The founder of Bridgewater Associates—the world’s largest hedge fund—just revealed how every major crisis from 2000 to 2025 fundamentally changed the game of investing. And the next crisis? It’s already brewing.

If you’ve been investing the same way you did 10 years ago, you’re playing by rules that no longer exist. Ray Dalio, who’s managed over $150 billion in assets, explains why each market crisis doesn’t just reset the game—it rewrites the entire rulebook.

From the dot-com crash to the 2008 financial crisis, from the COVID pandemic to the AI revolution, every crisis has introduced new mechanisms, new policies, and new realities that most investors completely miss.

Let’s break down what Dalio sees that you don’t—and what it means for your money right now.

The 25-Year Pattern: How Crises Keep Rewriting The Investment Playbook

Ray Dalio has identified a disturbing pattern: every major crisis in the 21st century hasn’t just created temporary disruptions—it’s fundamentally changed how markets operate.

Here’s the timeline that should terrify and enlighten you:

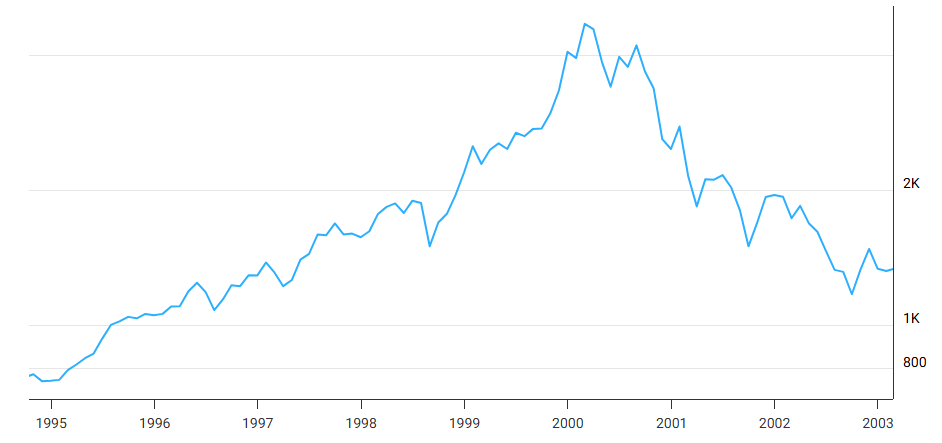

2000: The Tech Bubble – When Irrational Exuberance Met Reality

Federal Reserve Chairman Alan Greenspan asked the prophetic question in 1996: “How do we know when irrational exuberance has unduly escalated asset values?”

The answer came brutally in early 2000. The market peaked and then dropped 30% in just a few months. Tech stocks that were valued at absurd multiples crashed back to earth.

What changed: Investors learned (temporarily) that growth without profits eventually collapses. The “new economy” narrative died. Traditional valuation metrics mattered again.

But this was just the beginning of a quarter-century of crisis-driven transformations.

2001-2008: Post-9/11 Wars And The Housing Bubble

According to Dalio, after the tech bubble burst, geopolitics entered the equation. The September 11th attacks led to the war on terrorism, with the U.S. spending approximately $8 trillion on these wars.

“We run big budget deficits,” Dalio explains. This set the stage for what would become a pattern: governments solving problems by spending money they don’t have.

Then came 2008—the great global financial crisis. But this wasn’t just about subprime mortgages and collapsing banks.

The bursting of the housing bubble started as what seemed like an orderly exit. But as one market observer noted: “Most people began to sell stocks that were directly tied to the housing market. But eventually that began to spread to other areas of the market that had nothing to do with housing or credit.”

Triple-digit swings became normal. Major financial institutions teetered on collapse. Some failed entirely.

What changed forever: This was the first time interest rates hit zero since 1933. That’s a marker moment in financial history.

The Birth Of Money Printing: How QE Changed Everything

2008 introduced something most investors had never seen: Quantitative Easing (QE).

What is QE? The Federal Reserve literally prints money and buys bonds to inject liquidity into the financial system. It’s as simple and as radical as it sounds.

The Fed’s QE program was so ambitious they did it three times:

- QE1 during the 2008 crisis

- QE2 to support the recovery

- QE3 to keep markets stable

According to financial market analysts, “Quantitative easing was the effort by the Fed to stabilize the markets.” They ended QE3 in 2014, but had to restart it less than a decade later when COVID hit.

What this taught markets: Dalio explains it perfectly: “We start to learn that large budget deficits can be monetized.”

Translation: Governments discovered they could print money to solve problems. And once that genie was out of the bottle, there was no putting it back.

The new rule: Don’t fight the Fed. When central banks print money, asset prices go up. Period.

2020: The COVID Shock That Broke Every Model

“The COVID pandemic was undoubtedly one of the biggest exogenous shocks for financial markets in modern history,” according to market analysts.

The market plunged 20-30% in just five and a half weeks. Fastest crash in history. Fastest recovery too.

Why? Because governments and central banks had learned from 2008. They went massive immediately.

The response was unprecedented:

- Trillions in stimulus packages

- Fed printing money at rates that made 2008 look modest

- Direct payments to citizens

- Business bailouts across every sector

The result? Headline inflation rates topped 9%—the highest for the modern era.

But something else happened during COVID that changed markets forever…

The Meme Stock Revolution: When Boredom Met Rebellion

“Meme stocks. The best way to describe the meme stock boom can probably be summed up in one word: boredom,” one analyst laughed.

GameStop became the symbol. “GameStop is one of the most compelling asymmetric opportunities in the market today. Really, I don’t understand how you could disagree with that.”

“You’re witnessing the French revolution of finance,” some proclaimed. “There is a rebellion aspect to it. There is an anti-establishment aspect to it.”

What changed: By 2025, the vast majority of activity in U.S. public equity markets is driven by individual investors rather than institutional investors. That has a massive impact on prices and valuations.

Retail investors—regular people—now move markets. The rules changed again.

Dalio’s Framework: Connecting Markets, Geopolitics, And Society

Here’s where Ray Dalio’s analysis gets profound. He doesn’t just see these crises as isolated financial events. He connects them to deeper forces:

The Wealth Gap Explosion

The 2008 crisis “brings over the wealth gap issue. In other words, Occupy Wall Street,” Dalio explains.

When the Fed printed trillions to save the financial system, asset owners got richer. People without assets got nothing. The wealth gap exploded.

This created political consequences that are still playing out today.

The Rise Of Populism (2016 Onwards)

“2016, the change, the big change in the world order and the big change domestically. The beginning of populism. And Donald Trump being elected president.”

Dalio sees this as inevitable: “We have this greater polarity left and right that reflects the wealth gap differences.”

When monetary policy makes rich people richer while regular workers struggle, political anger follows. Populist movements on both left and right emerged from the economic conditions created by crisis responses.

From Globalization To Nationalism

Trump’s election “meant a big change in the relationship with China. In other words, recognizing that there’s a great power conflict.”

The world shifted “from globalization to nationalism. And the change in that world order.”

For investors, this means: Supply chains fragmenting. Tariffs returning. Friend-shoring replacing offshoring. The globalized investment landscape of 1990-2016 is dead.

The Leveraging Up Of Everything: Private Equity’s Dangerous Game

Here’s something most investors miss. Dalio points to a crucial consequence of zero and negative interest rates:

“What that does is it causes the leveraging up of assets. In other words, private equity, the emergence of private markets, venture capital, private equity, all being leveraged up.”

When money is free, everyone borrows it to buy assets. Private equity firms loaded up on debt to acquire companies. Venture capital valuations went insane. Everything got leveraged.

“We begin to have the tightening. We’re beginning to feel that effect, the deterioration of the venture capital market and the private equity market, and the fragility associated with that.”

Translation: When interest rates finally rose, all that leverage became a problem. Companies and funds that borrowed cheap money suddenly face expensive debt. Many won’t survive.

The investment implication: Be extremely careful with highly leveraged investments. When the tide goes out, you see who’s been swimming naked.

2025 And Beyond: The AI Bubble Question

“As we begin the second quarter of the 21st century, we’re returning to talk of bubbles. In 2000, it was the tech bubble. Now people are wondering if we could be building an AI bubble.”

Sound familiar? History doesn’t repeat, but it rhymes.

But there’s a difference this time, according to Dalio. The government is playing a much more active role.

From Referee To Player: How Government Changed The Game

“Some people have said they’ve gone from being a referee to actually being a player in the game. What are the consequences of that for financial markets?”

Dalio’s answer is illuminating: “That’s always been the case in times of great conflict.”

In the AI world, you need infrastructure and energy sources. “If people just get rich and buy expensive things, like expensive handbags and so on, and it’s not directed, you’re not going to have the country be competitive.”

Industrial policy is back. Governments are directing capital, picking winners, and competing directly in strategic industries.

“In AI and related technologies, quantum computing and the like, it’s quite typical in history to see what’s now happening in terms of the competition, or let’s call it the tech war between the United States and China, because the tech war is also related to the military war. Whoever wins is going to win everything.”

Investment implication: The biggest returns won’t just come from finding great companies. They’ll come from understanding which industries governments are backing and which geopolitical winners emerge.

The Geography Of Wealth: Surprising Winners And Losers

Dalio points to unexpected geographic shifts that most investors missed:

The Decline Of The Developed World

“Europe, the United States, China… generally speaking, what we would think of as the developed world… have declining populations.”

Meanwhile, “in the emerging world, the Global South, as we call it, they have growing populations that want to migrate.”

Why this matters: Shrinking populations mean shrinking economic growth—unless productivity increases dramatically (hello, AI and automation).

The Rise Of The Gulf States

Would Dalio have predicted 25 years ago that Saudi Arabia and the Gulf would become so prominent?

His framework for successful countries is simple:

Three requirements:

- Educate your children well so they’re productive and civil

- Create productive economies with functioning capital markets where people earn more than they spend

- Stay out of wars—both internal and external conflicts

The Gulf states have executed this strategy brilliantly, using oil wealth to build infrastructure, education, and diversified economies.

Meanwhile, Europe has struggled with migration issues, internal conflicts, and economic stagnation.

Investment implication: Don’t assume traditional economic powers will remain dominant. Watch demographics, political stability, and capital formation.

Climate Change: The Force Multiplier Nobody Priced In

Dalio identifies climate change as a major historical force alongside pandemics and geopolitical conflicts:

“Acts of nature, droughts, floods and pandemics have been a major force in history.”

Climate change “creates greater heat, and so on in these areas, it drives migration.”

The connection: Climate → Migration → Political instability → Economic disruption → Market volatility

Most investors still treat climate as an ESG talking point. Dalio treats it as a geopolitical and economic force that will reshape nations.

“As we’re looking at the migration and immigration issues, they become greater issues.”

Investment implication: Factor in climate-driven migration, infrastructure costs, and political instability when evaluating long-term investments.

The Big Picture: What Every Investor Must Understand

Ray Dalio’s analysis reveals something crucial: You can’t understand markets without understanding the broader context.

Here’s what connects everything:

The Debt-Inflation-Policy Loop

- Crisis hits → Governments spend massively

- Central banks monetize debt (print money)

- Inflation eventually appears

- Wealth gaps expand (asset owners win, workers lose)

- Political populism rises

- Governments intervene more in markets

- New rules emerge

- Next crisis hits… repeat

The Geopolitical-Technology-Military Connection

The tech war between the US and China isn’t just about economics—it’s about military dominance.

“Whoever wins is going to win everything.”

AI, quantum computing, and advanced technology will determine:

- Which country has the strongest military

- Which economy grows fastest

- Which currency dominates

- Which assets appreciate most

The Everything Changed Rule

Every crisis from 2000 to 2025 changed the fundamental rules:

- 2000: Growth without profits doesn’t work

- 2001-2008: Geopolitics affects everything

- 2008: Interest rates can hit zero; QE is real

- 2016: Globalization is reversing

- 2020: Governments will print unlimited money to solve crises

- 2025: AI and technology determine geopolitical winners

The meta-lesson: The biggest mistake is assuming the rules that worked in the last cycle will work in the next one.

How To Actually Invest In A World Where Rules Keep Changing

Based on Dalio’s framework, here’s what sophisticated investors should do:

1. Understand The Macro Context

Don’t just pick stocks. Understand:

- Where we are in the debt cycle

- What governments and central banks are doing

- Which geopolitical conflicts are brewing

- What demographic trends are developing

Dalio’s approach: “I think you have to relate the markets to the geopolitics, the politics.”

2. Diversify Across The Changing World Order

The US-centric portfolio that worked for 50 years may not work for the next 25.

Consider exposure to:

- Emerging markets with young populations

- Gulf states building diversified economies

- Countries aligned with future technology winners

- Hard assets that survive currency debasement

3. Factor In Government Industrial Policy

Governments are picking winners in AI, semiconductors, clean energy, and strategic industries.

Investment strategy: Follow the government money, but be ready to exit when policies change.

4. Prepare For Multiple Scenarios

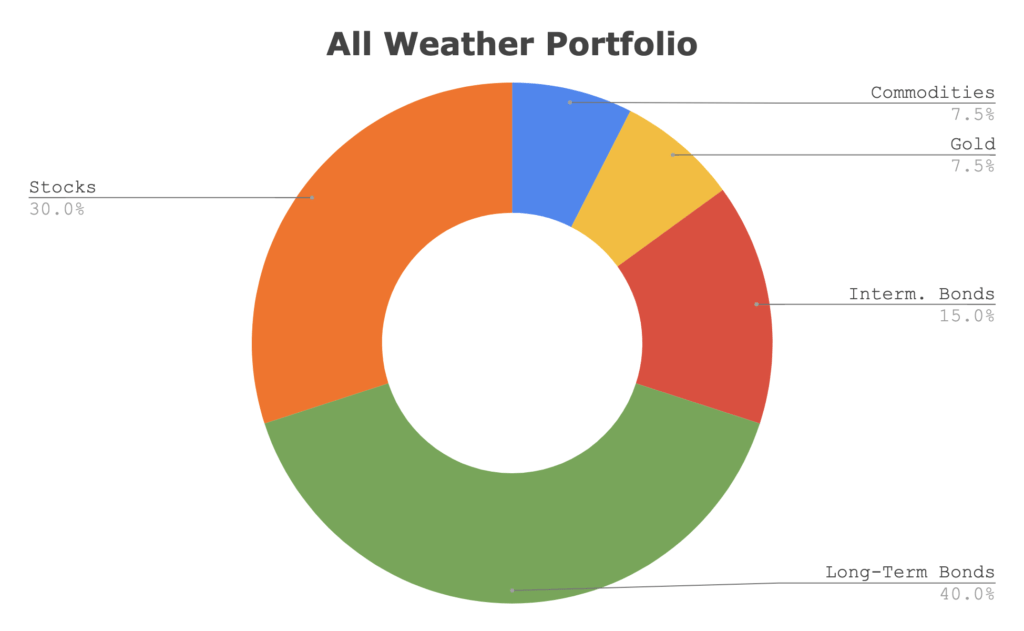

Dalio is famous for “All Weather” investing—structuring portfolios to survive different economic environments.

Build positions that work in:

- High inflation (commodities, real assets)

- Deflation (government bonds, cash)

- Growth (equities, tech)

- Stagnation (income-producing assets)

5. Watch For The Next Rule Change

The next crisis will change the rules again. Be ready.

Potential upcoming rule changes:

- Central Bank Digital Currencies (CBDCs) replacing cash

- Negative interest rates becoming permanent

- Universal Basic Income to address AI unemployment

- Capital controls as geopolitical conflicts intensify

The only certainty: The rules will change. Position accordingly.

