Nvidia reported record-breaking Q3 2025 earnings. Markets celebrated for 2 hours, then erased $1.5 trillion. Prof G Markets host Scott Galloway and Ed Elson explain why even perfect earnings can’t stop the AI bubble fears.

Nvidia’s Record Q3 2025 Earnings: The Numbers That Should Have Sent Stocks Soaring

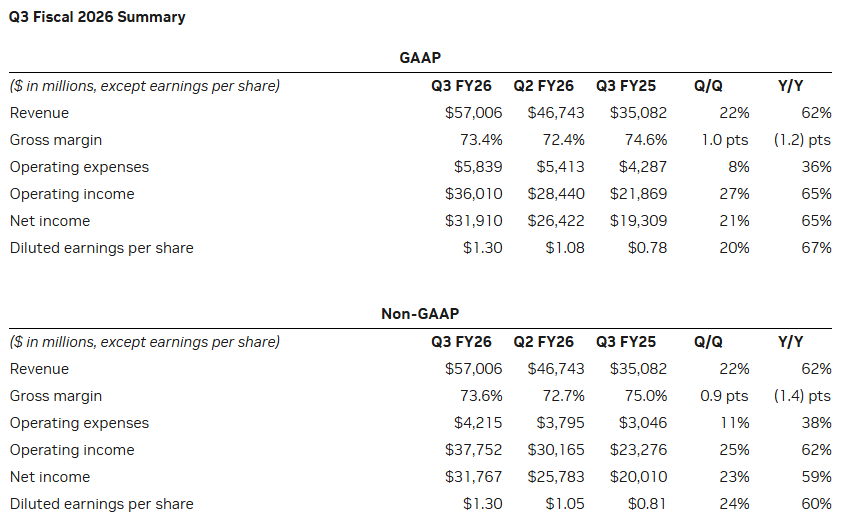

On November 20, 2025, Nvidia (NASDAQ: NVDA) reported third-quarter fiscal 2026 results that would have been considered impossible just a few years ago. The numbers were staggering:

- Total revenue: $57.0 billion (up 62% year-over-year, up 22% quarter-over-quarter)

- Data Center revenue: $51.2 billion (up 66% YoY, up 25% QoQ)

- Earnings per share: $1.30 (both GAAP and non-GAAP, beating analyst expectations)

- Q4 guidance: $65 billion revenue expected (± 2%)

CEO Jensen Huang celebrated the results: “Blackwell sales are off the charts, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference.”

Yet within hours of the after-hours trading surge, something unexpected happened: the entire market gave back its gains. By noon the next trading day, Nvidia had surrendered all its post-earnings momentum. The S&P 500 erased approximately $1.5 trillion in market cap—larger than Italy’s entire stock market—in less than two hours.

The Market’s Stunning Reversal: From Euphoria to Fear in 24 Hours

According to Scott Galloway and Ed Elson, hosts of the Prof G Markets podcast, this whipsaw reaction reveals something more significant than just profit-taking.

“The narrative shifted in just three weeks,” Galloway observed. “A month ago, it was ‘AI boom.’ Now it’s ‘AI bubble.’ The market was jonesing for a sign of the bubble popping, and they just didn’t get it from these earnings.”

What Changed So Quickly?

Ed Elson noted the sentiment transformation: “If you look at the vibe a month ago versus now on AI, it completely flipped. Everyone was expecting Nvidia’s earnings to be that moment where we’d say, ‘Oh, look how stupid the bears look.’ Instead, we’re back in the red.”

The earnings themselves weren’t the problem—they were exceptional by any measure. Rather, according to Galloway and Elson’s analysis, the underlying concerns about AI sustainability weren’t addressed by the report.

The Real Concerns Nvidia’s Earnings Couldn’t Address

1. Revenue Concentration: The Same Four Companies

Elson highlighted a critical vulnerability: “Four companies make up 60% of Nvidia’s total revenue. The underlying concern isn’t that there isn’t enough demand right now—we see that in the earnings. The concern is that this demand is all coming from the same small set of players who are recycling each other’s revenues.”

