What if everything you thought you knew about the next twelve months was wrong? While most investors are chasing the tail end of the 2024 AI hype, a shift is happening in the undercurrents of the global economy.

“Nothing wonderful is going to happen to you without taking risks. But there’s a difference between bad risks and good risks.” — Scott Galloway

In this comprehensive analysis, we break down the definitive predictions for 2026 from the “Prof G Markets” lens. We’ll explore why the AI bubble is finally shifting toward physical robotics, why Amazon is the “top pick” of the year, and the surprising reason why your most important investment in 2026 won’t be on a screen.

1. The AI Correction: From “Bits” to “Atoms”

For the last few years, the market has been obsessed with “bits”—software, LLMs, and digital data. However, Scott Galloway predicts that 2026 will be the year of the AI correction. While companies like Nvidia have signaled they will add nearly $800 billion in revenue over the next five years, Galloway warns that the market may be overestimating the pricing power of the current AI duopoly of Nvidia and OpenAI.

The Rise of Open-Source Models

The catalyst for this correction? China and the proliferation of open-source models.

- 80% of startups in major portfolios (like Andreessen Horowitz) are already using open-source Chinese AI models.

- These models often perform as well as American counterparts but at a fraction of the capital investment.

- This “flooding of the market” is expected to squeeze margins for the “Magnificent Seven” and could lead to a broader market recession.

2. Why Amazon is the Big Tech Stock Pick for 2026

If you’re looking for where the “smart money” is moving, look at Seattle. Galloway identifies Amazon as his top pick for 2026.

While the world focuses on AWS (Amazon Web Services), the real profit story is in retail automation.

- The “Champagne and Cocaine” Cocktail: This is Galloway’s term for the convergence of AI and robotics.

- Efficiency Gains: Amazon has already reduced the time between “click and delivery” by 78% through robotic integration.

- Projected Growth: Automation is expected to catalyze a 2x increase in gross merchandise value by 2033—without the need for hiring new employees.

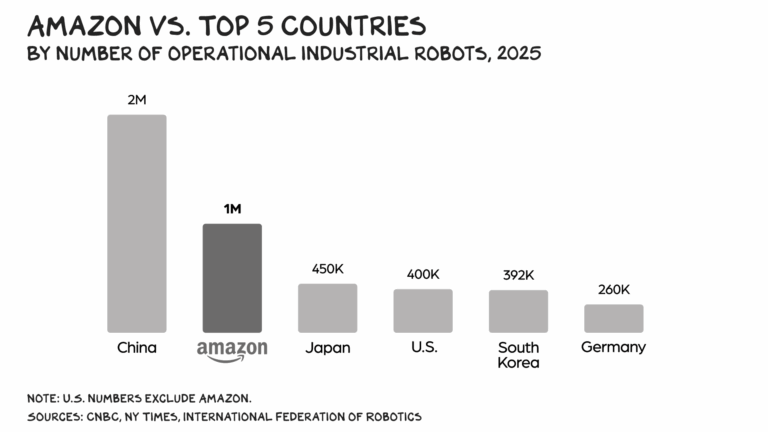

- Robot Workforce: By the end of 2025, Amazon was on pace to have more robot workers than humans in its warehouses.

The “Holy Unlock” of Robotics

Amazon is currently testing robots that can handle the “dangerous work” of loading and unloading trucks—a task previously reserved for humans. This shift from “bits to atoms” allows Amazon to reduce real-world friction and expand margins in a way competitors cannot match.

3. The Space Monopoly: SpaceX Controls the Universe

“Space is the next big thing,” according to Galloway. But it’s not a crowded field; it’s a near-monopoly.

- Launch Dominance: SpaceX accounted for 84% of U.S. space launches in 2024.

- Cost Reduction: The cost to put a kilogram of payload into orbit has fallen by 89% over the last 15 years.

- The Comparison: Galloway posits that if Google controls information and Meta controls social connections, SpaceX controls 90% of everything else in the universe.

4. The “Vice of the Year”: Prediction Markets

For the first time, Galloway has ventured into “uncharted territory” by naming Prediction Markets the “Vice of the Year” for 2026.

- Platform Explosion: Apps like Robinhood, Kalshi, and Polymarket are seeing exponential growth.

- Sports Betting Integration: The line between prediction markets and sports betting has become “razor thin”.

- The Danger: Galloway warns that we have “tied our economy” to decreasing young people’s risk aggression in relationships and redirecting it into online screens.

“You can get all of your risk aggressiveness out on betting on sports or on who’s going to win the mayoral race… and that is one of the greatest misallocations of a resource in history.”

5. Synthetic Relationships: The Silent Epidemic

As of 2026, AI-powered companionship has moved from science fiction to a standard societal norm.

- 20 Million Users: Apps like Character.AI now have massive user bases, with over half being under the age of 24.

- The Substitution Effect: One in four young adults now believes AI “partners” could replace real-life romance.

- The Cost of Frictionless Intimacy: While these tools fill emotional gaps, they also remove the “complexity of human relationships” that leads to personal growth.

6. Actionable Takeaway: Take Better Risks

In a world of screens and synthetic bots, Galloway’s advice for 2026 is counterintuitive: Be risk-averse with your money and risk-aggressive with your time.

- Stop Screen-Based Gambling: Take less risk with apps like Robinhood, Poly Market, and Crypto.

- Increase Human Friction: Get out of the house. Approach strangers. Express friendship and romantic interest.

- Focus on “Good Risks”: Telling someone you care about them is a “good risk.” Betting on an outcome on a screen is a “bad risk”.

Resources and References

- Podcast: Prof G Markets – Scott Galloway’s Predictions for 2026

- Article: Big Tech Stock Pick of 2026: Amazon | No Mercy / No Malice

- Follow on Instagram: Investing Time Daily

- Visit the Website: Investing Time Daily