The Fragility Behind The Markets

Here’s what keeps Dalio up at night:

“Now we have an economy where so much of it, since really 2020, large budget deficits and necessarily the monetization of that.”

We’re living on:

- Massive government debt

- Continued money printing

- Large gaps in wealth and values

- Rising populism

- A great power conflict with China

- Climate change effects

- Fragile overleveraged private markets

The system is fragile. It looks stable until it’s not.

“The fragility associated with that” in overleveraged private equity and venture capital markets means when the next shock comes, it could be severe.

What This Means For You Right Now

Let’s get practical. What should you actually do with this information?

If You’re Just Starting Out:

- Build skills in AI, technology, or strategic industries governments are backing

- Invest in education and productivity (Dalio’s first rule for successful countries applies to individuals)

- Start small with diversified investments across different asset classes and geographies

- Learn about macroeconomics—it’s not optional anymore

If You’re Mid-Career With Some Savings:

- Review your portfolio through Dalio’s lens—are you prepared for rule changes?

- Reduce leverage—if you’re over-leveraged, the next crisis will hurt

- Diversify beyond US assets—the unipolar world is ending

- Consider inflation protection—governments will keep printing money

- Build cash reserves—opportunities emerge when markets panic

If You’re Near Retirement:

- Don’t assume the past predicts the future—20% annual stock returns aren’t normal

- Prepare for volatility—each crisis brings wild swings

- Factor in geopolitical risk—your portfolio may be more concentrated than you think

- Consider hard assets—real estate, commodities, precious metals

- Have a Plan B—if markets crash 50%, can you survive?

The 2025 Warning: Are We In An AI Bubble?

We started with bubbles. We’ll end with bubbles.

“In 2000, it was the tech bubble. Now people are wondering if we could be building an AI bubble.”

Here’s the uncomfortable truth: probably yes. But that doesn’t mean you should avoid AI investments entirely.

The difference between smart and stupid bubble investing:

Stupid: Buying every AI stock at any price because “it’s the future”

Smart: Understanding that AI will be transformational, investing in real companies with real products, but maintaining reasonable valuations and diversification

Remember: Amazon fell 95% in the dot-com crash. But if you bought after the crash and held, you made 1,000x+ returns.

The technology was real. The valuations were insane. Both can be true.

Dalio’s lesson applies: The crisis will change the rules for AI investing too. Position accordingly.

Final Thoughts: The Only Constant Is Change

Ray Dalio has studied centuries of economic history. His conclusion is both humbling and empowering:

Markets will keep changing the rules. Crises will keep coming. Governments will keep intervening. Technologies will keep disrupting.

But successful investors adapt. They study history. They understand macro forces. They diversify across scenarios. They don’t fight the Fed or the government. They don’t assume tomorrow looks like yesterday.

“Maybe now I see it better than I saw maybe 25 years ago,” Dalio admits. Even the world’s greatest investors are constantly learning.

The question isn’t whether the next crisis will come. It’s whether you’ll be prepared when it does.

And whether you’ll recognize that the rules have changed—again.

Continue Your Education

Watch The Full Interview: Ray Dalio on Bloomberg – Market Crises Changing Rules: [YouTube Link]

Essential Reading:

- “Principles” by Ray Dalio

- “Principles for Dealing with the Changing World Order” by Ray Dalio

Follow For Market Analysis:

- Website: https://www.investingtimedaily.com/

- Instagram: https://www.instagram.com/investingtimedaily/

- Ray Dalio on LinkedIn and Twitter for regular macro insights

Learn More:

- Bridgewater Associates Research Papers

- Federal Reserve Economic Data (FRED)

- World Bank Demographic Reports

- IMF Global Economic Outlook

Your Turn: How Are You Preparing?

Drop a comment: What worries you most about the next market crisis? Are you positioned for rules to change again?

Share this article with investors who think the 2010s playbook still works in 2025. They need to see this.

The markets keep changing the rules. Make sure you’re not playing yesterday’s game.