Disclaimer: This article is for informational and educational purposes only. It’s not financial advice. Always do your own research or consult a licensed advisor before investing. This post contains affiliate links. If you make a purchase through these links, I may earn a small commission at no extra cost to you

Why ETFs Are Still the Smart Investor’s Favorite in 2025

If you’re wondering where to invest in 2025, you’re not alone. With inflation stabilizing, tech rebounding, and interest rates in flux, ETFs (Exchange-Traded Funds) continue to be one of the most efficient, diversified, and beginner-friendly ways to invest.

Unlike picking individual stocks, ETFs allow you to own hundreds or even thousands of companies in a single purchase — automatically spreading your risk while keeping costs low.

In this guide, we’ll explore the best ETFs to invest in 2025, explain how to choose them responsibly, and show what tools professionals use to make informed decisions.

Everything here is based on data, not hype — with references from Vanguard, Morningstar, and academic classics like The Little Book of Common Sense Investing by John C. Bogle (available here:

Table of Contents

- Why ETFs Are Still the Smart Investor’s Favorite in 2025

- Table of Contents

- What Makes an ETF Great in 2025?

- Best Global ETFs for Long-Term Growth

- Top S&P 500 ETFs for U.S. Exposure

- Emerging Markets ETFs for Higher Growth Potential

- The NASDAQ 100: Tech-Focused ETF Opportunities

- Thematic ETFs: AI, Robotics, and Beyond

- How to Choose the Right ETF (Step-by-Step)

- Tools to Research and Compare ETFs

- Key Takeaways for 2025 Investors

- Suggested Videos from Investing Time Daily 🎥

What Makes an ETF Great in 2025?

The best ETFs share a few common traits, regardless of what the market is doing. When evaluating your options in 2025, consider these core factors:

- Low Expense Ratio:

The lower the annual fee, the more money stays invested and compounds for you. Example: A 0.03% fee vs. 0.20% can mean thousands of dollars difference over 20 years. - Diversification:

Great ETFs cover many sectors and countries. Global or total-market ETFs offer instant diversification. - Liquidity:

Larger ETFs (those with billions in assets) are easier to buy and sell at fair prices. - Tracking Accuracy:

A fund should mirror its index closely. High tracking error means you’re not getting the performance you expect. - Reputation of Provider:

Names like Vanguard, BlackRock (iShares), Invesco, and State Street (SPDR) are trusted for reliability and transparency.

“In investing, you get what you don’t pay for.” — John C. Bogle, Vanguard founder

Best Global ETFs for Long-Term Growth

Global ETFs are ideal for both beginners and long-term investors because they offer exposure to thousands of companies worldwide.

They include both developed and emerging markets, giving you automatic diversification without extra effort.

1. Invesco FTSE All-World ETF (Ticker: FWRG)

- Tracks: FTSE All-World Index (Developed + Emerging Markets)

- Holdings: 2,300+ companies

- Annual Fee: 0.15%

- Dividend Type: Accumulating (dividends reinvested automatically)

- Assets Under Management: ~£600 million

This ETF provides instant global exposure — ideal for investors who want a “set it and forget it” portfolio.

2. Vanguard FTSE All-World ETF (Ticker: VWRP)

- Tracks: FTSE All-World Index

- Annual Fee: 0.22%

- Dividend Type: Available in both Accumulating and Distributing versions

- Reputation: One of the most trusted ETFs globally

Vanguard’s version has a longer history and higher liquidity than Invesco’s. Many investors prefer it for the brand trust and scale, despite slightly higher fees.

Top S&P 500 ETFs for U.S. Exposure

The S&P 500 remains the most recognized stock index globally, representing 500 of the largest U.S. companies — from Apple and Microsoft to Coca-Cola and Amazon.

These ETFs are perfect for investors who want strong exposure to the U.S. economy and its blue-chip companies.

1. Vanguard S&P 500 UCITS ETF (Ticker: VUSA / VUAG)

- Tracks: S&P 500

- Annual Fee: 0.07%

- Dividend Type:

- VUSA → Distributing (pays dividends)

- VUAG → Accumulating (reinvests dividends)

Vanguard’s S&P 500 ETFs are globally popular for their simplicity, reliability, and ultra-low cost.

2. SPDR S&P 500 UCITS ETF (Ticker: SPXP / SPYL)

- Tracks: S&P 500 (Physical Replication)

- Annual Fee: 0.03%

- Note: Not to be confused with leveraged U.S. SPXL fund

- Why it matters: It’s one of the cheapest ETFs in the UK market for 2025

💡 Example calculation:

Over 30 years, investing $10,000 annually at 8% average return —

A 0.03% fee saves you over $17,000 compared to a 0.20% fee.

Emerging Markets ETFs for Higher Growth Potential

Emerging markets represent countries like China, India, and Brazil, where economies are growing faster but with higher volatility.

These markets only make up about 10% of global market cap but hold most of the world’s population — meaning huge potential over time.

Vanguard FTSE Emerging Markets UCITS ETF (Ticker: VFEM / VFEG)

- Tracks: FTSE Emerging Markets Index

- Fee: 0.22%

- Dividend Type: Accumulating or Distributing

- Regions: China, India, Taiwan, Brazil, South Africa

This ETF lets you tap into long-term growth opportunities while keeping costs low.

📚 Suggested read:

“The Bogleheads’ Guide to Investing” – explains why global diversification (including emerging markets) matters.

The NASDAQ 100: Tech-Focused ETF Opportunities

If you believe AI, automation, and semiconductors will continue to dominate, the NASDAQ 100 ETF is your tech gateway.

Invesco NASDAQ 100 UCITS ETF (Ticker: EQQQ)

- Tracks: NASDAQ 100 (non-financial companies)

- Fee: 0.30%

- Top Holdings: Apple, Microsoft, NVIDIA, Amazon, Meta

- Concentration: Top 10 holdings = 50% of fund

This ETF has historically outperformed due to Big Tech’s success, but it’s also more volatile. A smart approach is to use it as a satellite holding — not your whole portfolio.

Thematic ETFs: AI, Robotics, and Beyond

2025’s hottest themes include Artificial Intelligence, Robotics, and Semiconductors. While exciting, these ETFs are high-risk, high-reward — they’re less diversified and more speculative.

Some popular options include:

- Global X Robotics & AI ETF (Ticker: BOTZ)

- iShares Automation & Robotics ETF (Ticker: RBOT)

- VanEck Semiconductor ETF (Ticker: SMH)

How to Choose the Right ETF (Step-by-Step)

Choosing an ETF doesn’t have to be overwhelming. Follow this checklist to make smart, informed choices:

- Check the Exchange and Currency:

Prefer ETFs listed in your home currency (e.g., GBP on LSE) to avoid conversion fees. - Compare Fees (TER):

Even small differences compound. Always check the Total Expense Ratio (TER). - Look for Size and Liquidity:

Funds with billions in assets usually have tighter spreads and lower trading costs. - Replication Method:

- Physical ETFs actually hold the shares — generally safer for most investors.

- Synthetic ETFs use swaps; slightly riskier but can track better.

- Understand the Index:

Always read the factsheet or Key Investor Information Document (KIID) to see what’s inside the ETF. - Stay Simple:

Many top investors (including Warren Buffett) recommend simple, global, or S&P 500-based ETFs for most portfolios.

“Don’t look for the needle in the haystack. Just buy the haystack.” — John C. Bogle

Tools to Research and Compare ETFs

You don’t need professional software — just the right free tools:

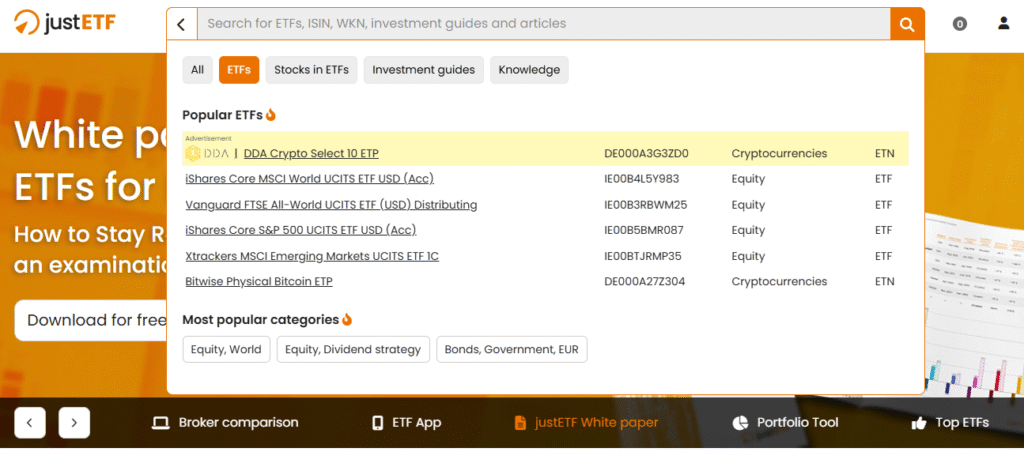

- JustETF.com – ETF screener, comparison charts, and performance filters

- Morningstar.com – Data, ratings, and historical returns

- Your Broker’s Platform (e.g., Trading 212, Fidelity, Vanguard) – Check prices and execute trades

Key Takeaways for 2025 Investors

- ETFs remain the simplest and most efficient way to invest globally.

- Keep fees low — every 0.1% saved compounds over decades.

- Diversify smartly: combine global + S&P 500 + a touch of emerging/tech.

- Use trusted ETF providers like Vanguard, Invesco, and State Street.

- Avoid chasing past performance — focus on consistency and cost.