The circular nature of AI infrastructure spending includes:

- Microsoft investing in OpenAI, which then uses Azure infrastructure

- Google, Amazon, Meta, and Microsoft collectively representing the bulk of Nvidia’s data center sales

- These same companies reporting this spending as their own “AI revenue”

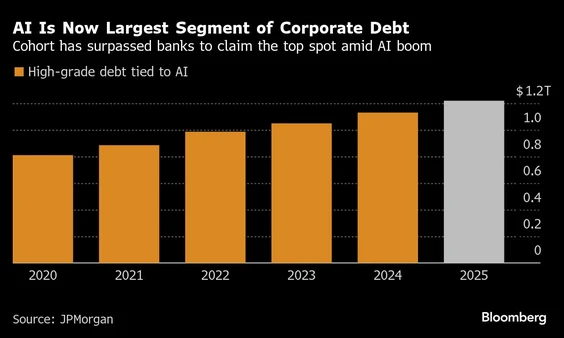

2. The Debt Mountain Nobody’s Talking About

Perhaps most concerning is what Galloway and Elson call “the debt accumulation that’s really come to light in the past couple of weeks.”

According to their research:

- $1.2 trillion in AI-related debt has been issued

- Tech companies are borrowing more than banks right now

- Google, Amazon, Meta, Microsoft, and Oracle have raised more debt this year than the previous three years combined

“This is dangerous,” Elson emphasized. “Some of these companies like Oracle and CoreWeave are actually playing with fire.”

The Oracle and CoreWeave Problem

The podcast highlighted two particularly vulnerable companies:

CoreWeave:

- $14 billion in debt on $5 billion in revenue

- 7:1 debt-to-EBITDA ratio

- Highly leveraged position in AI infrastructure

Oracle:

- 4:1 debt-to-EBITDA ratio

- More than $100 billion in debt outstanding

- Cash flow negative

- CapEx expected to reach 138% of operating cash flow in 2026

- Not expecting profitability until 2030

Credit default swap prices for Oracle have tripled in recent months, signaling market concern about the company’s ability to service its debt.

“These are two very obviously exposed companies that are perfectly positioned to get eviscerated if we see any sort of downturn,” Elson warned.

The Shadow Banking Problem: SPVs and Hidden Leverage

One of the most alarming trends Galloway and Elson discussed is the rise of Special Purpose Vehicles (SPVs) in AI financing.

How SPVs Hide True Debt Levels

As Elson explained: “Meta raises $60 billion to finance a big data center. $30 billion shows up on the balance sheet. The rest goes on the balance sheet of this separate entity they created with Blue Owl Capital.”

This means:

- Borrowing is happening but isn’t publicly disclosed

- Private credit firms are financing operations off-balance-sheet

- True leverage in the AI ecosystem is impossible to calculate

“What makes me feel more anxious is we’re only seeing the tip of the iceberg,” Elson noted. “There’s so much obscurity and opacity in the private markets that we just don’t have access to.”

Galloway’s Warning: Never Sign a Personal Guarantee

Drawing on his investing experience, Galloway offered this analogy: “When I was an activist investor, I used to create SPVs. The thing about them was they are sequestered from one another. What you would really like to do is have every investment be an SPV—that way profits are sequestered from losses.”

His advice to entrepreneurs: “Never sign a personal guarantee. Market dynamics always trump individual performance. People have no idea how bad things can get and how quickly.”

Why America’s Economy Has Become “Fragile”

Galloway made a broader structural argument about why even healthy earnings from Nvidia represent a systemic risk:

The Concentration Problem

“Our economy has become more fragile,” Galloway argued. “The wrong 10% of Americans—the wealthiest—are responsible for 50% of consumer spending. You would much rather have the middle 60% representing 50% of purchasing power.”

The vulnerability: If Nvidia drops 60-70% (as Tesla fell 67% in 2022 and Amazon dropped 53% in 2022), the wealth effect hits the highest spenders hardest.

“The top 10% base their confidence off the market,” Galloway explained. “If Nvidia goes down 70% and there’s a $3.5 trillion destruction in the market, there’s no way you’re not going to see a substantial decrease in spending.”

The “Anti-Fragile” Economy Problem

According to Galloway’s framework:

- Fragile economy: Small shock causes large damage (current situation)

- Robust economy: Small shock causes small damage

- Anti-fragile economy: Small shocks make system stronger

“We are more dependent on a small handful of companies than ever before,” Elson added. “Which means we’re more dependent on a small handful of leaders making decisions at these companies.”

