Alphabet just reported something that hasn’t happened before: a quarter with over $100 billion in revenue. On October 29, 2025, the tech giant announced Q3 results that exceeded expectations, with revenue reaching $102.3 billion—a 16% increase year-over-year.

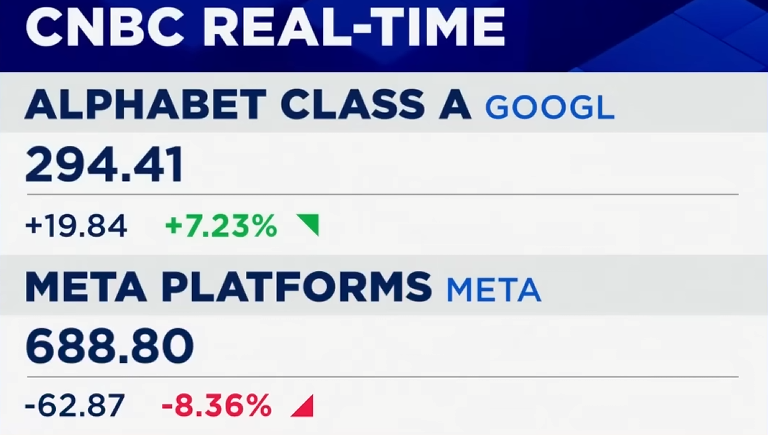

But here’s what made this quarter particularly interesting: while Meta’s stock dropped after earnings due to concerns about AI spending, Alphabet’s rose. Both companies are investing heavily in artificial intelligence, so what made the difference?

According to Mark Mahaney, head of internet research at Evercore ISI, the answer is clear: “Google proved last night that they could deploy AI to also improve their core search business and YouTube,” he told CNBC. “This company clearly proved that it should be included in that category of AI winners.”

Let’s break down what actually happened in Q3 2025 and what the numbers tell us.

The Key Numbers from Q3 2025

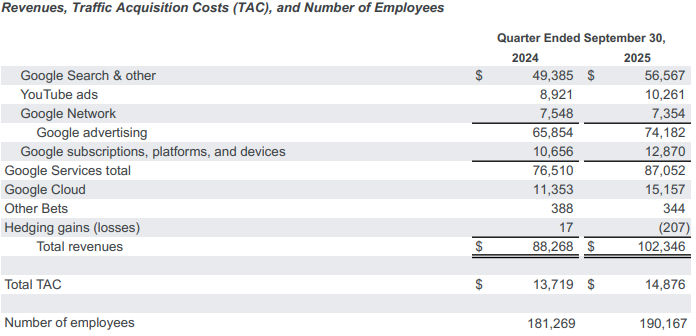

Here’s what Alphabet reported for the quarter ended September 30, 2025:

Revenue Breakdown

- Total Revenue: $102.3 billion (up 16% YoY)

- Google Search & Other: $56.6 billion (up 15% YoY)

- YouTube Ads: $10.3 billion (up 15% YoY)

- Google Cloud: $15.2 billion (up 34% YoY)

- Google subscriptions, platforms, and devices: $12.9 billion (up 21% YoY)

Profitability

- Operating Income: $31.2 billion (30.5% margin)

- Operating Income (excluding EC fine): $34.7 billion (33.9% margin, up 22% YoY)

- Net Income: $35.0 billion (up 33% YoY)

- Earnings Per Share: $2.87 (up 35% YoY)

The quarter included a $3.5 billion fine from the European Commission for competition law violations, which impacted the operating margin.

Source: Alphabet Q3 2025 Earnings Release, October 29, 2025

What Made This Quarter Stand Out

According to Mark Mahaney’s analysis on CNBC, something unusual happened: “You just had this kind of inflection point quarter—you don’t get these too often—but revenue growth accelerated for search, for YouTube, and for cloud.”

It’s rare to see a company of Alphabet’s size show accelerating growth across multiple major business lines simultaneously.

Search and AI: The Big Question Gets Answered

For the past 18 months, investors worried that AI chatbots like ChatGPT might hurt Google’s search business. This quarter provided some clarity on that concern.

