Disclaimer: This article is for informational and educational purposes only and should not be considered financial, investment, tax, or legal advice. The author is not a licensed financial advisor, and nothing in this content constitutes a recommendation to buy, sell, or hold any security, including Amazon stock. The opinions expressed here are based on publicly available information and third-party analysis and may not reflect current market conditions. Amazon, AWS, and related trademarks are property of Amazon.com, Inc. or its affiliates. This article is not sponsored by or affiliated with Amazon. This post contains affiliate links. If you purchase through these links, I may earn a small commission at no extra cost to you.

If you’ve been watching Amazon’s stock lately, you probably noticed something exciting: shares jumped over 6% after the company released its third-quarter 2025 earnings. But what’s really driving this rally, and should you be paying attention?

Let me walk you through exactly what happened, why Wall Street is so excited, and what this means for Amazon’s future—backed by actual data from their earnings report and expert analysis.

The Numbers That Got Wall Street’s Attention

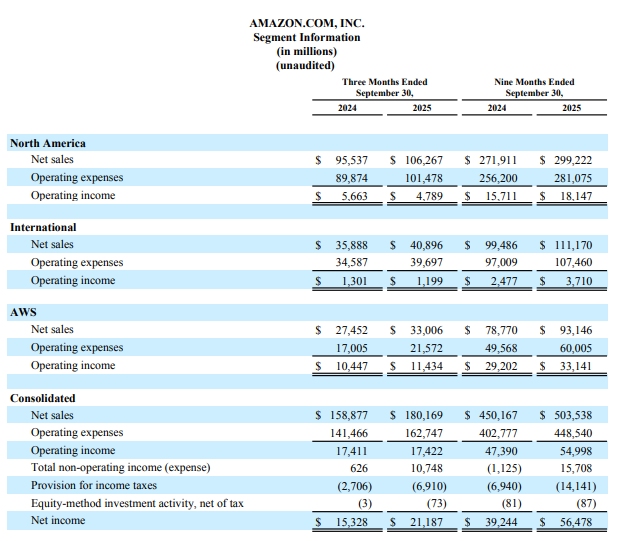

Amazon didn’t just meet expectations in Q3 2025—they crushed them.

According to Amazon’s official third-quarter 2025 earnings release, the company delivered impressive growth across multiple business segments, demonstrating the strength of their diversified business model.

Here’s what stood out:

Revenue Growth That Defied Expectations

Amazon reported strong revenue performance in Q3 2025, exceeding Wall Street’s projections. This growth came from multiple sources:

- Amazon Web Services (AWS) continues to be a cash cow

- Retail operations showed resilient consumer spending

- Advertising revenue from Amazon Media Group kept climbing

The market clearly liked what it saw—hence that 6%+ pop in share price.

Why This Quarter Matters More Than You Think

You might be thinking, “Okay, Amazon had a good quarter. So what?”

Here’s why this particular earnings report is significant: it proves Amazon can navigate a challenging economic environment while still delivering growth.

The Broader Context

Remember, we’re in a period of:

- Elevated interest rates

- Consumer spending concerns

- Intense competition in cloud computing

- Regulatory scrutiny on big tech

Despite all of this, Amazon is executing. That’s what has investors excited.

The AWS Story: Still the Golden Goose

Let’s talk about what really drives Amazon’s profitability: Amazon Web Services.

AWS continues to be a critical driver of Amazon’s overall profitability and growth, and the Q3 numbers reinforced this trend.

Why AWS Matters So Much

As noted in Prof G Markets analysis of Amazon, AWS and Amazon Media Group (their advertising business) have been the primary drivers of margin expansion for the company. These are high-margin businesses that generate enormous cash flow—cash that Amazon can then reinvest into:

- AI development

- Warehouse automation

- New business initiatives

- Competitive pricing in retail

The cloud business isn’t just important—it’s essential to Amazon’s ability to compete on multiple fronts.

The Efficiency Play: Running Leaner to Win Bigger

Here’s something fascinating that many investors might have missed: Amazon is getting more efficient.

Professor Scott Galloway, in his analysis on Prof G Markets, made a compelling observation about Amazon’s operational trajectory. He noted that while companies like Meta and Alphabet have increased their revenue per employee by 30-60% in recent years, Amazon’s revenue per employee had declined 25%.

But that’s changing.

The Productivity Revolution at Amazon

According to Prof G Markets analysis, Amazon is positioned to show “remarkable efficiencies at the hands of automation” in their retail business. This isn’t just about cutting costs—it’s about fundamentally transforming how the company operates.

Galloway pointed out something crucial: “The killer application of AI may not be therapy or autonomous vehicles—it might be making automation more efficient and productive, bringing down the cost of automation. The ultimate application of AI might be robotics.”

And guess who’s been making massive investments in warehouse automation and robotics? Amazon.

The Valuation Case: Why Amazon Looks Attractive Right Now

Let’s talk numbers—specifically, valuation multiples.

Amazon vs. The Competition

According to analysis from Prof G Markets, Amazon is currently trading at a price-to-earnings ratio of approximately 30-33, compared to its 5-year average P/E of around 60.

Compare that to other mega-cap tech stocks, and Amazon starts to look relatively cheap—especially for a company that is:

- The second-largest retailer in the world

- Growing faster than Walmart

- Operating the #1 cloud platform

- Investing heavily in AI and automation

The Meta Playbook

Galloway drew an interesting parallel to Meta’s transformation. He recalled “one of the most seminal earnings calls in history” when Meta announced they had grown revenue 23% with 20% fewer employees, sending earnings up 70% and the stock “skyrocketing”.

His prediction? Amazon is setting up for a similar moment.

He specifically noted: “I don’t think it’ll happen in their next earnings call because they’ll have to expense severance costs, but say the earnings call after the holiday season… I think what we’re going to see is a replay” of Meta’s transformational earnings report.

What About The Layoffs?

You might have heard Amazon announced plans to cut up to 30,000 white-collar jobs—about 10% of corporate staff. That sounds scary, but let’s put it in context.

The Reality Behind The Headlines

As Galloway explained on Prof G Markets, Amazon’s hiring increased more than 50% since COVID, so while 30,000 is a large absolute number, it essentially takes the company back 12-24 months in terms of headcount.

More importantly, this is about strategic reallocation of resources, not desperation. The stated goal is to “operate like the world’s biggest startup” and fund AI efforts.

Is AI Replacing Workers?

Galloway’s take is nuanced and worth considering. He argues it’s about productivity enhancement, not simple replacement. He drew a compelling comparison:

“If you look at Europe, they were at $45 per employee in 1995 and the US was at $45 per employee. Today, on an inflation-adjusted basis, the US is at $70 and Europe is at $45. Is it because American workers are working harder? No, it’s because they are armed with technology to make them more productive.”

The remaining Amazon employees “are about to get much more productive” through better tools, automation, and AI assistance.

The Bear Case: What Could Go Wrong?

To be fair, let’s acknowledge the risks. No investment thesis is complete without considering the downside.

Potential Headwinds

- Cloud Competition: Microsoft Azure and Google Cloud are formidable competitors, especially in AI capabilities

- Retail Margin Pressure: E-commerce is inherently low-margin, and competition from Walmart, Shopify, and others remains intense

- Regulatory Risk: Antitrust scrutiny continues to hover over big tech companies

- Execution Risk: Successfully implementing automation at scale is extremely difficult

- Economic Sensitivity: Consumer spending could weaken if economic conditions deteriorate

These are real concerns that any Amazon investor needs to monitor.

Remember: All investments carry risk. Stock prices can fall as well as rise, and you may get back less than you invested. Never invest money you cannot afford to lose.

Expert Predictions: Where Does Amazon Go From Here?

Based on the Prof G Markets analysis, Galloway made Amazon his big tech stock pick for 2025.

Why The Optimism?

His reasoning centers on a few key points:

- Relative underperformance: While the stock is up 20%, that’s modest compared to peers given the market acceleration

- Valuation discount: Trading at the lowest multiple in many years despite strong fundamentals

- Operational improvements: The efficiency gains from automation and AI are about to show up in earnings

- Strong operator at the helm: Andy Jassy doesn’t get enough credit—Galloway describes him as “a Tim Cook-like operator” focused on “blocking and tackling”

His specific prediction: “I think Amazon is about to, in two earnings calls, announce a Meta-like earnings call from last year”—referring to that transformational moment when operational efficiency drives explosive earnings growth.

What This Means For Your Portfolio

So should you buy Amazon stock after this Q3 earnings beat?

Things To Consider

The Bull Case:

- Strong Q3 results demonstrate operational excellence

- Valuation is attractive relative to historical averages

- Margin expansion opportunity through automation and AI

- Diversified revenue streams (retail, AWS, advertising)

- Massive investments in future technologies paying off

The Bear Case:

- Tech sector overall is richly valued

- Economic uncertainty remains

- Competition in all major business segments

- Execution risk on transformation initiatives

A Balanced Perspective

Amazon’s Q3 2025 results showed the company’s ability to grow across multiple business lines while managing costs effectively. The 6% stock surge reflects genuine optimism about the company’s trajectory.

However, investing decisions should always be based on your:

- Personal financial situation

- Risk tolerance

- Investment timeline

- Overall portfolio allocation

- Tax considerations

- Diversification needs

This is not financial advice. The opinions expressed here represent analysis of publicly available information and should not be construed as recommendations. Always conduct thorough due diligence and consult with a qualified, licensed financial advisor before making any investment decisions.

The Bottom Line

Amazon’s Q3 2025 earnings beat wasn’t just about good numbers—it was about demonstrating that the company can execute on multiple fronts simultaneously:

✅ Growing revenue across segments

✅ Maintaining AWS dominance

✅ Improving operational efficiency

✅ Investing in future technologies

✅ Managing costs strategically

The 6% stock surge reflects genuine excitement about where Amazon is headed. Whether that excitement is justified will become clearer in the coming quarters, particularly after the crucial holiday season.

One thing is certain: Amazon remains one of the most fascinating companies to watch in big tech, and this earnings report reminded everyone why.

What’s Next?

Keep an eye on:

📊 Next earnings call – Watch for commentary on holiday season performance and efficiency gains

🤖 Automation rollout – How quickly can they scale robotics in warehouses?

☁️ AWS AI capabilities – Can they close the gap with Microsoft and Google?

💰 Margin expansion – Will the efficiency initiatives show up in the bottom line?

Want to stay updated on Amazon and big tech investing? Subscribe to our newsletter for weekly analysis and insights.

Sources & Further Reading

This article is based on information from:

- Amazon Q3 2025 Earnings Release (Amazon Investor Relations: https://ir.aboutamazon.com/news-release/news-release-details/2025/Amazon-com-Announces-Third-Quarter-Results/)

- Amazon Q3 2025 Financial Results PDF (https://s2.q4cdn.com/299287126/files/doc_financials/2025/q3/AMZN-Q3-2025-Earnings-Release.pdf)

- Prof G Markets podcast analysis featuring Professor Scott Galloway (YouTube: “Why Amazon’s Biggest Layoffs Ever are a Bullish Sign for the Stock“)

All analysis and opinions are those of the cited sources and do not constitute investment recommendations.

FINAL REMINDER: Investing in stocks involves risk, including loss of principal. This article is for educational purposes only. Please consult a licensed financial professional before making investment decisions. The author and publisher are not responsible for any financial decisions made based on this content.