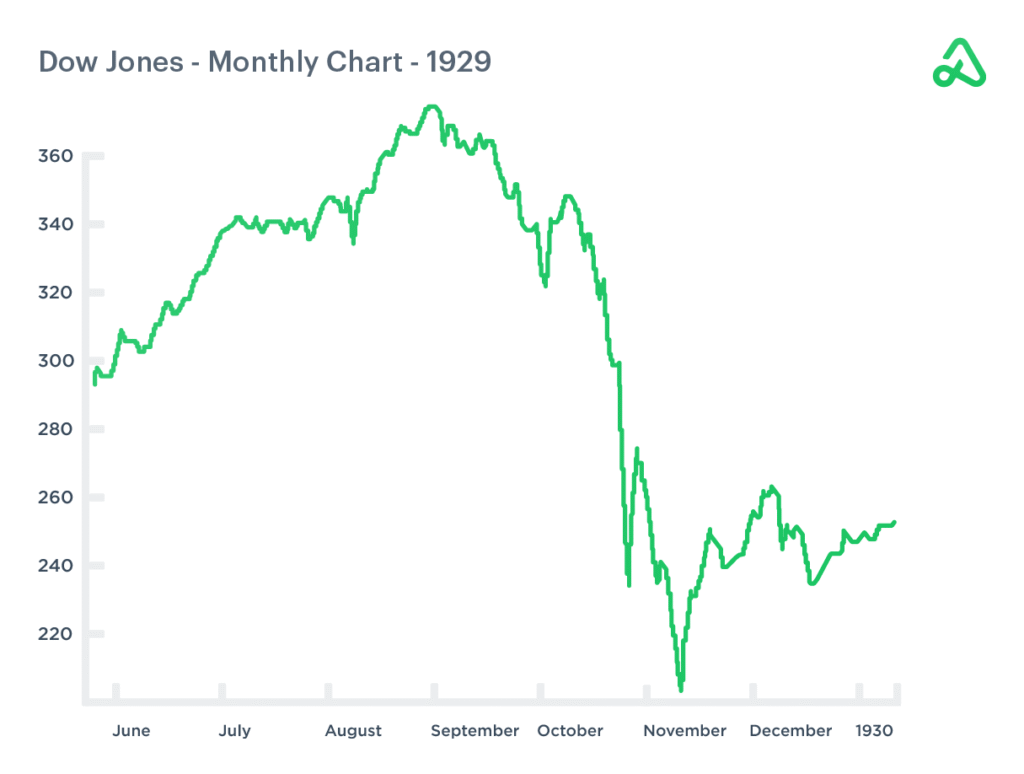

What Actually Happened in 1929 (Dalio’s Framework)

In Big Debt Crises, Dalio breaks 1929 into phases:

1. The Bubble Phase

- easy money

- soaring asset prices

- record leverage

- investors convinced “this time is different”

2. The Top

- subtle slowdown

- credit tightens

- sentiment shifts

3. The Crash

- forced deleveraging

- bank failures

- liquidity vanishes

- panic accelerates the collapse

4. The Depression

- massive deleveraging

- deflation

- high unemployment

It wasn’t one event — it was a process.

Principles for Navigating Big Debt Crises — Ray Dalio

👉 https://amzn.to/4p93xLX

Why Dalio Says Today Is “Similar But Not the Same”

Dalio points out several similarities between today and the late 1920s:

- high debt levels

- rising geopolitical conflict

- large wealth gaps

- stretched asset valuations

But also critical differences:

- floating currency system

- modern central bank tools

- better regulation

- more flexible credit systems

- faster information flow

His conclusion:

We may experience stress, but it won’t look exactly like 1929.

Dalio’s Larger Warning: Cycles Always Turn

While he avoids predictions, Dalio stresses one reality:

Long-term cycles always end in a deleveraging.

Sometimes it’s slow (Japan 1990s).

Sometimes it’s violent (1929, 2008).

Sometimes it’s inflationary (1970s).

The key is understanding where we are in the cycle, not guessing dates.

Book Recommendation

Want the complete cycle framework?

Principles for Navigating Big Debt Crises — Ray Dalio

👉 https://amzn.to/4p93xLX

Conclusion

Dalio is not predicting another 1929.

He is highlighting rhymes, not repeats.

His message is simple:

- history offers clues

- cycles create risk

- awareness matters more than prediction

And understanding those patterns is the best protection investors have.