Search revenue didn’t just grow—it grew faster than the previous quarter. CEO Sundar Pichai noted in the earnings release: “Our full stack approach to AI is delivering strong momentum and we’re shipping at speed, including the global rollout of AI Overviews and AI Mode in Search in record time.”

The company’s Gemini AI models are now processing 7 billion tokens per minute through direct API use, and the Gemini App has over 650 million monthly active users, according to Pichai’s statement.

YouTube’s Continued Strength

YouTube advertising revenue reached $10.3 billion, growing 15% year-over-year. The platform now has over 300 million paid subscriptions across Google One, YouTube Premium, and YouTube TV, including NFL Sunday Ticket.

Google Cloud: The Growth Story

Google Cloud delivered $15.2 billion in revenue with a 23.7% operating margin, up from 17.1% in Q3 2024. The business also ended the quarter with $155 billion in backlog—contracted revenue that will be recognized in future periods.

Sources:

- Alphabet Q3 2025 Earnings Release

- Mark Mahaney interview on CNBC, October 30, 2025

Why Alphabet and Meta Had Different Market Reactions

Both Alphabet and Meta reported earnings on the same day. Both are investing heavily in AI. But the market responses were opposite—Alphabet’s stock rose while Meta’s fell.

Mark Mahaney explained the key difference to CNBC: “Meta sort of proved that to the market about a year, year and a half ago” that they can use AI to improve their core business. “But they surprised the market by how much they want to invest in their next initiative, which is chasing AGI, which is chasing super intelligence.”

He noted that Meta’s core business is performing well, but “the market is choking a little bit on the amount of investment capex and total expense guidance that the company is giving to the street to chase super intelligence.”

The Monetization Difference

Mahaney highlighted another crucial distinction: “Amazon, a Microsoft, and Google can all monetize AI through external sales—cloud is what I’m really thinking about. Meta doesn’t have that product. So that puts a little bit more pressure on Meta.”

In other words, Alphabet can sell AI infrastructure and services directly to other businesses through Google Cloud. Meta’s AI investments primarily improve their own products like Instagram and Facebook, without the same external revenue opportunity.

Source: Mark Mahaney interview on CNBC Squawk Box, October 30, 2025

Breaking Down the Business Segments

Google Services: $87.1 Billion in Revenue

This segment includes Search, YouTube, Android, Chrome, Google Maps, Google Play, and hardware. It generated $87.1 billion in revenue (up 14% YoY) with $33.5 billion in operating income.

The $3.5 billion European Commission fine was recorded in this segment’s general and administrative expenses.

Google Cloud: $15.2 Billion in Revenue

Cloud revenue grew 34% year-over-year, driven by:

- Google Cloud Platform (GCP) core products

- AI Infrastructure services

- Generative AI Solutions

Operating income reached $3.6 billion with a 23.7% operating margin, compared to $1.9 billion and 17.1% margin in Q3 2024.

Other Bets: $344 Million in Revenue

This includes businesses like Waymo (autonomous vehicles) and Verily (healthcare). The segment posted a $1.4 billion operating loss, which is expected for early-stage ventures.

Source: Alphabet Q3 2025 Earnings Release, Segment Results

The Capital Expenditure Picture

Alphabet’s capital expenditures in Q3 2025 were $24.0 billion, up 83% year-over-year. The company now expects 2025 total capital expenditures between $91 billion and $93 billion.

This spending primarily goes toward data centers, servers, and AI infrastructure to support growing demand for cloud services and AI capabilities.

Despite the high capex, Alphabet generated:

- Q3 2025 Operating Cash Flow: $48.4 billion

- Q3 2025 Free Cash Flow: $24.5 billion

- Trailing Twelve Months Free Cash Flow: $73.6 billion

Additionally, changes to U.S. tax law enacted on July 4, 2025, now allow for immediate expensing of domestic research and experimentation costs and accelerated depreciation on eligible capital expenditures, which improves the company’s cash flow position.