Historical Parallels: The 1999 Playbook

Both Galloway and Elson drew comparisons to previous bubble cycles, particularly the late-1990s dot-com boom.

The Charles Merrill Lesson

Galloway recalled: “In 1928, Charles Merrill told everybody to get out of the market. He was right—and he was wrong. From the beginning of 1928 to September 1929, the stock market went up 90%.”

The lesson: Timing matters as much as being correct about valuations.

When Do Bears Throw in the Towel?

“Julian Robertson threw in the towel in 1997,” Galloway noted. “Michael Burry has lost so much money that he’s had to close his fund. The bears just get creamed and cleared out.”

According to Galloway’s pattern recognition: “About the time the bears throw in the towel and say ‘okay, I give up’ is when you see a look-out below.”

The “New Era” Warning Sign

Galloway identified the danger signal he watches for: “What I saw in ’07 and ’99 was you started to see articles about ‘it’s a new age of productivity’ and ‘the economy is being reshaped.’ In other words, ‘it’s different this time.’ That’s when you look out below.”

Currently, he sees the market “climbing this wall of worry”—continuing to grind up despite bubble concerns. But he’s watching for that narrative shift.

What Nvidia’s Earnings Actually Revealed

While the market focused on fears, the official Nvidia earnings report contained several significant developments:

Blackwell’s Dominance

- Achieved highest performance in SemiAnalysis InferenceMAX benchmarks

- Delivering 10x throughput per megawatt vs previous generation

- Already in volume production, with first wafer produced on US soil at TSMC’s Arizona facility

Major Partnership Announcements

- OpenAI: At least 10 gigawatts of Nvidia systems deployed

- Anthropic: 1 gigawatt of compute capacity (first time running on Nvidia infrastructure)

- Oracle Solstice: 100,000 Blackwell GPUs for US Department of Energy’s largest AI supercomputer

Beyond Data Centers

- Gaming revenue: $4.3 billion (up 30% YoY)

- Professional Visualization: $760 million (up 56% YoY)

- Automotive: $592 million (up 32% YoY)

The Leverage Question: Every Bubble’s Common Thread

Both Galloway and Elson emphasized that leverage—not valuation—ultimately triggers every financial crisis.

Andrew Ross Sorkin’s Framework

They referenced CNBC anchor Andrew Ross Sorkin’s recent commentary: “Every financial crisis, if I learned anything from covering 1929 and 2008, it is leverage. It is people borrowing to make all of this happen.”

Which Companies Are Actually at Risk?

Lower Risk (High cash flow):

- Google, Meta, Microsoft, Amazon

- Borrowing large amounts, but generating massive cash flows

- Debt-to-EBITDA ratios remain manageable

Higher Risk (High leverage, low cash flow):

- Oracle (4:1 debt-to-EBITDA, cash flow negative)

- CoreWeave (7:1 debt-to-EBITDA)

- Smaller AI infrastructure startups with undisclosed financing

Unknown Risk (Private, undisclosed):

- OpenAI (no public auditor identified)

- Various AI startups using SPV financing structures

Andrew Ross Sorkin book: https://amzn.to/4op3Xwz

The China Factor: A $46 Trillion Question Nobody’s Discussing

While US investors fixate on earnings beats and AI spending, a larger geopolitical shift threatens the foundation of tech company growth.

American Brands Are Collapsing in China

According to Galloway and Elson’s research on the “Guochao” (national tide) movement:

Nike: Market share dropped from 25% (2021) to 20% (2025)—no longer market leader Starbucks: Market share dropped from 34% (2019) to 14% (2025) Tesla: Market share plunged to 3% (down from 8% previous month)—lowest in 3 years

Chinese sentiment toward America has become “highly negative for pretty obvious reasons,” Elson noted, referencing tariff policies and geopolitical tensions.

The Winners: Chinese Domestic Brands

- Anta (athletic wear): Now larger than Nike’s China business by 30%

- Luckin Coffee: Offering quality coffee for $1.50 vs Starbucks pricing

- BYD (electric vehicles): Now leading with 23% market share vs Tesla’s 3%

- Song (luxury): Online bag sales up 90% while Gucci dropped 50%

Impact on Nvidia: China represents a significant market for AI chips, though US export restrictions have complicated this relationship.

What Comes Next: Three Possible Scenarios

Based on the Prof G Markets analysis and historical patterns, three scenarios emerge:

Scenario 1: The Grinding Rally Continues

- Nvidia and AI stocks continue climbing the “wall of worry”

- Bears like Michael Burry get cleared out

- Market reaches euphoric “new paradigm” phase

- Then the crash comes (2026-2027)

- Galloway: “That’s when you see articles saying ‘maybe the internet has taken us to a different age’—that’s your signal”

Scenario 2: The Correction Starts Now

- Current debt concerns trigger risk-off behavior

- Oracle or CoreWeave face liquidity crisis

- Credit markets seize up, forcing deleveraging

- Nvidia drops 50-70% (historical norm for high-flyers)

- Contagion spreads to other AI infrastructure plays

- However: Actual AI technology continues advancing (like internet post-2000)

Scenario 3: The Soft Landing

- AI revenue finally materializes at scale

- Companies successfully monetize LLM investments

- Debt gets serviced from growing cash flows

- Valuation multiples compress but no crash

- Market transitions from growth to value

What Investors Should Watch For: The Canary Signals

Galloway and Elson identified specific warning signs to monitor:

Red Flags to Watch:

- Credit default swap spreads widening (Oracle’s already tripled)

- Private credit firms reducing AI exposure

- Hyperscaler capex guidance cuts (first sign of demand concerns)

- Nvidia inventory building up (currently tight supply)

- Media narrative shift to “new paradigm” (Galloway’s key indicator)

- Michael Burry closing his short positions (bears capitulating)

Green Flags That Would Change the Picture:

- AI revenue scaling at enterprise level (beyond tech giants)

- Clear path to profitability for OpenAI and others

- Diversification of Nvidia’s revenue base (currently 60% from 4 companies)

- Successful debt refinancing at Oracle/CoreWeave

- China relationship stabilization

The Bottom Line: Perfect Earnings, Imperfect Timing

Nvidia’s Q3 2025 earnings were objectively spectacular:

- Record revenue

- Record data center sales

- Stronger-than-expected guidance

- Dominant market position with Blackwell

Yet the market’s rejection of these results within 24 hours reveals a deeper truth: earnings excellence doesn’t inoculate against systemic concerns.

As Elson summarized: “The underlying concern isn’t demand right now—we see plenty of demand. The concern is this demand is artificial, coming from circular flows of the same players borrowing heavily to finance each other’s growth. Is this sustainable?”

Galloway’s framework offers perspective: “We’ve become too vulnerable to a certain sector. The US economy is now more concentrated in a few AI companies than it’s ever been in its history. That’s not healthy regardless of how good the earnings are.”

For Individual Investors

The Prof G Markets team didn’t offer specific investment advice, but their analytical framework suggests:

- Understand concentration risk in your portfolio (tech/AI exposure)

- Monitor debt levels at companies you own

- Don’t fight the Fed or the leverage cycle

- History shows every high-flying stock experiences 50-70% drawdowns eventually

- The best companies survive bubbles (Amazon fell 95% in 2000-2002, then recovered)

The Bigger Picture

Perhaps Galloway’s most important observation: “It’s always the [expletive] you’re not expecting. No one was expecting 9/11 or COVID. Something else will hit us.”

Nvidia’s earnings may have been perfect, but perfection doesn’t prevent corrections—especially when the entire economy is concentrated in a few companies borrowing unprecedented amounts to finance explosive but unproven demand.

The market’s $1.5 trillion vanishing act in two hours wasn’t about Nvidia’s results. It was about leverage, concentration, and the uncomfortable realization that even flawless execution can’t outrun systemic risk.

Sources and Further Reading

- Nvidia Official Q3 FY2026 Earnings Release

- Prof G Markets Podcast: “Even Nvidia Can’t Rescue the Market From the Fear Cycle”

- Historical market data: Yahoo Finance, Bloomberg

- Credit default swap data: Bloomberg Terminal

DISCLAIMER: This article is for educational and informational purposes only. It does not constitute financial, investment, or professional advice. Views expressed are based on podcast commentary and public earnings data. Always conduct your own research and consult financial professionals before making investment decisions. This post contains affiliate links. If you purchase through these links, I may earn a commission at no extra cost to you