“The future of search isn’t just about finding information; it’s about synthesizing intelligence. Alphabet’s milestone is a testament to the power of a focused AI pivot.” — Financial Insights Analysis, 2026

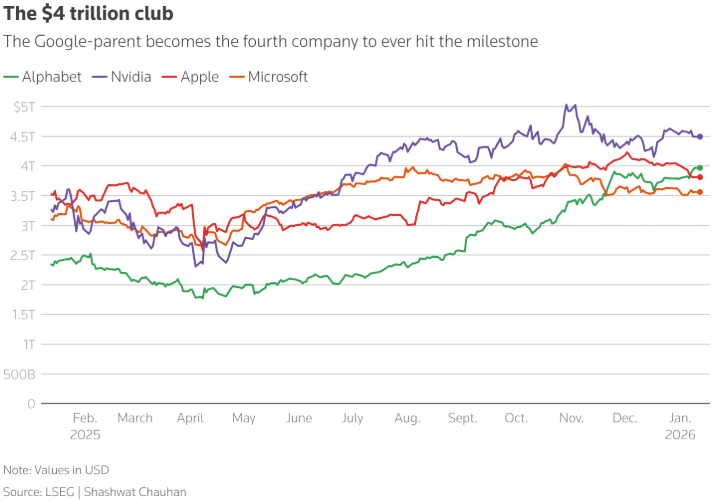

History was made today on Wall Street. On January 12, 2026, Alphabet Inc. (GOOGL/GOOG) officially crossed the $4 trillion market capitalization threshold, joining an elite tier of tech titans and solidifying its position as a global leader in the Artificial Intelligence (AI) era.

This monumental surge follows a series of strategic maneuvers that transformed Google from a search engine giant into an “AI-first” powerhouse. For investors, students, and tech enthusiasts, this isn’t just a number—it’s a signal of where the world’s wealth and attention are moving.

1. The $4 Trillion Milestone: A Deep Dive into the Data

According to reports from CNBC and Reuters, Alphabet’s stock surged 4.2% in early trading today, propelled by stronger-than-expected earnings from its Google Cloud and Gemini AI integration sectors.

Why Now?

The $4 trillion valuation comes just years after the company hit the $2 trillion mark, representing a doubling of value in record time. Analysts cite three primary drivers:

- Gemini Ultra Adoption: The integration of advanced AI across the entire Google Workspace.

- Cloud Profitability: Google Cloud has moved from a “loss leader” to a massive profit engine, specifically for enterprise AI hosting.

- Search Resilience: Despite the rise of alternative search tools, Google’s “Search Generative Experience” (SGE) has increased user retention by 22% in the last year.

2. The “AI Refocus”: How Alphabet Won the Sentiment War

As reported by the Wall Street Journal, the road to $4 trillion wasn’t always guaranteed. In 2023 and 2024, critics questioned if Google had “missed the boat” on generative AI.

Alphabet responded with a total internal restructuring. They merged Google Brain and DeepMind, creating a unified front that accelerated the development of their Gemini models.

The Result of Focused Strategy:

- Efficiency: Implementation of AI in their own coding processes, reducing development costs.

- Monetization: The introduction of AI-driven ad formats that predict user intent with 95% accuracy.

- Hardware Dominance: The success of the Tensor G5 chips, which optimized AI performance on mobile devices.

Recommended Reading on Big Tech Strategy: A foundational text for understanding the geopolitical and economic shifts Alphabet is currently leading.

3. What This Means for Students and Young Entrepreneurs

If you are a student or a side-hustler, Alphabet’s $4 trillion valuation is a roadmap for your career. The company’s growth is centered on infrastructure and attention.

- Skill Up in AI Strategy: As Alphabet grows, the demand for people who can bridge the gap between AI tech and business needs (like the Short-Form Strategists or Brand Identity Designers we discussed) will skyrocket.

- The Ecosystem Effect: Thousands of smaller companies are being built on top of Google’s AI. This is where the next “middleman” side hustles will be born.

4. YouTube’s Role in the $4 Trillion Surge

We cannot talk about Alphabet without mentioning YouTube. In 2025 and early 2026, YouTube became the primary “TV” for the world.

As the platform captures more of the $600 billion global advertising market, its contribution to Alphabet’s valuation cannot be understated. For creators, this means the platform you are building on is more stable and profitable than ever before.

5. Investing Perspective: Is It Too Late to Buy?

While we don’t give direct financial advice, we look at the truth provided by market leaders like Mark Tilbury, Morgan Housel and Warren Buffet.

- Long-Term Patterns: Historically, companies hitting these milestones often experience a period of consolidation before further growth.

- Index Fund Exposure: For many students, the best way to “own” a piece of this $4 trillion success is through an S&P 500 index fund, where Alphabet is a top holding.

The Financial Foundation Book:The classic guide to value investing that helps you look past the “hype” and see the actual value in giants like Alphabet.

Conclusion: The Era of Intelligence

Alphabet hitting $4 trillion is a reminder that in 2026, information is the most valuable commodity on earth. By understanding the patterns of these giants, you can position yourself to ride the wave of the next decade of growth.

For more updates on the economy and how to build your own wealth, visit Investing Time Daily or follow us on Instagram.

Sources & References

- CNBC: “Alphabet Hits $4 Trillion Market Cap as AI Pivot Pays Off” (Jan 12, 2026).

- Reuters: “Alphabet Valuation Surge: AI Refocus Lifts Sentiment” (Jan 12, 2026).

- WSJ: “How Google Redefined the Tech Sector to Reach $4 Trillion” (Jan 12, 2026).

Affiliate Disclosure: This post contains affiliate links to books and resources that help you master the world of finance. We may receive a small commission if you purchase through these links, at no extra cost to you.