Source: Alphabet Q3 2025 Earnings Release and Cash Flow Statement

What This Means for Investors

What the Numbers Show

Alphabet demonstrated that:

- Revenue growth is accelerating across major business lines

- AI investments are generating measurable returns in the core business

- Cloud is growing profitably with significant contracted backlog

- Free cash flow remains strong despite heavy capital spending

Things to Watch

Regulatory Environment: The $3.5 billion EC fine is a reminder that Alphabet faces ongoing regulatory scrutiny, particularly in Europe. The company notes in its earnings release that actual results may differ from predictions due to risks outlined in their SEC filings.

Capital Intensity: The $91-93 billion capex guidance for 2025 is substantial. Whether this level of spending continues will depend on customer demand and competitive dynamics.

Competitive Position: How Alphabet’s AI capabilities stack up against Microsoft, Amazon, and emerging competitors will be important to monitor in coming quarters.

Analyst Perspective

Following the earnings report, Evercore ISI’s Mark Mahaney raised his firm’s price target on Alphabet while lowering the target on Meta. As he told CNBC: “We took up our price target on Google. We took down our price target on Meta.”

Sources:

- Alphabet Q3 2025 Earnings Release

- Mark Mahaney interview on CNBC, October 30, 2025

Looking Ahead: Q4 and Beyond

In the earnings release, CEO Sundar Pichai stated: “We are investing to meet customer demand and capitalize on the growing opportunities across the company.”

The $155 billion cloud backlog provides visibility into future revenue, though the timing of recognition will vary based on contract terms.

The company’s Board of Directors declared a quarterly cash dividend of $0.21 per share, payable December 15, 2025, to stockholders of record as of December 8, 2025.

Key Takeaways

Based on Alphabet’s Q3 2025 earnings report and Mark Mahaney’s expert analysis:

- First $100 Billion Quarter: Alphabet crossed a significant revenue milestone with $102.3 billion in Q3 2025

- Growth Acceleration: Revenue growth accelerated in Search, YouTube, and Cloud simultaneously—a rare occurrence for a company this size

- AI Validation: The quarter demonstrated that AI is improving Alphabet’s core businesses rather than disrupting them, according to analyst commentary

- Cloud Momentum: Google Cloud revenue grew 34% YoY with improving margins and $155 billion in backlog

- Strong Cash Generation: Despite $24 billion in quarterly capex, the company generated $24.5 billion in free cash flow

- Market Differentiation: Alphabet’s ability to monetize AI through external sales (Cloud) distinguishes it from competitors like Meta who primarily use AI to improve internal products

- Regulatory Costs: The $3.5 billion EC fine is a reminder of ongoing regulatory challenges

Sources:

- Alphabet Inc. Q3 2025 Earnings Release (October 29, 2025)

- Alphabet Inc. Q3 2025 Earnings Slides

- Mark Mahaney interview on CNBC Squawk Box (October 30, 2025)

Additional Resources

Want to dive deeper? Here are the primary sources:

Official Documents:

- Alphabet Q3 2025 Earnings Release (PDF)

- Alphabet Q3 2025 Earnings Slides (PDF)

- Alphabet Investor Relations Website

Expert Analysis:

- Watch Mark Mahaney’s full CNBC interview on YouTube

- Review Evercore ISI research (available through financial platforms)

Final Thoughts

Alphabet’s Q3 2025 earnings provided concrete evidence that the company’s AI investments are producing measurable business results. With revenue exceeding $100 billion for the first time and growth accelerating across major segments, the quarter addressed many investor concerns about AI’s impact on the business.

As Mark Mahaney noted to CNBC, Alphabet proved they “should be included in that category of AI winners.”

The combination of strong current performance and $155 billion in cloud backlog suggests the company has positioned itself well for continued growth, though regulatory challenges and high capital requirements remain factors to monitor.

Disclaimer: This article is for informational purposes only and is not financial advice. All information is based on publicly available documents from Alphabet Inc. and analyst commentary from Evercore ISI. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

Word Count: ~2,100 words

Reading Time: 8-10 minutes

Sources: